Discover how a Canadian family achieved 239% returns using strategic...

Read MoreRRSP or TFSA: The Smart Way to Maximize Your Money

Ms. Helen, a seasoned entrepreneur and mother of three, built her wealth early on through strategic real estate investments. However, as the market evolved—with tighter regulations, shrinking profit margins, rising holding costs, and decreasing liquidity—she began to feel the strain of negative cash flow and recognized the need to reassess her financial strategy.

In 2021, a turning point came when she attended an investment seminar led by Mr. Feng, CEO of Ai Financial. Inspired by AiF’s core investment principles of long-term planning, risk management, and capital efficiency, Ms. Helen and her husband became clients, strategically diversifying their portfolio across TFSA, RRSP, RESP, and non-registered investment accounts.

As the partnership grew, so did her trust in AiF—prompting her to increase her investment allocations. The financial wisdom didn’t stop with her; her eldest daughter also became a client. Most recently, she took a bold new step by securing an investment loan and is preparing to implement a 3:1 leveraged investment strategy later this year.

From real estate holdings to leveraged investment strategies, Ms. Helen’s financial evolution reflects more than just changing tactics—it’s a strong vote of confidence in Ai Financial’s expertise and long-term value proposition. Her journey underscores a key truth in investing: true commitment is never driven by short-term market performance, but by deep trust in a systematic, forward-looking approach.

Over the past four years, despite global uncertainty and economic upheaval, Ms. Helen’s investments have continued to grow—testament to AiF’s disciplined strategies. In 2022, the U.S. stock market faced one of its steepest and longest declines in nearly 50 years, enduring nine straight months of losses. For many, confidence wavered. But for AiF clients, this was a time to stay the course.

Fast forward to April 2025, when another market shock hit: a dramatic 2,200-point plunge in the Dow Jones Industrial Average in a single day sent tremors through the financial world. Yet, even amid such volatility, Ai Financial’s focus on risk management and asset efficiency helped clients weather the storm—and emerge stronger.

This unwavering approach is what continues to earn AiF the trust of families like Ms. Helen’s, where investment decisions are guided not by fear or hype, but by strategy, discipline, and vision.

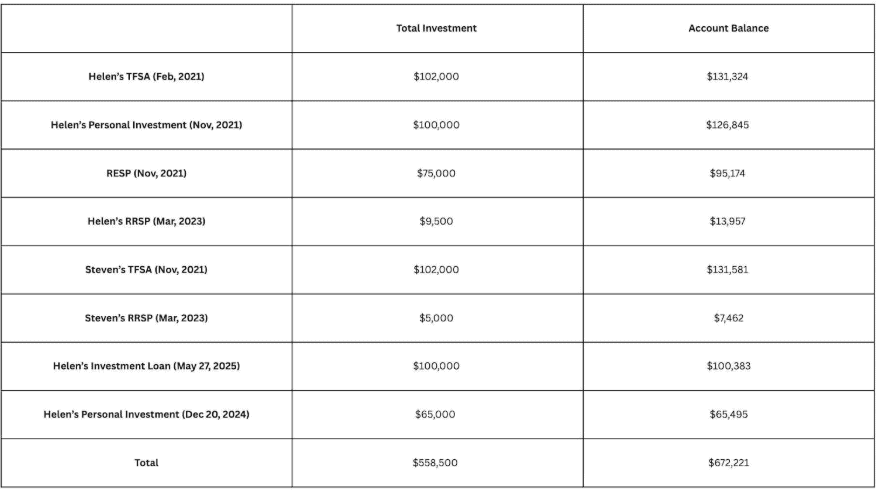

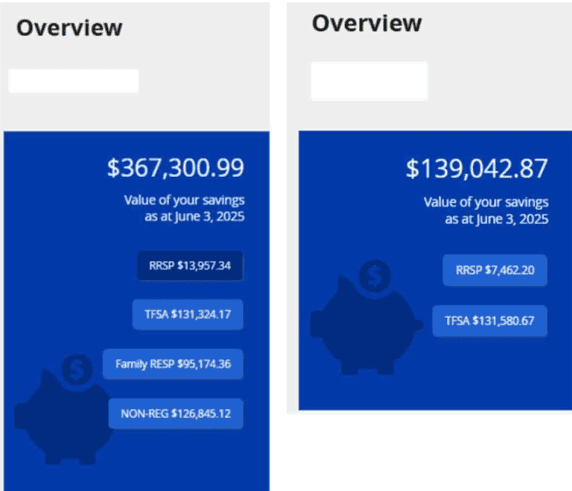

Summary of the total investment return of Mrs. Helen and her family over four years:

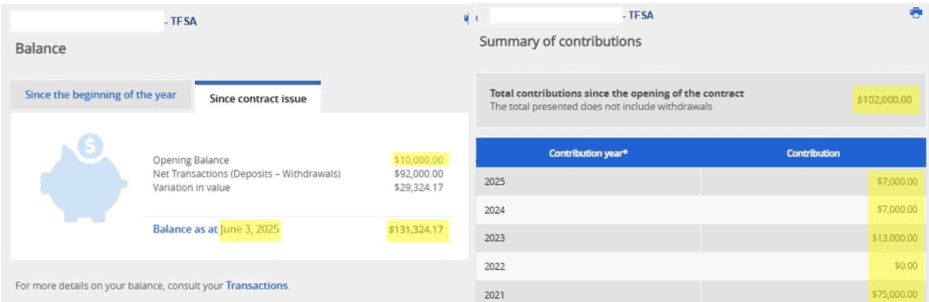

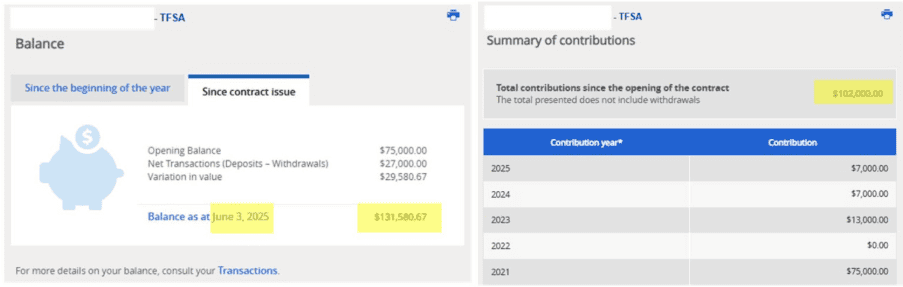

Under the professional advice of AiF, Mrs. HELEN also opened a TFSA account in February 2021. By increasing the balance each year and managing her assets by AiF’s professional investment team, Mrs. HELEN’s TFSA account has achieved significant appreciation in four years.

- TFSA opening account investment amount in February 2021: $10,000

- TFSA account total investment amount: $102,000

- June 2025 , account balance: $131,324

- Showing cumulative investment profit: $29,324

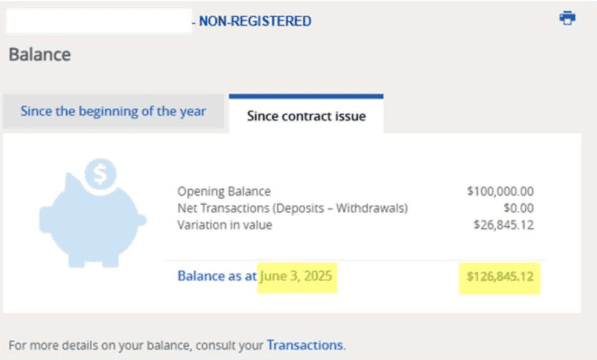

With the steady growth of the TFSA account in the short term, Mrs. HELEN has established a deeper trust in the investment strategy and professional capabilities of the Ai Financial team. On this basis, in November 2021, with the assistance of AiF, she invested $100,000 of her own funds in a non-registered account, with AiF providing strategic planning and full assistance. This is not only an expansion of the scale of funds, but also reflects her high recognition of AiF’s long-term planning capabilities.

✅ Investment capital: $100,000

✅ Total investment value: $126,845

✅ Net investment profit: $26,845

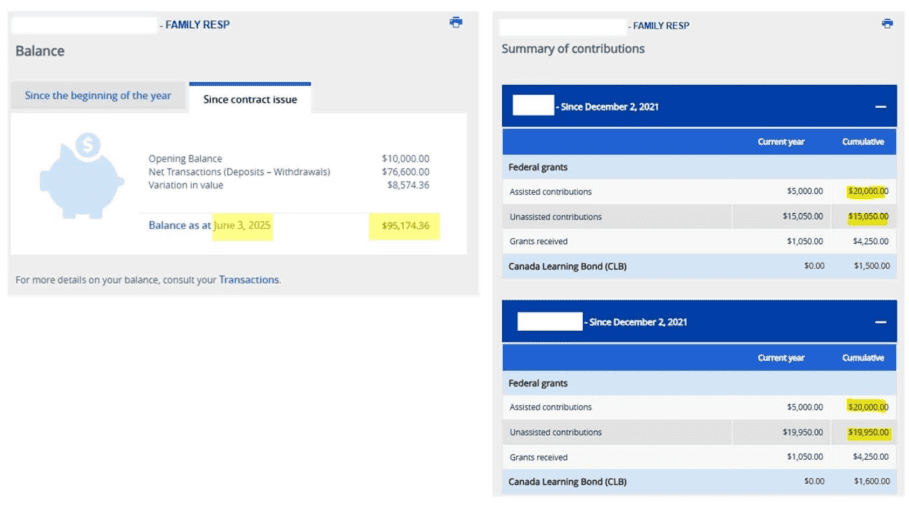

At the same time, on November 11, 2021, AiF assisted Ms. HELEN in planning for her children’s education funds in advance, opened an RESP account, and invested $10,000 for the first time.

Since then, under the advice of the AiF team, she has continued to increase her investment almost every year, investing a total of $75,000 in four years. Through reasonable allocation and strategic management, the two RESP accounts have received a total of $11,600 in government subsidies as of June 2025, with a total balance of $95,174, achieving an investment growth of $8,574.

✅ Total investment capital: $75,000

✅ Total investment value: $95,174

✅ Government subsidy: $11,600

✅ Net investment profit: $8,574

✅ Total profit: $20,174

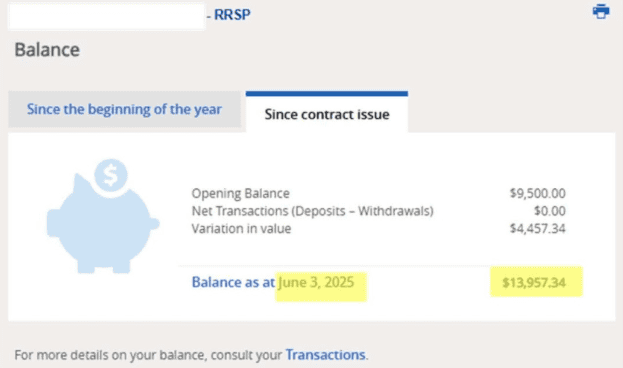

With the professional advice of AiF, Ms. Helen also opened an RRSP account in March 2023 to plan for her future retirement life. Through regular investment and the management of her assets by AiF’s professional investment team, Mrs. HELEN’s RRSP account has also achieved significant appreciation in two years.

🔹 RRSP account investment amount in March 2023 : $9,500

🔹 June 2025 , Account Balance: $13,957

🔹Return rate: 47%

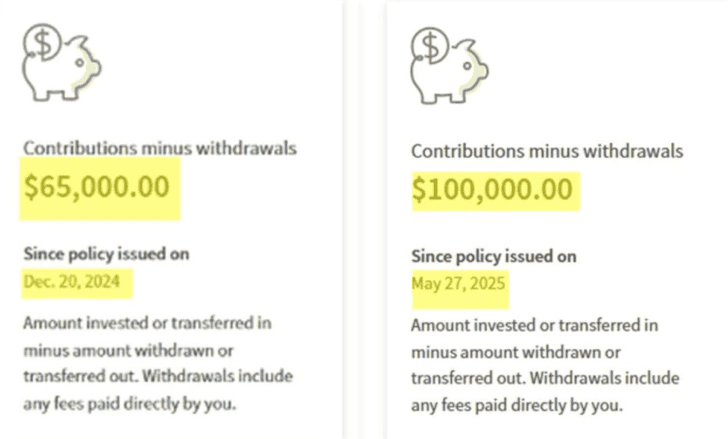

After gradually improving the configuration of the TFSA, RESP, and RRSP, Mrs. HELEN, with the advice and assistance of the Ai Financial team, opened a non-registered investment account with Canada Life in December 2024 with an initial investment of $50,000. After entering 2025, she continued to add $15,000 , and successfully applied for a $100,000 investment loan in May of the same year, leveraging funds into the market to achieve a higher level of capital utilization efficiency.

👨👩👧👦AiF Recommendation: Family assets should not rely on just one person

Mrs. Helen’s achievements have influenced her family. In November 2021, Mr. Steven came into contact with the AiF team under her introduction.

After doing a complete asset assessment, the team recommended that he start a TFSA and RRSP portfolio.

⭐️So Mr. Steven invested $75,000 into his TFSA account in November 2021, and increased the amount every year.

TFSA account total investment amount: $102,000

🔹 June 2025, account balance: $131,581

🔹Mr. Steven’s TFSA investment profit: $29,581

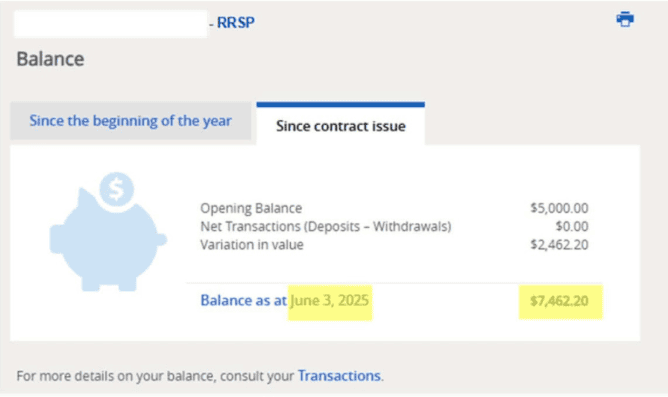

🔹 RRSP account investment amount in March 2023: $5,000

🔹 June 2025, Account Balance: $7,462

🔹Return rate: 49%

After four years of steady investment, Helen and Steven’s account balances have reached astonishing amounts:

- Mrs. HELEN’s total investment value: $533,178

- Mr. Steven’s total investment value: $139,043

Under the influence of Ms. Helen and the company of Ai Financial, Ms. Helen’s eldest daughter also opened her own TFSA investment account through the AiF team and gradually established her awareness of long-term investment. In 2021, she invested $6,000 and added $10,000 in 2024.

✨The key to investment has never been “how good are you at reading the market,” but rather whether there is someone willing to think one step further for you and take a more steady approach.

The achievements of Mrs. Helen and Mr. Steven’s family are not accidental luck, nor are they a short-term rush, but the result of long-term planning and repeated adherence to the advice of the AiF team.

With every additional funding, every market fluctuation, and loan application,

the AiF team bases its judgment on facts and makes clear decisions based on the client’s own interests and risks.

🎯 Investing is not a one-man show.

You just need to make the right decision and find the right professional team, and leave the rest to professionals.

🔹 Want to know more customer cases and AiF strategy support? You are welcome to contact an AiF investment consultant to tailor your asset growth path for you.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More