Discover how a Canadian family achieved 239% returns using strategic...

Read MoreTrusting Their Financial Planner: How a Couple Achieved Six-Figure Growth with AiF

Mrs. Z and Mr. Y are a couple known for their rational, data-obsessed approach to decisions. She excels at planning living expenses, while he rigorously compares every expenditure. In early 2021, they began to hear friends talking about AiF Financial—and how a reliable financial planner can bring calm and confidence during market turbulence. They wondered: “Why do others invest confidently while we stay on the sidelines?” Inspired, Mrs. Z decided to take the first step

The Journey Begins: A Financial Planner’s Tailored Strategy

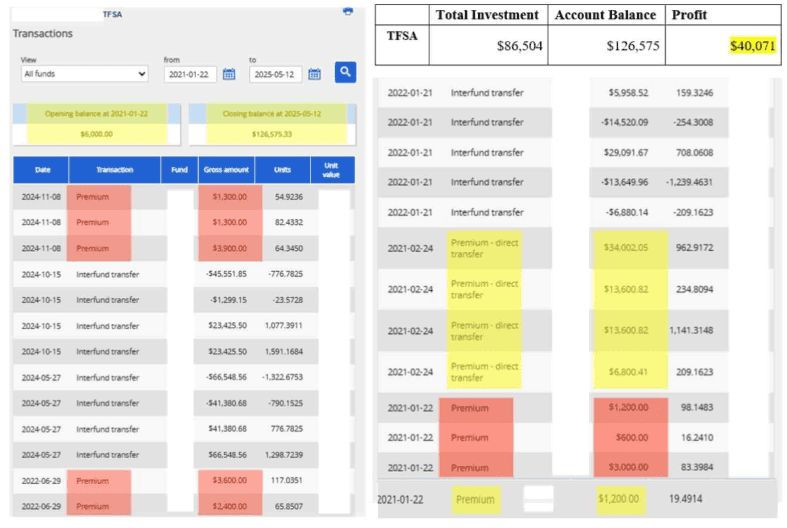

On January 22, 2021, Mrs. Z opened her TFSA with $6,000. She told the AiF financial planner she wanted to “see the results first.” Instead of jumping straight into product pitches, the financial planner took a holistic view—reviewing her assets, planning different investment configurations, and modeling projected growth across scenarios, even starting with just $6,000. This structured, data-driven method quickly built trust.

One month later, on February 24, 2021, Mrs. Z confidently added $68,004 to her TFSA, marking the start of a full partnership with the AiF team. Additional investments followed after consultation:

June 29, 2022: +$6,000

November 8, 2024: +$6,500

Total TFSA contributions reached $86,504.10. By May 12, 2025, the account had grown to $126,575.33.

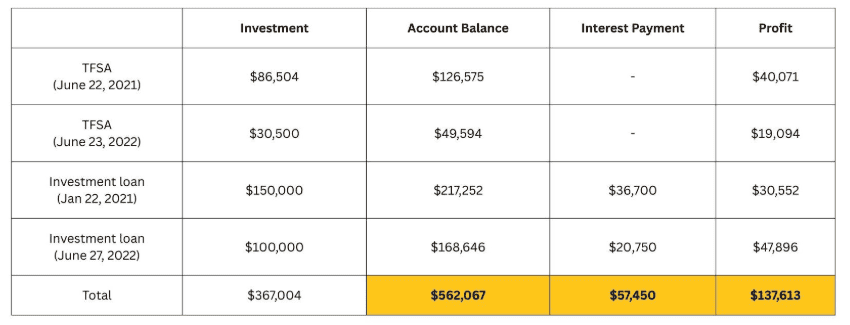

Summary of the couple’s total investment return over four years:

Mrs. Z’s TFSA investment return display:

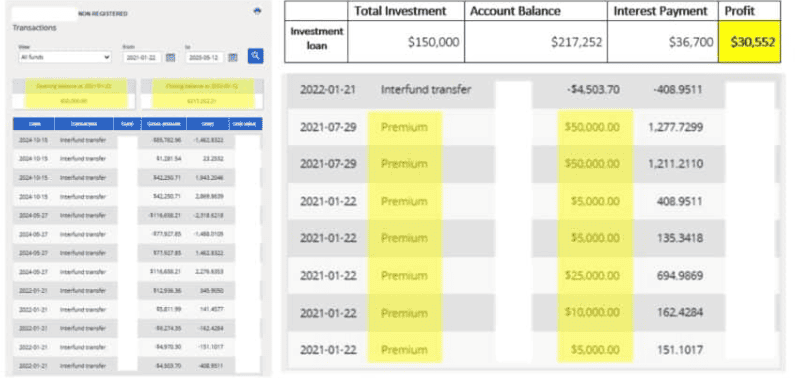

Loan-Based Investing: Strategic Leverage Guided by the Financial Planner

Simultaneously, the planner recommended coordinating non-registered and TFSA accounts for diversification. Mrs. Z trusted this advice and began supplementing her investments:

January 22, 2021: $50,000 investment loan

July 29, 2021: $100,000 investment loan (Manulife)

November 2024: $100,000 investment loan (Canada Life)

By May 12, 2025, her non-registered portfolio value reached $217,252, with loan interest totaling $36,700, and a net profit of $30,552. This wasn’t a gamble—it was a thoughtfully structured, planner-guided leverage strategy.

Mrs. Z’s investment loan return:

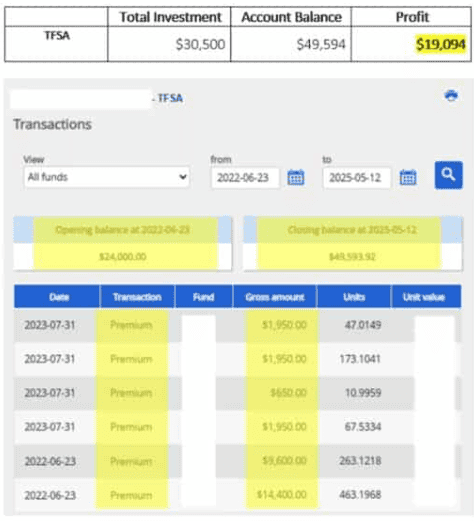

Broadening the Plan: Mr. Y Enters with a Financial Planner’s Support

Mrs. Z’s progress impressed Mr. Y, who joined in 2022 on her recommendation. The AiF financial planner reviewed his situation and suggested both TFSA and loan-backed investing:

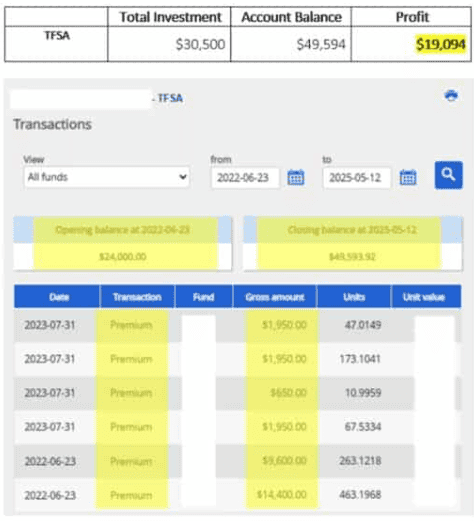

June 23, 2022: Mr. Y’s TFSA opened with $24,000; added $6,500 in July 2023

• TFSA value by May 12, 2025: $49,593.92June 27, 2022: $100,000 investment loan

• Current account value: $168,646.34

• Loan interest: $20,750, net profit: $47,896

• Real return: 231%

Again, the success stemmed from professional strategy, not luck. The couple leaned on expert advice to manage structure, timing, and risk—even when leveraging.

Mr. Y’s TFSA investment returns:

Mr. Y’s investment loan return:

Key Lesson from a Financial Planner: Strategic Support Over Lone Decisions

Mrs. Z and Mr. Y’s story shows that the real advantage didn’t come from market predictions—but from working with a financial planner who thought one step ahead. Each investment, loan application, and market fluctuation was approached with clarity on structure, rhythm, and risk.

Investing Isn’t a Solo Game

You don’t need to be a market genius. You need the right plan—and a professional you can trust to guide the way. Want to see more success stories like Mrs. Z and Mr. Y’s—and understand how a financial planner could personalize your asset growth strategy? Contact an AiF financial planner today to explore your path.

Ready to Star Your Own Journey?

If you’re looking to achieve sustainable investment growth, AiF offers a proven, professional approach:

- ✔️ Use investment loans to maximize capital

- ✔️ Strategically manage registered accounts for retirement

- ✔️ Leverage AiF’s AI-powered asset management platform

With an average annualized return of 21.6% over the past 10 years, AiF has helped clients turn possibility into performance.

📩 Contact AiF today to create your custom wealth strategy and start growing your assets with confidence

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More