Compounding - A Lesson in the Best Passive Income Strategy

Wealth is the gateway to true freedom. It’s the power to break free from the shackles of a traditional 9-to-5 job, to say goodbye to the rigid schedules and the relentless ticking of the clock that governs your every move. It’s the escape from the soul-crushing routine of commuting, office meetings, and monotonous tasks that drain your energy and creativity. With wealth, you unlock the freedom to live life on your own terms, to make choices driven by passion and purpose, not by necessity. It’s about waking up each day with the excitement of knowing you are in control of your time, your life, and your future—no longer bound by someone else’s agenda.

In this article, we will talk about how passive income works, including how compound interest grows wealth, the ESBI model, and how expert-managed investments like segregated funds offer security, growth, and more freedom with minimal effort.

What is Passive Income?

Passive income is money you can earn with little effort and without working a traditional job. You can earn passive income by renting out property, through dividend stocks, or a high-yield savings account. Unlike active income, which requires ongoing work, passive income involves an initial investment of time, money, or both. Once you’ve set things up, passive income can pay off for years to come.

To build true wealth, you need to own equity. You need to create something that generates income without needing constant attention. That’s where Ai Financial comes in.

What are the Benefits of Compound Interest?

One of the best ways to grow your wealth passively is through compound interest. Compound interest is the process where you earn interest not just on your initial investment (principal), but also on the interest that accumulates over time. The longer you leave your money to grow, the more powerful compound interest becomes, leading to exponential growth. The key benefit is that it accelerates your wealth over time without requiring much ongoing effort from you.

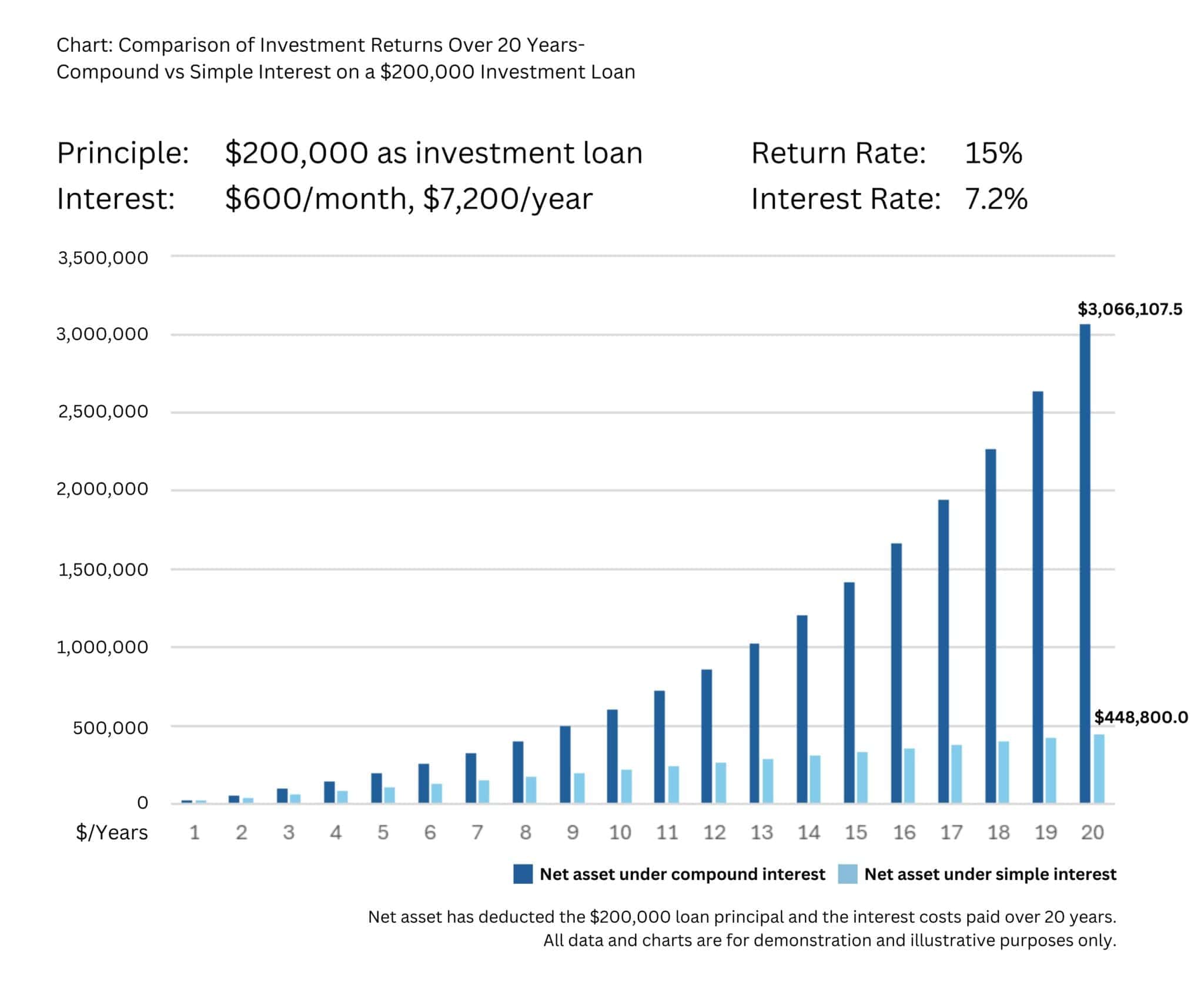

The following table demonstrates the difference between compound and simple interest calculations on a $200,000 investment loan, with a loan interest rate of 7.2% and an annual return rate of 15%, showing the results after 20 year.

Under the same investment amount, the compound interest effect can create a $2.6 million difference.

Of course, the duration of the investment and the initial amount also have a significant impact.

(We use the long-term growth rate of the S&P 500—a common measuring stick for how the stock market is performing—the current historically average annual rate of return is around 15%.)

In general, if you choose to purchase an investment that offers an interest rate compounded over time, the longer the term of the investment, and the more frequent the compound calculation occurs, the higher your return could be. And the earlier you start investing, the sooner interest can begin to compound.

Compound Interest: Start Saving Early

The sooner you start saving, the more you can benefit from compound interest. The earlier you begin, the longer your money has to grow. Even small investments, if left to compound, can lead to significant wealth over time. It’s never too early to start thinking about compound interest as part of your passive income strategy.

“Give me a lever long enough, and a place to stand, and I will move the earth.”

- Archimedes

To understand how compound interest works, think of it like a snowball rolling down a hill. As it rolls, it gathers more snow, becoming larger and larger. In the same way, your interest is calculated on both your original investment and the accumulated interest. For example, if you invest $1,000 at 15% annual interest, by the end of the first year, you’ll earn $150. In the second year, you’ll earn interest on $1,150, and so on. Over time, this adds up significantly.

Pros and Cons of Compound Interest

Pros:

- It grows wealth exponentially over time.

- The longer you leave your money to grow, the better the returns.

- It requires minimal ongoing effort after initial investment.

Cons:

- The power of compound interest depends on time, so early investment is key.

- You need to have a strong interest rate to see significant gains.

- It works best when you can leave your money untouched for extended periods.

Ai Financial has an astonishing 20%+ average annual investment return over the past decade.

Exploring the ESBI Model

The ESBI model categorizes four different ways to earn income

- E: Employee – You work for someone else and get paid a salary or hourly wage.

- S: Self-Employed – You work for yourself, like renting out items or selling products.

- B: Business Owner – You create a business that works for you and others, like a YouTube channel or eBook.

- I: Investor – Your money works for you. You invest in things like real estate or stocks, and they generate passive income for you.

Being an Investor is the ideal quadrant for passive income. Investors place their money in vehicles like stocks, real estate, or funds, and their money works for them, often generating returns through compounding. The power of compound interest—where your returns build on each other over time—gives investors the potential to generate significant passive income without ongoing effort.Incorporating investing as part of your passive income strategy, particularly by leveraging compound interest, helps you transition into the Investor quadrant, where your money works for you. This strategy allows you to build wealth over time with minimal hands-on effort, creating more freedom and financial stability for your future.

Tom or Jerry?

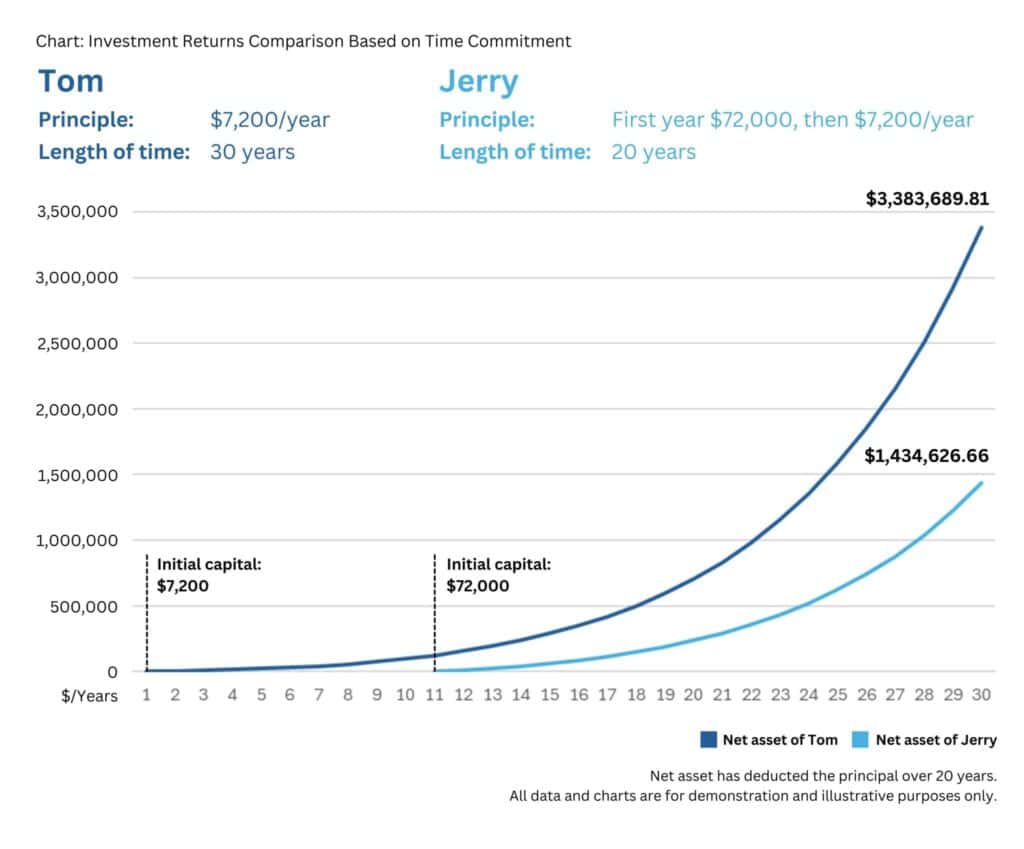

Let’s say Tom start saving $7,200 every year at age 30. He earns an average compounded return of 15% annually across 30 years. He could earn $3,383,689.81 by age 60. His principal investment was just $216,000.

His sibling Jerry doesn’t begin investing until age 40. He invests $72,000 initially, then $7,200 annually for 20 years, also averaging an annually compounded 15% return. By age 60, Jerry could only earn $1,434,626.66, with a same principal investment of $216,000.

Even Jerry invests twice than Tom, when they both reach their 60, Tom’s investing will still be $1 million more than Jerry.

Why Investing is the Best Option for Passive Income

Investing in financial products like segregated funds or investment loans allows you to build wealth without the need to manage properties or create products. It offers security and the potential for growth while minimizing day-to-day involvement. Plus, with the right strategy, you can amplify your returns by leveraging investment loans, which enhances your passive income potential. It’s a streamlined way to grow wealth with professional management and fewer headaches compared to real estate.

Passive income is an excellent way to secure your financial future, especially in uncertain economic times. Investing in segregated funds or similar products provides a reliable and effective strategy for generating passive income. It allows you to build wealth without the burdens associated with active income sources. Investing is not just a way to earn money—it’s a path to greater freedom and financial security.

Got questions? Talk to an advisor at AIFinancial today!

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……