Discover how a Canadian family achieved 239% returns using strategic...

Read MoreCanada Pension Plan (CPP): Crisis, Reform & New Solutions

Read all AiF opinions and articles

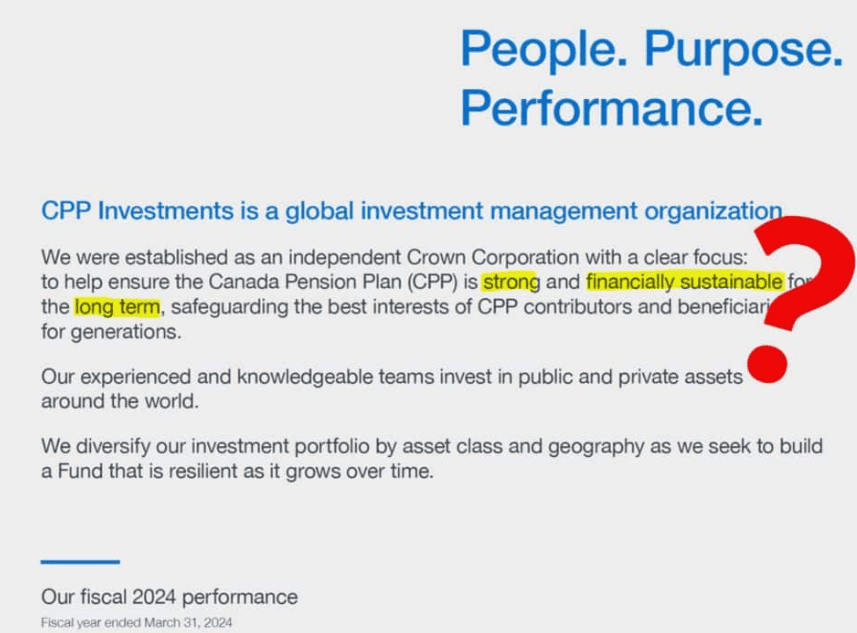

In March, Canada’s pension fund CPP released its 2024 investment report for the Canada pension plan, revealing key issues in the system. It’s clear the current system struggles to support today’s retirees, let alone future needs. Let’s examine the data to understand the growing crisis.

The entire report is over 140 pages long and contains a lot of content. We will select some of the data to share with you.

What’s in this blog:

The data is scary

Next, we move on to the first part, which contains a large amount of professional data with high reference value.

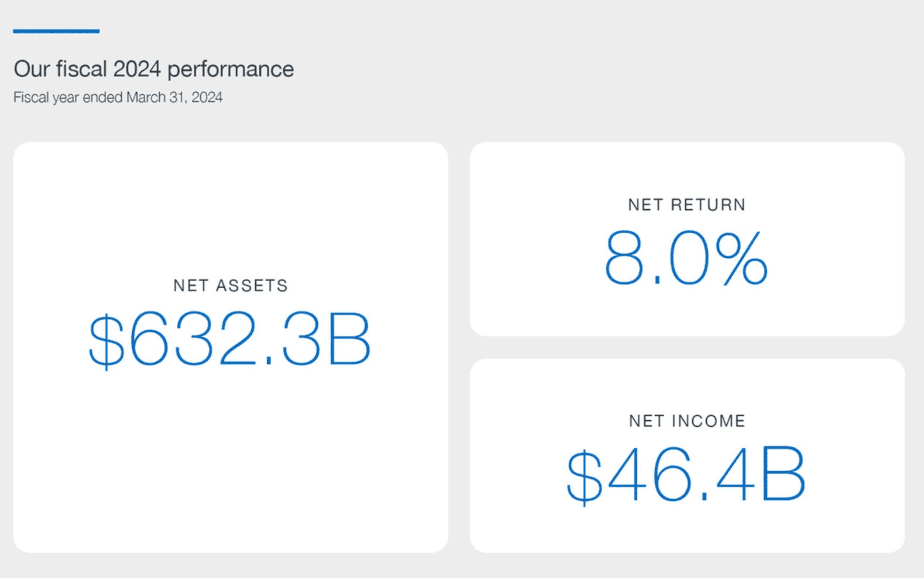

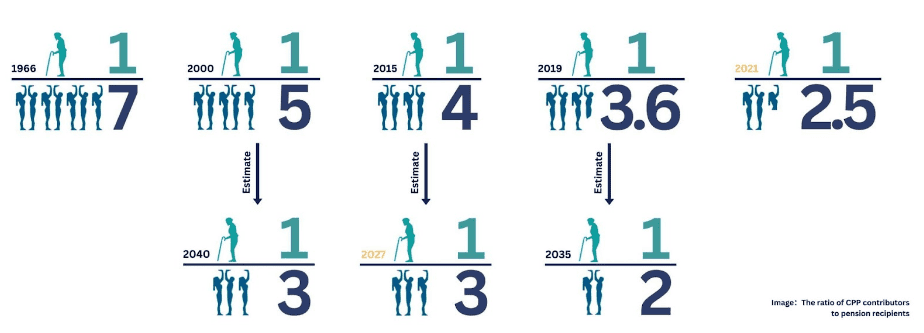

First, the Canada pension plan released its performance table for 2024. The left side shows that its net assets are 632.3 billion Canadian dollars, the rate of return is 8%, and the net income is 46.4 billion Canadian dollars. Then we look at the second set of data, which explains the relationship between contributors and withdrawers.

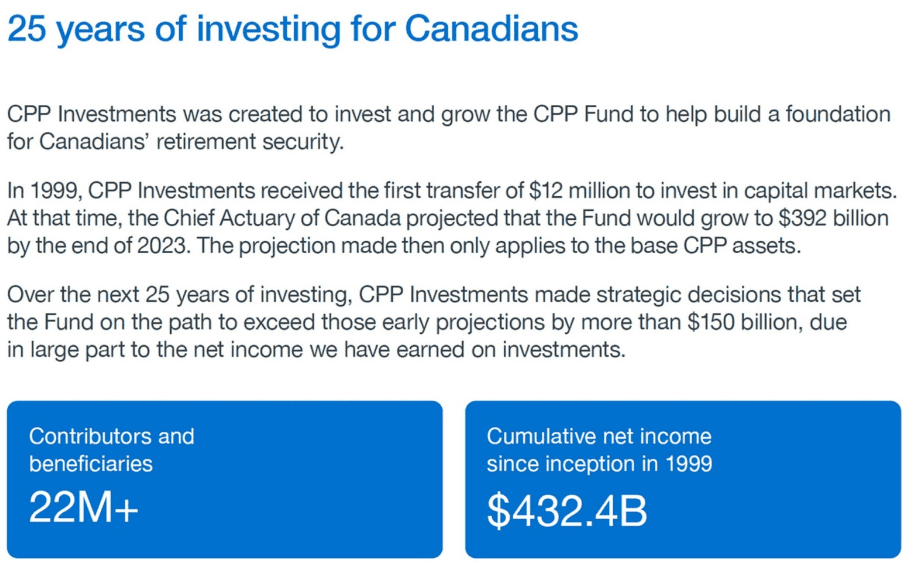

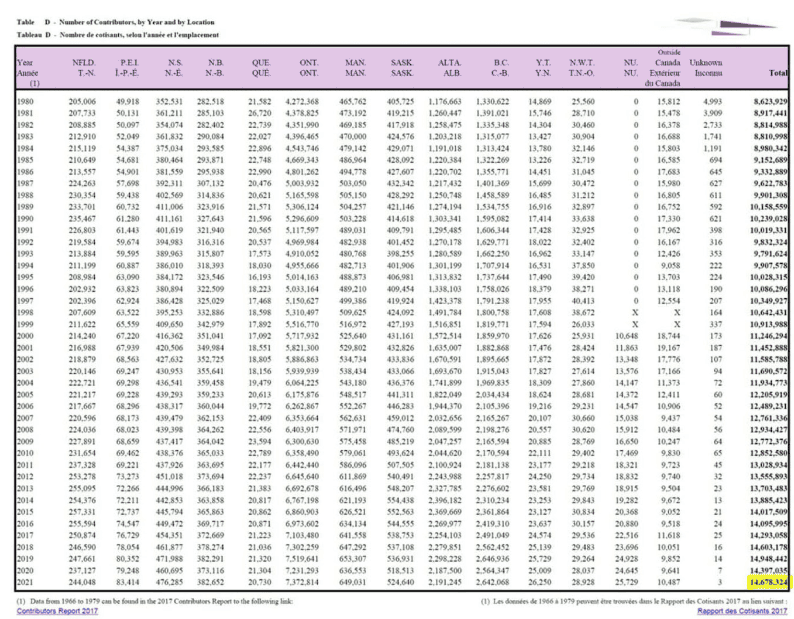

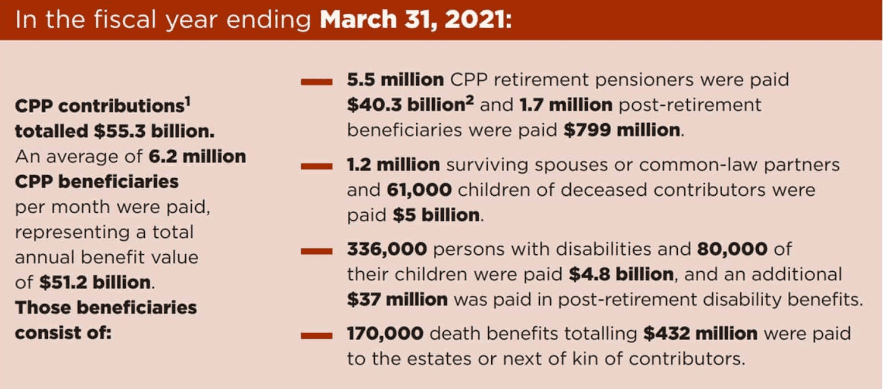

CPP, established in 1999, has been operating for 25 years with around 22 million contributors and beneficiaries. As of 2021, only 14 million Canadians—about 40% of the 36 million population—contribute to CPP, meaning 60% won’t receive CPP benefits in retirement.

In 2021, 6.2 million people were receiving CPP, many being elderly retirees. With 14 million contributors, that means roughly 2.5 workers were supporting each retiree.

This data is significant as it highlights a clear historical trend. In 1966, 7 workers supported one retiree; by 2000, the ratio was 5:1; in 2015, it dropped to 4:1. Although projections for 2027 estimated 3:1, the reality has shifted faster—by 2019, it was 3.6:1, and by 2021, just 2.5 workers were supporting each retiree.

The situation is likely to worsen in the future. For example, if I retire in 2035 and my children are just starting their careers, they may each need to support one retiree—a heavy burden. Today’s young people already rely on parental help just to afford housing, so expecting them to support us in retirement adds even more pressure.

It’s clear the CPP, as originally designed, can no longer keep up with today’s realities. Let’s return to the data: CPP currently manages $632.3 billion CAD in assets. This number may seem abstract, so next, we’ll break it down with specific figures to better understand the fund’s situation.

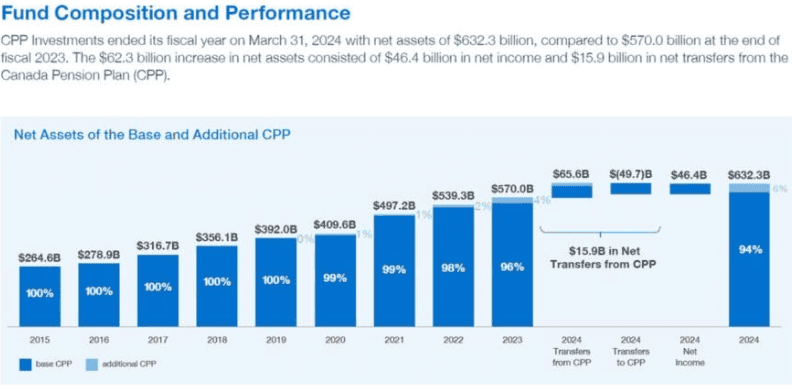

First, the report states that CPP contributions in 2024 will total $65.6 billion CAD, based on 2023 contributions. Of this, $49.7 billion will be paid out to retirees, leaving a net income of $15.9 billion.

Secondly, the $15.9 billion CAD net income in 2024, combined with $46.4 billion in investment returns from 2023, brings total income to $62.3 billion. Adding this to CPP’s 2023 year-end assets of $570 billion results in a total fund value of $632.3 billion—the current size of the CPP fund.

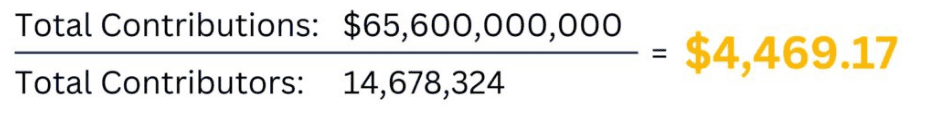

Based on the data, in 2023, Canadians contributed a total of $65.6 billion CAD to CPP. With 14 million contributors, that averages out to approximately $4,469.17 CAD per person for the year.

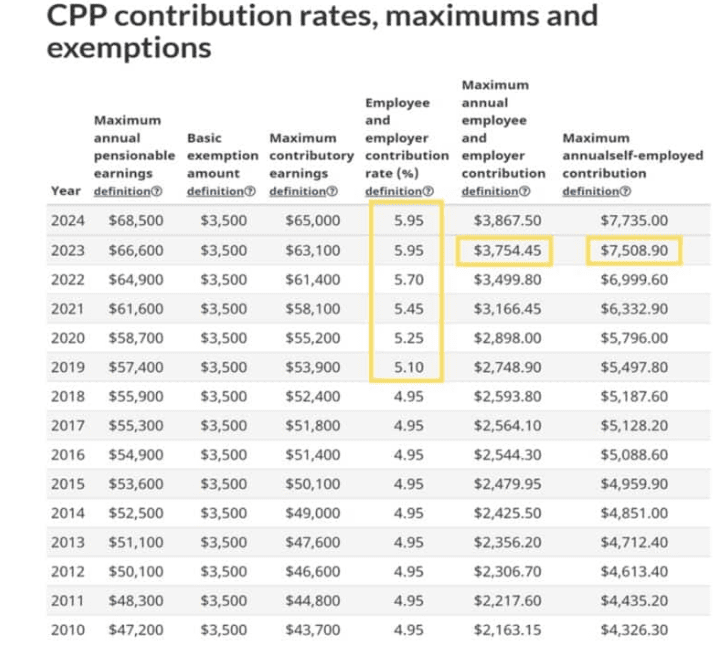

Looking at the data on the official Canadian website, the contribution rate has increased year by year from 2010 to 2024. Before 2018, the contribution rate was 4.95%, and it has increased year by year since 2019, reaching 5.95% in 2024. This trend shows that CPP funds are short, so the contribution rate is increasing year by year.

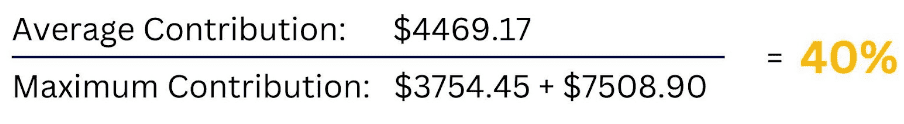

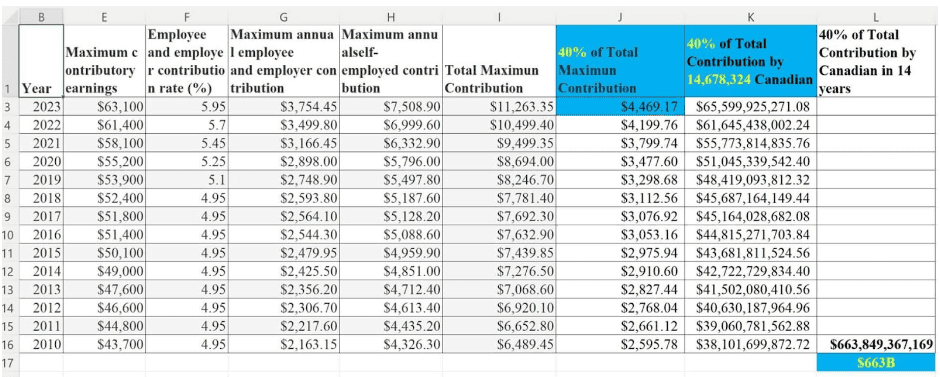

In 2023, with maximum contributions set at $3,700 (individuals) and $7,500 (business owners), and an average of $4,469.17—about 40% of the max—we can estimate total annual CPP contributions from 14 million Canadians.

Over the past 14 years (2010–2023), Canadians have contributed $663 billion to the CPP, yet total CPP assets after 25 years stand at just $632.3 billion. This suggests contributions from 1999–2009 are not reflected, raising concerns about fund management and indicating potential erosion of principal.

These figures highlight a serious funding shortfall in the current pension system, making it clear that it may not be sustainable for future retirees. Addressing this gap is urgent.

Alberta to withdraw from CPP

Therefore, Alberta proposed to withdraw from CPP. In September last year, Alberta submitted a report requesting to withdraw from the entire Canadian Pension System CPP and plan to establish a new pension system on its own.

There are five reasons why Alberta withdrew.

The third reason is that, although the CPP was promoted as a national pension system, Quebec never joined. When the system was established in 1966, provinces were given the option to participate, and Quebec chose to create its own plan. Alberta argues that, since Quebec opted out, it too has the right to withdraw and manage its own pension system independently.

The third reason is that although the CPP was promoted as a national pension system, Quebec did not participate in it. When the pension system was established in 1966, each province could decide whether to join it, and Quebec chose not to join. Therefore, Alberta believes that since Quebec does not participate, it has the right to choose to withdraw.

The fourth reason is Alberta’s belief that a provincial pension system would be cheaper and more secure. With its large share of public funds, Alberta argues workers could contribute less while still receiving strong benefits. It also views the withdrawal process as straightforward once CPP funds are liquidated.

Alberta plans to establish its own pension plan, or APP, after laying out five reasons for its withdrawal.

First, any CPP funds Alberta transfers will be invested in the APP, with all future profits belonging to the APP. Additionally, all future employer and employee contributions must go into the APP.

If Alberta decides to withdraw from the CPP and create its own APP, it may need a referendum. If approved, Alberta must notify the CPP three years in advance to allow time for the CPP to sell assets and return funds. Since Alberta holds over $300 billion—about half of the CPP’s assets—this time is essential.

If Alberta withdraws, CPP’s funding gap will grow. With Quebec already outside and Alberta leaving, the CPP faces greater strain, highlighting its inability to meet future pension needs.

Where did the money go?

You might wonder why CPP is underfunded despite large monthly contributions. Let’s explore this by focusing on key points from the report.

First, CPP promises long-term financial stability, but the reality, as seen earlier, is less optimistic.

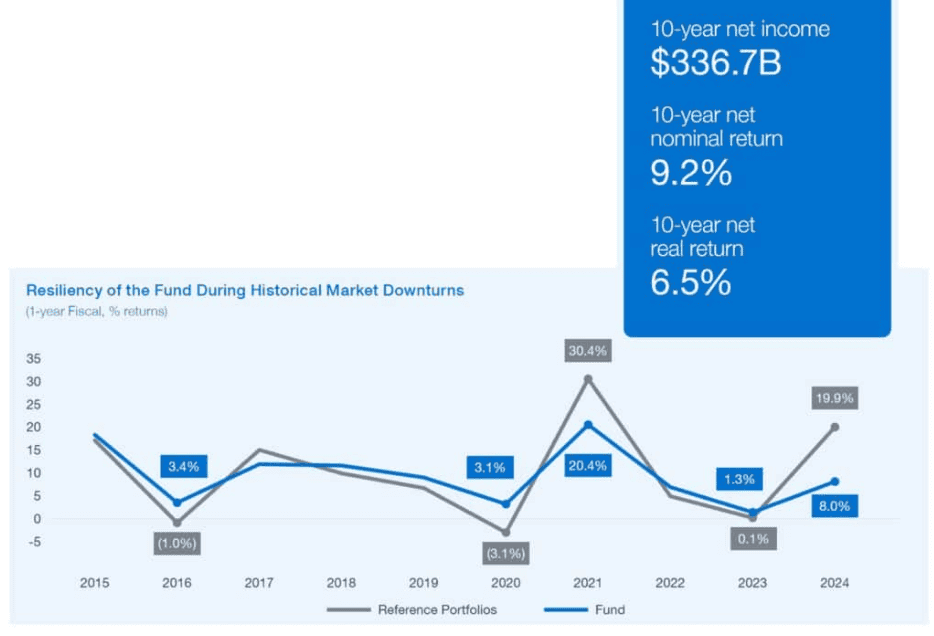

The report shows the CPP’s actual return over the past decade was 6.5%. This year, the CPP’s return is 8%, while similar funds achieved 19.9%. Clearly, the CPP’s investment returns are below par despite claims.

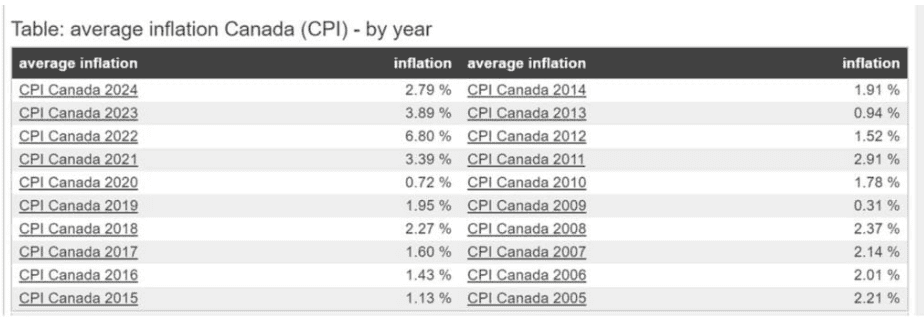

Canada’s average inflation over the past decade was 2.6%, making CPP’s real return only 3.9%. Since GIC rates have often exceeded 3.9%, CPP’s return is quite low.

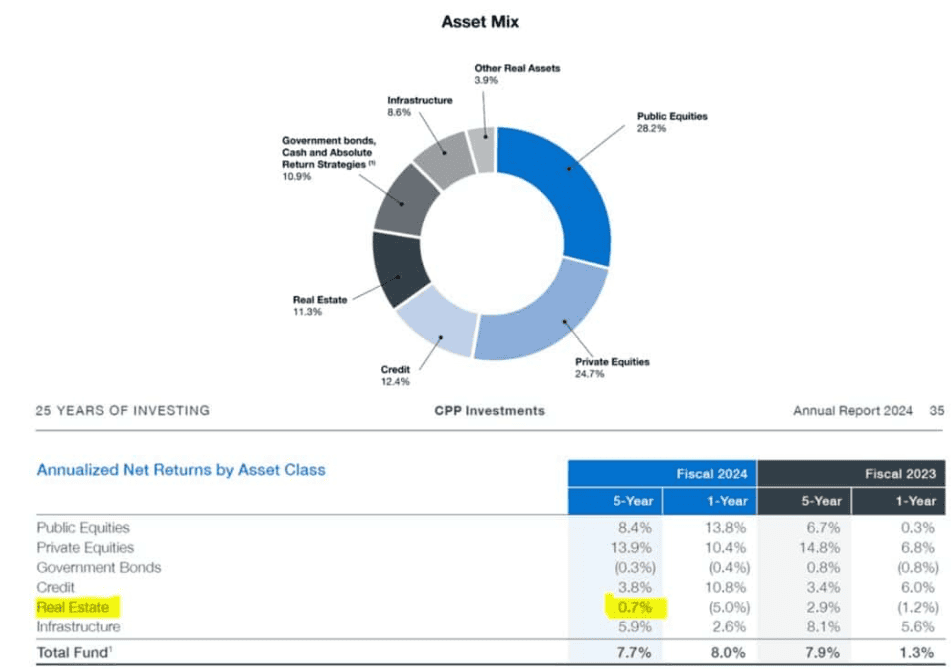

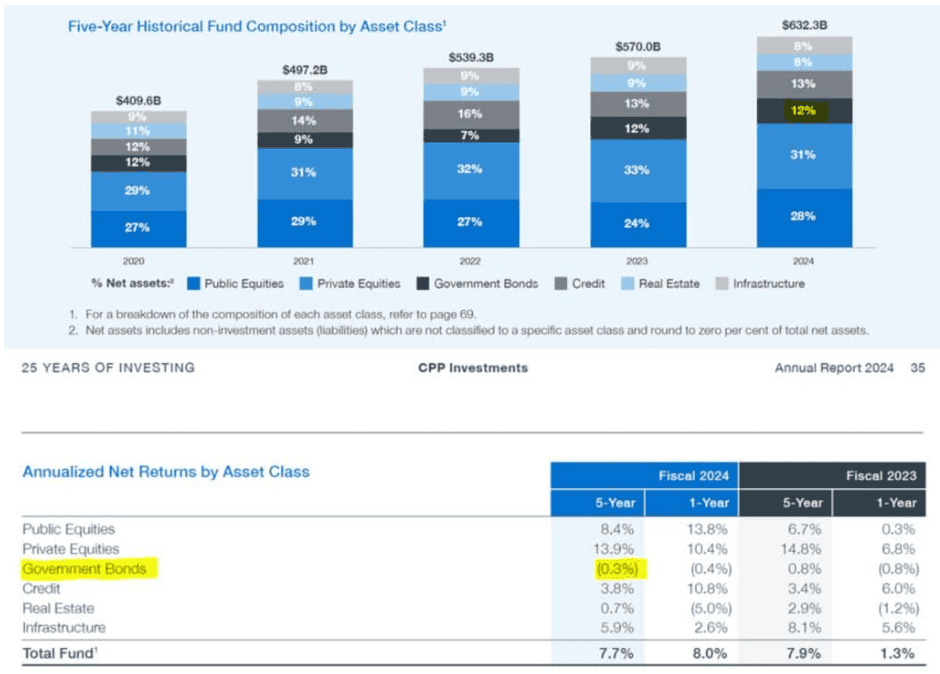

Where did the money go? CPP lost 5% ($124 million) on real estate—the worst since 2008. Post-pandemic remote work hit office and retail properties hard, and CPP’s heavy investment in this sector caused significant losses of 5%, or 124 million, on real estate alone last year.

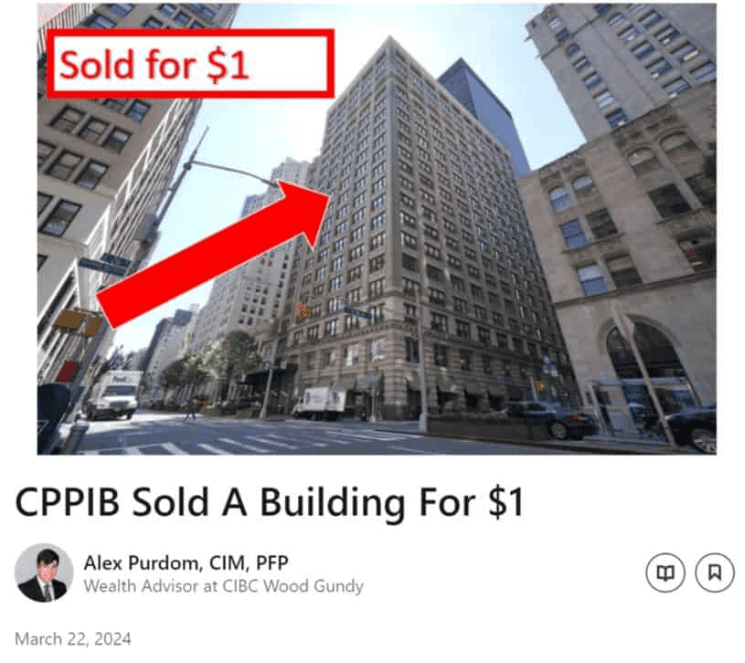

Notably, in February, CPP sold a Manhattan office building for $1, originally bought for $71 million. Debt exceeded assets, forcing the sale and highlighting a major real estate investment mistake.

Why did the CPP make this decision? They misjudged the investment environment. Riding two decades of booming real estate, the CPP assumed all property investments would be profitable. But they failed to see the golden age was over. Post-pandemic and inflation hit office, commercial, and retail real estate hard, yet the CPP didn’t adjust its strategy in time.

As shown, CPP still holds 11.3% in real estate—a high share. Over five years, real estate returned just 0.7%, far below other markets. This shows the real estate peak is over, but CPP’s investment approach hasn’t adapted.

By 2024, 12% of CPP’s portfolio is in government bonds, which returned -0.3% over five years—meaning a loss. Combined with real estate, these make up 23% of CPP’s assets, meaning a quarter of its assets have generated no income and are losing money.

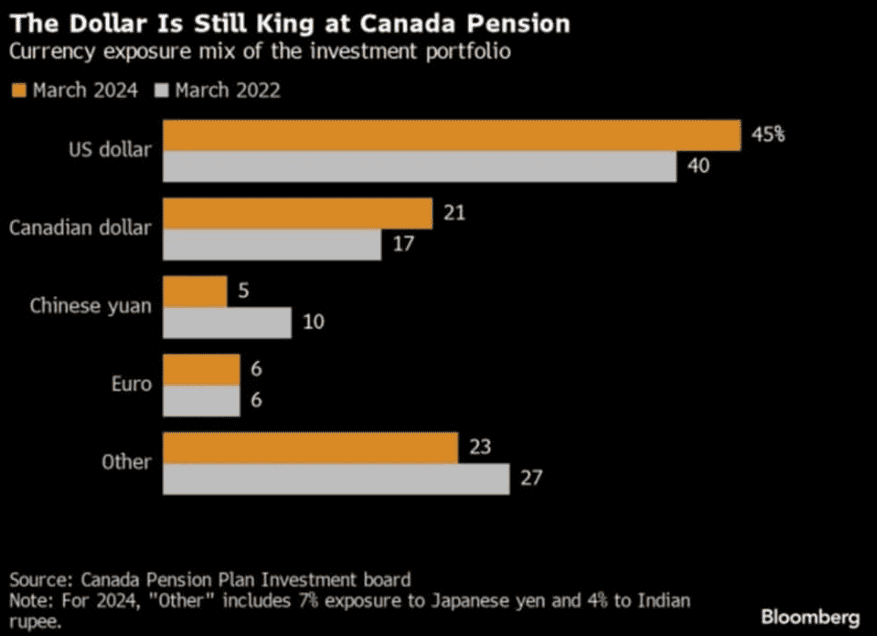

As of March 31, CPP’s holdings of US and Canadian dollars increased, but RMB assets dropped from 10% to 5% due to China’s economic downturn. This forced CPP to cut RMB investments quickly, causing significant losses. Investments in other regions also shrank, with China’s losses being the most severe.

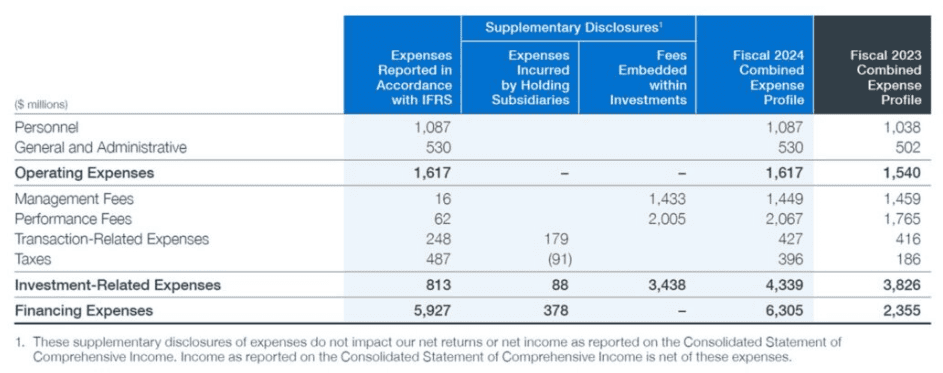

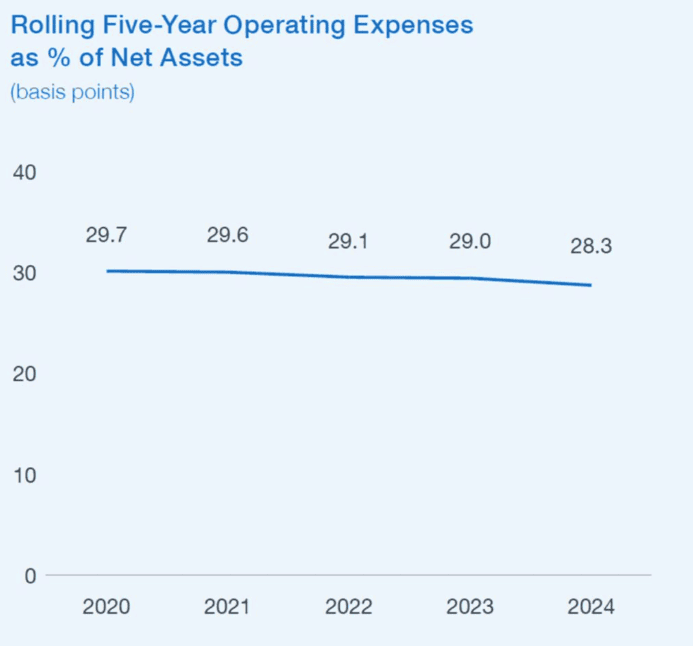

All these factors contributed to CPP’s major losses. But even more alarming are its costs—operating, investment, and financing expenses totaled $8.36 billion, or 28.3% of assets. Nearly a third of CPP’s assets went to expenses.

In summary, CPP funds are largely lost to poor investments or high operating costs. Much of the monthly pension contributions are drained this way. Clearly, Canada’s pension system is in urgent need of reform.

The pension system must be reformed

The government knows the pension system has problems and wants reform, but change from within alone isn’t enough. Why?

First, those already receiving CPP won’t accept reduced benefits for the sake of reform—they only want more. Likewise, current contributors won’t support changes that shift retirement responsibility to them or risk losing past contributions. In short, both groups resist reform that threatens their interests, making change within the current system nearly impossible.

So, if the current system can’t be reformed from within, change must come from outside. The key is to focus on today’s young people and working class. If they can build enough personal wealth to avoid relying on CPP in retirement, Canada’s pension crisis could be solved at its root.

It’s a good idea, but the key is helping young people earn more. The government aims to achieve this through policy.

I experienced China’s 1980s reform era. The country had little, but the government offered policy support, letting people explore their own paths—“crossing the river by feeling the stones.” This approach enabled cities like Shenzhen and Zhuhai to lead the way, sparking nationwide reform.

Policies aim to make some people wealthy first, which is crucial. Canada could apply this idea to reform pensions by helping people build wealth. However, some expect to rely solely on government support for retirement, living too comfortably without preparing.

During China’s 1980s reform, many started businesses, but those relying on the state resisted change and were eventually laid off. Those who lived through it know the struggle well. Canada may face a similar situation—relying on government retirement support is unrealistic. Instead, preparing early is essential to avoid future retirement worries.

The Canadian government can guide people to solve old-age care like China did in the 1980s, using an important tool: investment loans. By earning money through investments, individuals can secure their own retirement and reduce the country’s burden. That’s why Canada introduced a state-backed investment loan policy to help people build wealth for old-age care.

After the policy launch, many wanted to invest but lacked funds. The government provides loans through banks to help them invest, allowing money to grow. This reduces reliance on government support and fundamentally changes the pension system. Investment loans are state-endorsed.

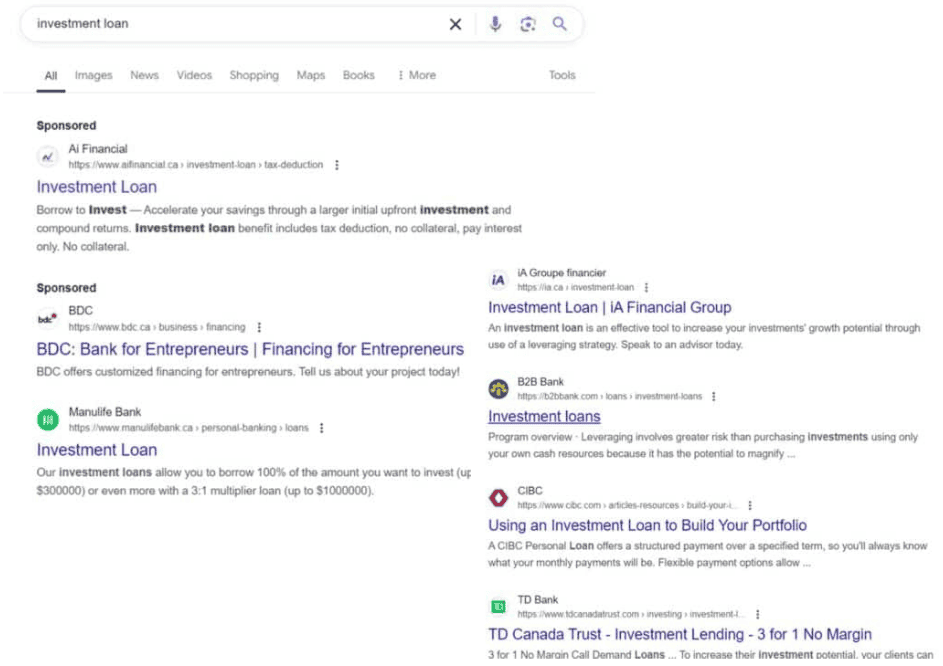

You can find many descriptions of investment loans online, including from Ai Financial. Major banks like BDC, Manulife, iA Trust, B2B, CBC, and TD all offer investment loans. These state-backed loans help people invest and grow their money.

How do you make money investing? The state backs the investment, and banks provide funds. These loans are invested only in principal-guaranteed funds—no other funds or mutual funds allowed.

Why protect the principal? Because the money is state-backed, so risk must be minimized. Insurance companies guarantee the principal. Funds come from banks, are state-endorsed, invested in fund companies, and protected by insurers. Through Ai Financial, we help Canadians invest and grow wealth, reducing reliance on state pensions—creating a win-win for all.

At Ai Financial, we’re dedicated to promoting this plan and improving Canada’s retirement system. This is our mission. We invite everyone to join us in creating a better future for themselves and the country.

At Ai Financial, we’ve operated in investment loans for years, achieving a 21.6% return over the past decade—far above the highest recent interest rates of nearly 8%. Since borrowing only makes sense if returns exceed interest, our 21.6% return comfortably covers the 8% cost, fulfilling the government’s goal of promoting investment loans.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More