加拿大TD银行在4月30号, 被爆出因反...

Read MoreCategories

Recent Posts

- 华尔街上涨以弥补本周的损失, 苹果宣布史上最大规模回购 | Ai Financial 财经日报 May 2, 2024

- AiF观点 | TD银行反洗黑钱监管不当, 被重罚4.5 亿 + 920万 May 2, 2024

- AiF观点 | 万锦王府井购物中心被接管,债务超过 5200 万美元 May 2, 2024

- Stocks are rising Thursday after Fed decides to hold rates steady May 2, 2024

U.S.Stocks rise on dovish signals from Federal Reserve

Wall Street has a new high water mark for the S&P 500

- March 25, 2024

- March 25, 2024

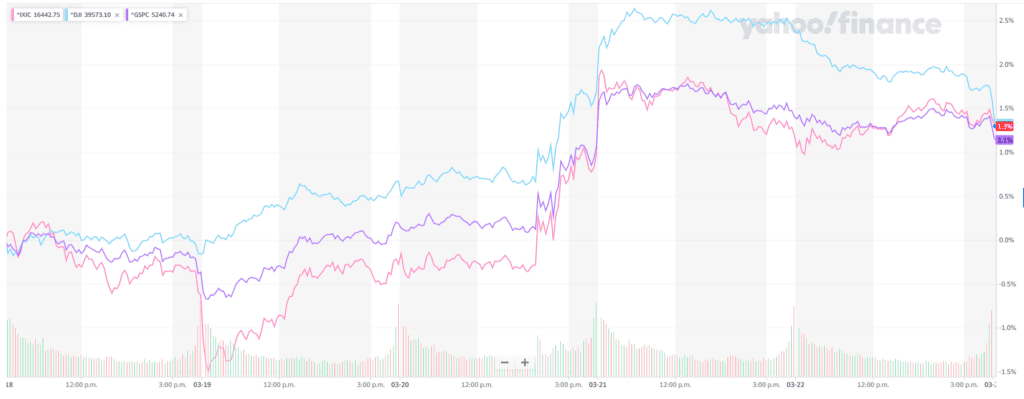

Last week, the three major US stock indexes closed higher. On a weekly basis, the Dow Jones Industrial Average (DJIA) rose by 761.13 points, or 2.0%, to close at 39,475.90 points; the S&P 500 index rose by 117.09 points, or 2.3%, to close at 5,234.18 points; and the NASDAQ index rose by 455.64 points, or 2.9%, to close at 16,428.82 points.

Key Takeaways:

Stocks moved higher for the last week, pushing the S&P 500 Index and the Nasdaq Composite to new records, as investors welcomed news that Federal Reserve policymakers were still anticipating three interest rate cuts later in the year. The S&P 500 index gained 9.7% in 2024 through last week, and its 20 record closes so far this year rank as the sixth most for a first quarter since World War II, according to Sam Stovall, chief investment strategist at CFRA. In both 2013 and 1998, the index posted 25 record closes in the first quarter.

U.S. inflation has eased from its pandemic highs and growth has held up. And expectations for S&P 500 earnings growth for 2024 have been revised up to about 11%, LSEG data show. Earnings expectations are even higher for tech companies that markets see leveraging artificial intelligence (AI). Communication services led the gains along with technology shares. A late rise helped artificial intelligence chipmaker NVIDIA reach a record high on Friday and lift the company’s market capitalization near USD 2.4 trillion. Reports that Apple might partner with Google parent Alphabet in offering generative artificial intelligence tools also boosted sentiment. Health care and real estate shares lagged. Trading the following week was scheduled to end on Thursday in observance of the Good Friday holiday.

The week’s main driver of sentiment appeared to be the Fed’s policy meeting concluding on Wednesday. As was widely anticipated, policymakers left the federal funds rate unchanged, but our traders noted that investors seemed to take heart from the quarterly release of the Fed’s Summary of Economic Projections, which summarizes the outlook of individual committee members. The so-called dot plot showed that the median expectation for three rate cuts in 2024 remain unchanged, while the median expectations for interest rates in 2025 and 2026 went up by less than 25 basis points (0.25 percentage points), or by less than one cut.

Investors also appeared encouraged by Fed Chair Jerome Powell’s post-meeting press conference, where he indicated that he was not overly concerned about the uptick in inflation data in January and February, chalking it up to seasonal noise. Powell also pushed back against worries over potential signs of cracks in the labor market, such as the unexpected increase in the unemployment rate in February.

This Friday, when markets will be closed, the Bureau of Economic Analysis reports its Personal Consumption Expenditures Price Index (PCE) for March. The PCE, the Fed's favored inflation gauge, will be closely studied after both the Consumer Price Index and the Producer Price Index (PPI) stoked inflation concerns earlier this month. Recent PCE reports appeared to paint a somewhat tamer picture of inflation than the CPI and PPI figures.

AiF does not speculate on whether or when rate cuts will occur. Our perspective is that the Fed's interest rate hikes aim to deflate the real estate bubble. So, whether the Fed will cut rates depends on whether it has achieved its goal of curbing the real estate bubble. If the goal has been achieved, the Fed will consider rate cuts. If not, we do not believe the Fed will cut rates.

The US stock market is in a bull market. Ai Financial, with its professional investment philosophy, seizing the opportunities of our time together and reap wealth.

21.6%

Average Annual Compound Return For Past 10 Years

Ai Financial delivers consistent and stable investment returns to clients, achieving 10%+ annual compounded returns over the past decade.

Thursday Seminar

Free Financial Online Seminar

Weekly free online seminars every Thursday evening, offering investors the latest insights on hot topics and market trends.

Mission and Vision

You fulfil your dream, we pay for your bill

Improve Canadian Retirement System.

Ai Financial Funds Investing - You fulfill your dreams, we cover your bills

Ai Financial is a leading Canadian Fin-Techfund investmentservice provider. We leverage cutting-edge technology to adhere toValue Investing principles,aiming to drive reform in Canada's pension system and enable more people to live better lives through financial investment.

Ai Financial has a background in financial compliance and anti-money laundering (AML). Through collaborations with banks, funds, and insurance companies, we select fund products suitable for clients and managevarious investment accountssuch as TFSA and RRSP. Additionally, we assist clients in applying for unique CanadianInvestment Loan, facilitating early attainment of financial freedom.

RELATED READING

Stocks break losing streak, while tech stocks rallied; Slow progress on inflation means rates will stay high for longer

Between a barrage of earnings, the first-quarter GDP report, and the release of……

Read More