Wealth Inequality and Investment Strategies: Follow the Rich

Read all AiF opinions and articles

In January, CBC predicted the world’s first trillionaire could emerge within a decade. While this signals rising wealth, it also underscores growing inequality.

The wealth gap is projected to widen over the next 229 years, raising concerns about a return to neo-feudalism—especially in countries like Canada. Reports from OXFAM warn that without smart investment strategies, many will fall behind, as the rise of trillionaires highlights deepening inequality.

Founded in 1942, Oxfam is a global NGO focused on poverty relief. With branches in 21 regions, its reports are highly credible. We’ve chosen to analyze its latest 57-page report, which explores the lifestyles and investment strategies of the world’s wealthiest individuals.

Due to the report’s complexity, we’ll highlight key data and insights rather than cover it all. First, let’s examine the recent living conditions and financial behaviors of the world’s wealthiest individuals.

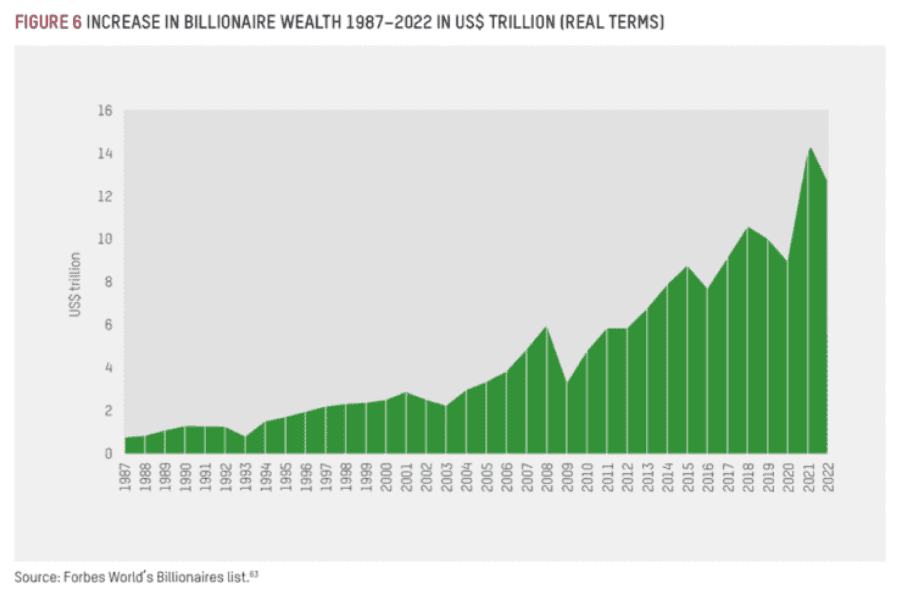

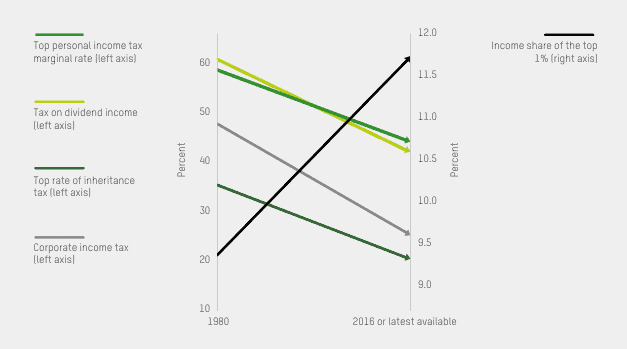

During the pandemic, while many faced hardship and lacked basic necessities, the richest 1% gained nearly two-thirds of new global wealth—widening the inequality gap.

In the past decade, billionaire wealth doubled, while the bottom 50% saw only a sixfold gain. Of every $100 in new wealth, $55 went to the top 1%, and just $0.70 to the bottom half. During the pandemic, the poorest 40% lost twice as much income as the richest 20%, deepening inequality.

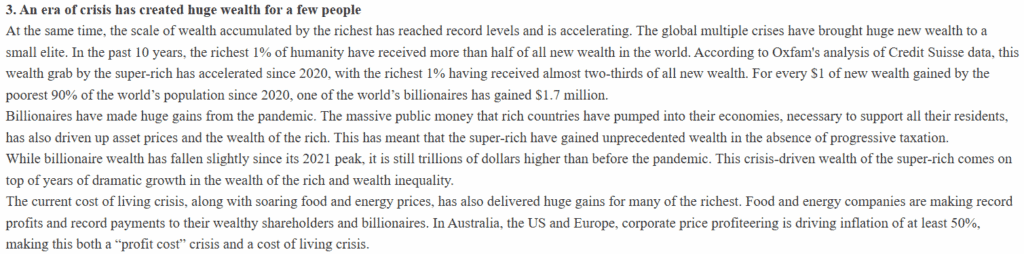

This highlights worsening inequality: the rich grow richer while the poor fall further behind. Over the past 40 years, the wealth of the world’s richest has grown 13-fold—doubling roughly every three years.

The richest 1% now hold 45.6% of global wealth, while the poorest 50% own just 0.75%. Just 81 billionaires have more wealth than half the world’s population—showing a stark and alarming wealth gap.

In the past two years, the bottom 90% of the population gained only 10% of all new wealth. The middle 99% received 37%, meaning the 9% just above the bottom gained 27%. Meanwhile, the richest 1% alone captured 63% of all new wealth. This shows that nearly two-thirds of newly created wealth went to the top 1% through investment strategies, deepening inequality—especially amid post-pandemic inflation.

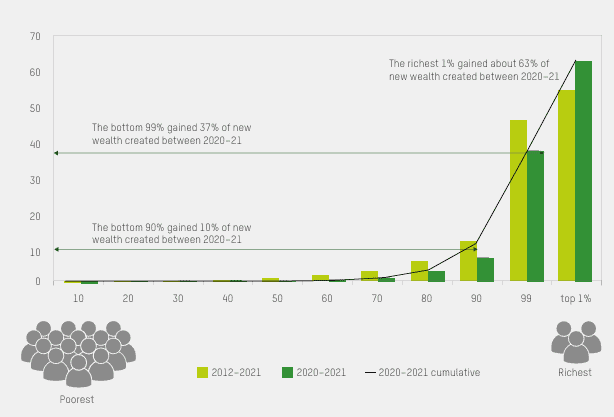

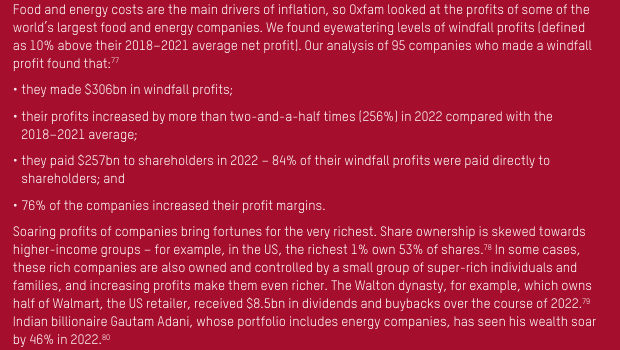

The Federal Reserve’s rate hikes to curb inflation mainly benefited the top 500 global companies, whose profits rose 156% pre-pandemic. From 2018 to 2021, their average profits grew 10%, with even larger gains during inflation, as they passed rising costs to consumers—especially in food and energy.

The Oxfam report reveals that 595 companies doubled their profits during the pandemic, gaining $306 billion, with 84% going to shareholders. This shows how the investment strategies of oligopolies can have huge profits. So, why should we analyze this? Because it reveals how the rich make money, offering key insights for our investment strategies.

During the epidemic, everyone felt the same high pressure and felt hurt.

But in fact, no one was spared during this period, except the shareholders of these large companies. During the epidemic, these large companies and monopolies obtained 84% of unexpected profits, which flowed directly to shareholders. At this moment, or at the moment of inflation, the shareholders of these large companies made a lot of money.

Why do shareholders earn so much? Because they own equity—and that’s key. In the U.S., the top 1% owns 53% of all equity. To build real wealth, you need to own equity too. For example, India’s billionaires saw their wealth jump 46% in 2020, highlighting how fast the rich are growing richer. We’re in an era of wealth explosion, and to keep up, you must learn to invest like the wealthy—by owning equity and developing good investment strategies.

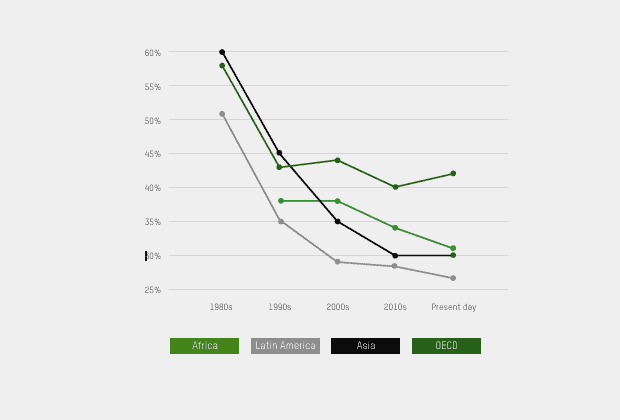

In contrast to the rich, the poor suffered heavily during the pandemic. As the economic crisis hit, ordinary workers faced wage cuts, job losses, and rising unemployment. Major companies laid off staff, hundreds of millions of jobs vanished, and lost income totaled hundreds of billions. At least 1.7 billion workers saw their wages fall behind inflation, with minority workers at even greater risk of poverty. Globally, over 700 million people fell into extreme poverty, living on less than $2.15 a day. Around 3.1 billion people—nearly 40% of the global population—can’t afford healthy food. These numbers highlight the stark and growing gap between rich and poor.

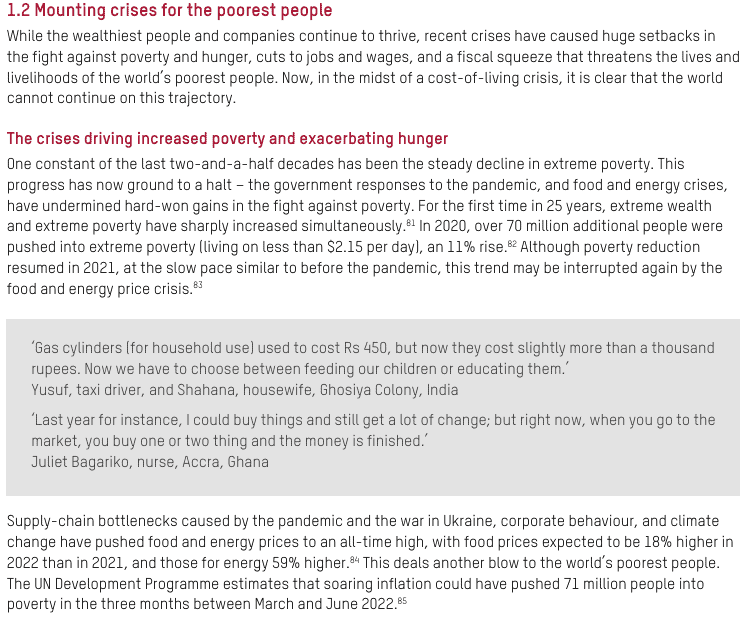

The rich are getting richer partly because their tax rates are falling while their incomes rise. Shareholders, in particular, benefit from low taxes as their wealth grows, showing how rising income, tax advantages, and smart investment strategies drive wealth inequality.

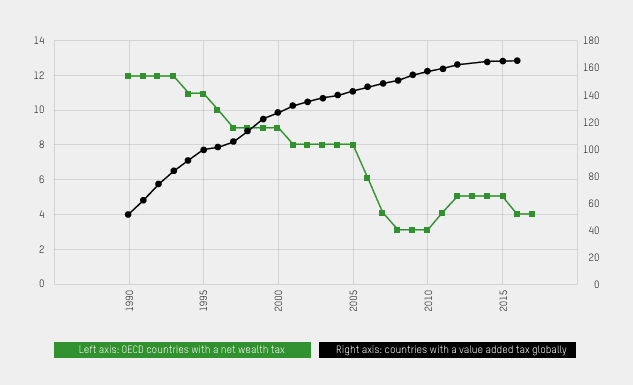

This chart shows how wealth has grown over time across countries, while taxes on the rich have steadily declined. In the past, top tax rates were as high as 60%, but they’ve dropped significantly, especially for the wealthy. As wealth increases, taxes decrease—a trend clearly seen in the chart, where the black line (wealth) rises and the green line (taxes) falls. This pattern is common globally, especially in wealthier nations.

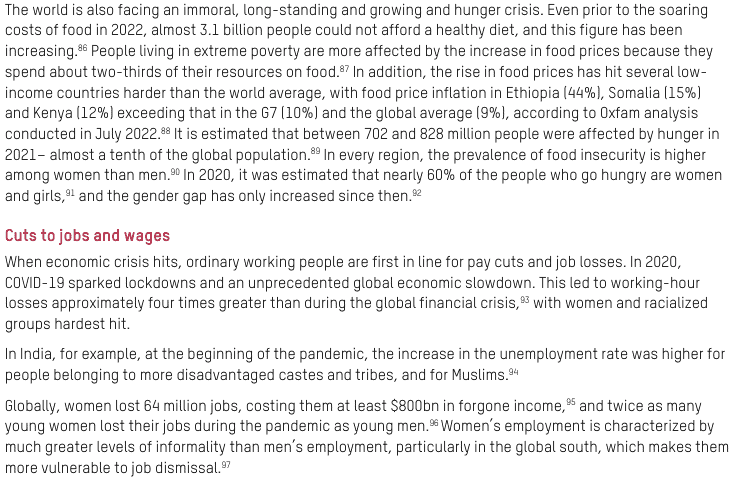

Next, we can’t help but think: Why is there such a sharp gap between the rich and the poor? An important factor is the introduction of an unequal consumption tax system. In the poorest countries, especially when funds are scarce, consumption taxes have become the main source of government tax revenue. Government tax revenue mainly depends on consumption, so consumption taxes have actually become an important tool for governments to generate revenue—while the wealthy continue to benefit from favorable investment strategies that help them avoid such burdens.

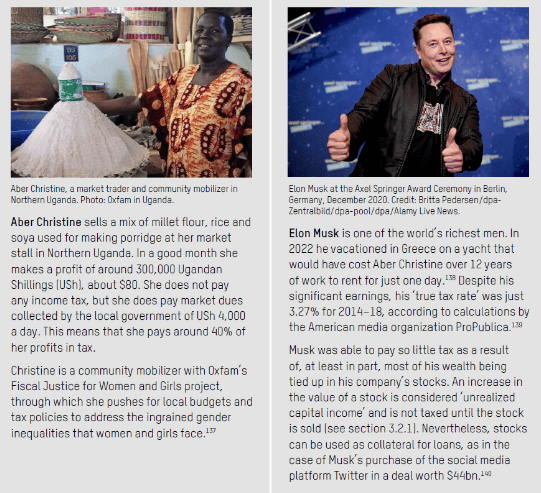

By comparing two individuals, we can clearly see the wealth gap. A small business owner in Uganda earns 300,000 shillings a day but pays up to 40% in market taxes. Meanwhile, billionaire Elon Musk paid just 3.27% in taxes from 2014 to 2018, since most of his wealth is in stocks, helping him avoid higher taxes.

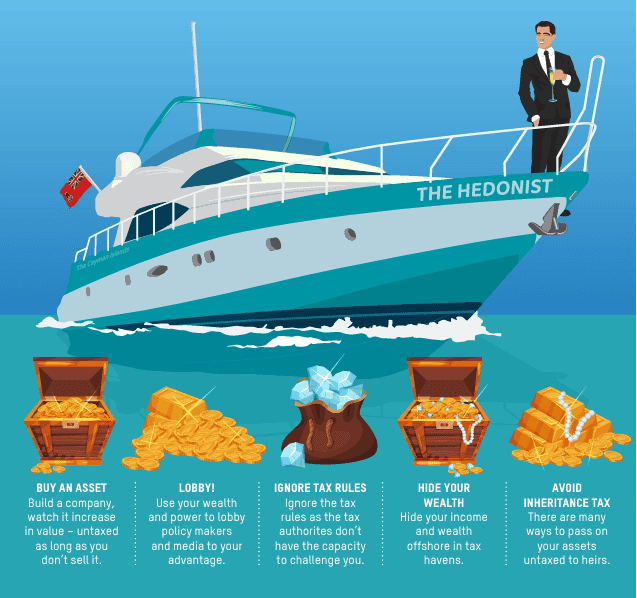

Want to know how billionaires build their wealth? Here are five key actions they often take.

First, the rich buy assets. By building or investing in companies, they gain value without triggering taxes—since unsold assets aren’t taxed. Capital preservation funds work the same way and count as asset purchases.

Second, they lobby for favorable tax policies. With wealth comes influence, and many capital preservation funds benefit from special tax rules because the wealthy invest in them.

Third, they often bypass tax rules. With expert teams, the rich structure their finances in ways tax authorities struggle to challenge.

Fourth, they hide wealth in offshore tax havens, legally minimizing taxes.

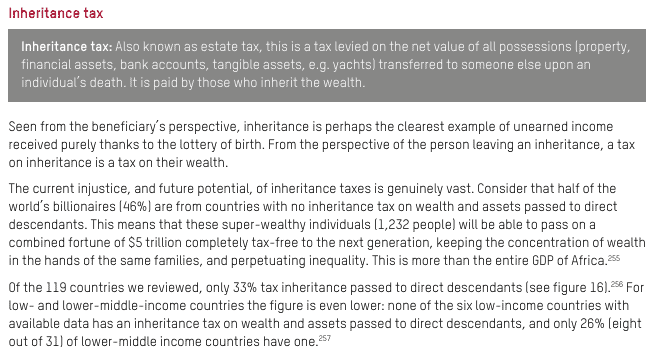

Fifth, they avoid inheritance tax by using legal strategies to pass wealth tax-free.

In short, capital preservation funds use many of the same investment strategies. To grow your wealth like the rich, adopting similar investment strategies is key.

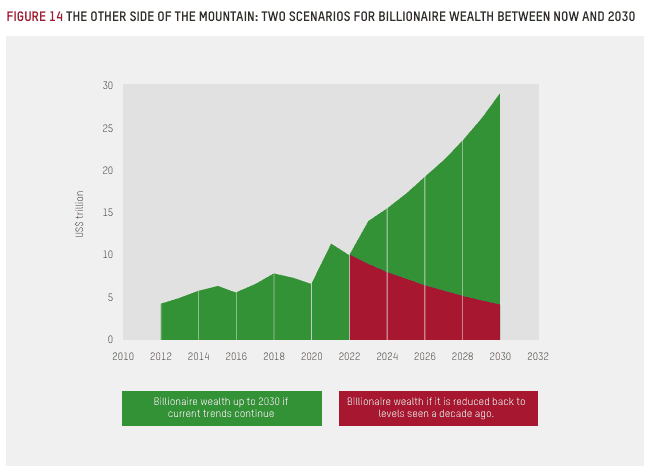

Next, let’s review the growth of wealth in recent years. Since 2014, the wealth of the rich has been growing continuously. If this growth trend continues, the wealth of the rich is expected to increase significantly by 2030. This also means that the redistribution of social wealth is happening, and we need to adapt to this change.

Finally, let’s realize that the rich are so rich because they know how to use financial tools and investment strategies. If we hope to catch up with them, we need to learn and adopt similar methods.

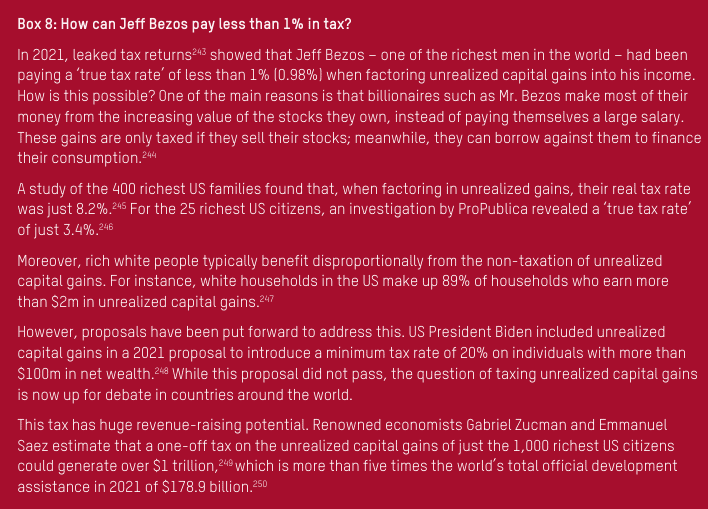

Here’s another example: Amazon’s Jeff Bezos earned $4.3 billion in 2021 but paid less than 1% in taxes—only 0.98%. Why so low? Most of his income comes from stock value growth, not wages. This means higher salaries mean higher taxes, keeping you “poor,” while the rich earn mainly from stocks, allowing them to delay taxes and reduce their burden.

We always emphasize the concept of buying real estate as an investment, but in fact this is very different from the concept of modern society. Rich people usually benefit disproportionately from unrealized capital gains rather than investing large amounts of money in real estate. For example, in the United States, 89% of unrealized capital gains of more than $2 million come from white families. This shows that the rich are more inclined to invest in company stocks rather than real estate.

We live in a modern society and need to update our thinking. The rich get wealthy by using smart investment strategies and financial strategies—not just by buying real estate. To build wealth, we should also focus on investing in assets like stocks and earning returns from them.

Finally, we need to realize that the reason why the rich can pass on their wealth to the next generation is because they understand how wealth is created and take corresponding measures. At the same time, we should also change this concept and not only understand how wealth is created, but also learn how to pass it on to future generations.

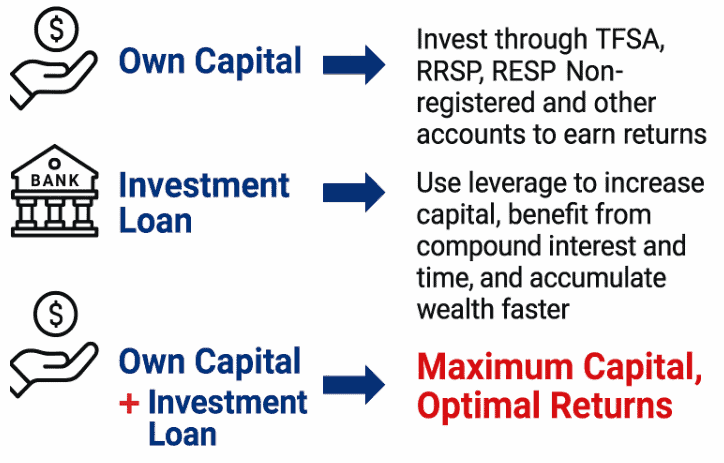

In terms of investment strategies, we should learn from the practices of the rich and use tools such as principal protection funds to invest. Even if you don’t have enough funds, you can invest through borrowing. Therefore, we always recommend long-term investment and investing funds in high-quality investment projects such as public funds, becoming shareholders of these companies and sharing their growth dividends.

Regardless of the amount of money a family has, they can invest it through Canadian registered accounts (such as TFSA, RSP, and education funds). You can invest in these accounts, including registered accounts and non-registered accounts. For example, you can deposit funds into a registered account or a non-registered account and invest them in your name.

Principal-guaranteed funds allow you to use leverage through investment loans to boost your principal. Over 10 to 20 years, this can help grow significant wealth, ensuring you have enough funds for retirement.

By combining investment loans with your own funds, you can maximize your principal and returns. To achieve financial freedom in retirement—especially for those born in the ’70s and ’80s—you’ll need at least one million yuan, which can be built over 10 to 20 years through smart investment strategies.

Therefore, don’t wait until later in life to start planning for retirement, as this could make your retirement life unnecessarily difficult. It’s important to start planning for retirement now to ensure your financial future is secure.

You may also interested in

Leverage Investment Success: How Clients Achieved Over 200% Leverage Returns| AiF Clients

Discover how a Canadian family achieved 239% returns using strategic...

Read MoreCanadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More