How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Asian Stocks Set to Drop as Dow Ends Historic Losing Streak

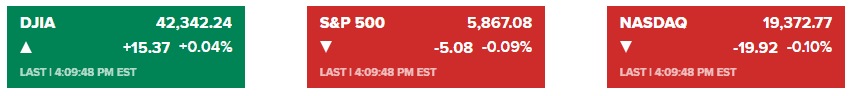

Market Overview:

The Dow Jones Industrial Average narrowly ended its longest losing streak since 1974, closing with a modest gain of 15.37 points (0.04%) at 42,342.24. The S&P 500 slipped 0.09% to 5,867.08, and the Nasdaq Composite edged down 0.10% to 19,372.77. Early session gains dissipated, leaving seven of the S&P 500’s eleven sectors in the red.

Treasuries exerted pressure on equities as the 10-year Treasury yield rose for the second consecutive day, reaching 4.57%, the highest level since May. Meanwhile, the two-year Treasury yield fell, further widening the yield curve inversion to levels last seen two years ago.

The Federal Reserve’s hawkish stance earlier in the week, which signaled a reduction to only two potential interest rate cuts in 2025, continued to weigh on market sentiment. Volatility eased slightly, with the Cboe Volatility Index retreating nearly 13% to 24 after hitting a high of 28.27 the previous day.

Economic data indicated resilience in the U.S. economy, with GDP growth in Q3 revised higher, consumer spending marked up, and unemployment claims decreasing. Existing-home sales in November exceeded expectations, reaching a six-month high. Markets are now awaiting the personal consumption expenditures (PCE) report for November, a key inflation gauge, due Friday.

Global markets reflected caution, with Asian stocks set to open lower. Futures for Japan, Australia, and Hong Kong pointed to declines, while the yen weakened 1.7% following the Bank of Japan’s decision to maintain its policy stance.

Corporate News:

- Nvidia saw a 2% rebound on Thursday after dragging the Dow lower in the previous session.

- JPMorgan Chase and Bank of America led gains in the financial sector, contributing to Thursday’s market recovery.

- The Bank of England maintained its borrowing rate at 4.75%, but market pricing shifted to anticipate up to three quarter-point rate cuts in 2025. The pound declined following the announcement.

- Mexico’s central bank implemented its fourth consecutive rate cut, with the peso recovering from initial losses.

- In Asia, South Korea’s won weakened significantly, potentially prompting the National Pension Service to sell up to $50 billion in foreign exchange for hedging purposes.

Commodities

Oil prices edged lower as the dollar strengthened in response to the Fed’s revised outlook. Gold halted a two-day decline with a modest gain, trading around $2,594 per ounce.

This cautious market environment reflects ongoing investor adjustments to the Fed’s policy signals, with global markets reacting to central bank actions and currency movements. Further economic data releases will provide critical insight into near-term market direction.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More