How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Drops 700 Points, S&P 500 Sees Worst Day as Strong Jobs Data Clouds Fed Rate-Cut Hopes

Market Overview:

On Friday, U.S. stocks experienced significant losses following a stronger-than-expected jobs report that dampened expectations for additional Federal Reserve rate cuts this year.

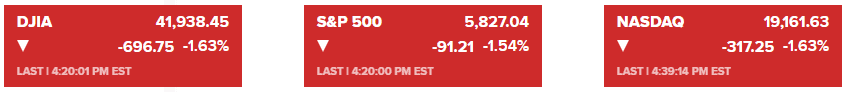

The Dow Jones Industrial Average dropped 696.75 points (-1.63%) to 41,938.45. The S&P 500 slid 1.54% to 5,827.04, and the Nasdaq Composite fell 1.63% to 19,161.63. These declines erased gains made earlier this year, marking a red start to 2025.

December’s payroll growth of 256,000 surpassed the expected 155,000, while the unemployment rate fell to 4.1% from a projected 4.2%. Treasury yields rose, with the 10-year note reaching its highest level since late 2023, as traders lowered their expectations for March rate cuts. Odds for a rate cut in March fell from 41% to 25%.

Consumer sentiment also pressured markets. The University of Michigan’s index dropped to 73.2, below the estimate of 74, with inflation expectations rising to 3.3% (one-year outlook) and 3.0% (five-year outlook).

Growth and small-cap stocks were hit hardest. Nvidia declined 3%, AMD lost 4.8%, and the Russell 2000 small-cap index dropped 2.2%. Financial strategists expressed concerns over the rapid rise in yields, potentially signaling a market pullback.

The Federal Reserve’s current stance and recent economic data point toward sustained volatility. Upcoming inflation reports and corporate earnings will play a pivotal role in shaping market sentiment.

Corporate News:

- Tesla Inc. refreshed its best-selling Model Y, incorporating design elements from its Cybertruck.

- Hewlett Packard Enterprise Co. secured a $1 billion deal to provide servers optimized for AI work to Elon Musk’s X platform.

- Nvidia Corp. criticized proposed U.S. export restrictions on chips, calling them politically motivated.

- Delta Air Lines Inc. exceeded profit expectations for Q4 2024, driven by gains in both domestic and international markets.

- Walgreens Boots Alliance Inc. posted quarterly sales above estimates, boosting its stock and alleviating strategic pressure.

- Constellation Energy Corp. announced a $16.4 billion acquisition of Calpine Corp., forming the largest U.S. power station fleet.

- Walt Disney Co., Fox Corp., and Warner Bros. Discovery Inc. canceled plans for a joint sports streaming service, focusing instead on existing platforms.

- Synopsys Inc. gained conditional EU approval for its $34 billion acquisition of Ansys Inc., addressing regulatory concerns.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More