Discover how a Canadian family achieved 239% returns using strategic...

Read MoreWall Street Sinks as Inflation Fears Deepen, S&P 500 Drops 2%

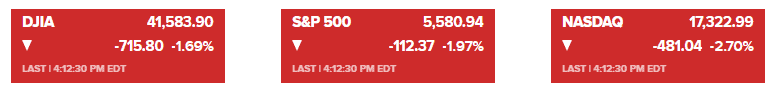

Market Overview

Stocks sold off sharply on Friday, driven by rising uncertainty over U.S. trade policy and renewed inflation concerns. The Dow Jones Industrial Average dropped 715.80 points, or 1.69%, closing at 41,583.90. The S&P 500 declined 1.97% to 5,580.94, while the Nasdaq Composite fell 2.7% to 17,322.99.

Investor sentiment weakened following the University of Michigan’s final March reading, which indicated the highest long-term inflation expectations since 1993. Additionally, the core personal consumption expenditures (PCE) price index for February exceeded forecasts, rising 2.8% year-over-year and 0.4% for the month, further fueling inflation concerns. Consumer spending increased 0.4%, slightly below the expected 0.5%.

Bond yields declined amid economic uncertainty, with the 10-year Treasury yield falling 10 basis points to 4.26%. Meanwhile, gold reached a record high as investors sought safe-haven assets. Bitcoin also experienced a sharp decline, dropping 4%.

Trade tensions remained in focus as President Donald Trump’s administration prepared to announce new tariff measures on April 2. Canada and the European Union are considering retaliatory actions, heightening market uncertainty. Trump also introduced a 25% tariff on all non-U.S.-made cars, raising concerns over economic slowdown.

Economists have revised down their U.S. GDP growth forecasts for 2025, now expecting a 2% expansion amid weaker consumer spending and reduced capital investment. Despite recent volatility, some analysts remain cautiously optimistic about the market’s long-term trajectory, noting that investor sentiment at extreme levels often precedes a rebound.

Corporate News

Tech stocks led Friday’s decline, weighing on the broader market. Alphabet and Amazon both dropped about 5%, while Microsoft and Meta fell more than 3.5%. The downturn contributed to the S&P 500 and Nasdaq heading for their fifth weekly decline in six weeks.

Lululemon Athletica shares tumbled 15% after issuing a weak outlook and citing concerns about consumer spending. The announcement reinforced fears that rising inflation and economic uncertainty are affecting discretionary purchases.

UBS Global Wealth Management revised its S&P 500 year-end target down to 6,400 from 6,600, citing recent economic turbulence. However, UBS still expects stocks to recover and post gains by the end of 2025.

Bank of America reported that U.S. stock funds saw their largest weekly outflow of the year, while European equities continued to attract inflows, reflecting investor concerns over U.S. economic conditions and trade policy shifts.

Looking ahead, market volatility is expected to persist until more clarity emerges on trade policy and inflation trends. Historically, April has been a strong month for stocks, but the current economic environment presents unique challenges for investors.

The 2025 Winter Promotion is in full swing! Successfully apply to get approved for a $200,000 investment loan to receive an IPhone 16 Pro Max! More offers are available for a limited time—learn more now!

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More