Discover how a Canadian family achieved 239% returns using strategic...

Read MoreWhy Canada’s RRSP Reform Could Save Your Retirement

Retirement planning in Canada can feel like walking a tightrope. For many, it’s not about whether they saved enough—it’s about whether those savings will last. But there may be a silver lining on the horizon. A new push from SIMA (Securities and Investment Management Association) calls for long-overdue RRSP reforms that could shift the retirement landscape in a big way.

If you’re in your 50s or 60s, this RRSP reform may be the key to stretching your savings further and protecting your financial future.

Understanding the RRSP Reform

RRSPs (Registered Retirement Savings Plans) help Canadians grow money tax-free until retirement. But current tax law forces individuals to convert their RRSP into a RRIF (Registered Retirement Income Fund) by the end of the year they turn 71. After that, mandatory minimum withdrawals begin—whether you need the money or not.

SIMA proposes two important changes:

Delaying mandatory RRIF conversion to age 73

Waiving withdrawals for RRIFs under $200,000

These ideas are designed to give retirees more flexibility and reduce the risk of outliving their money.

Delaying RRIF Conversion: A Hidden Advantage

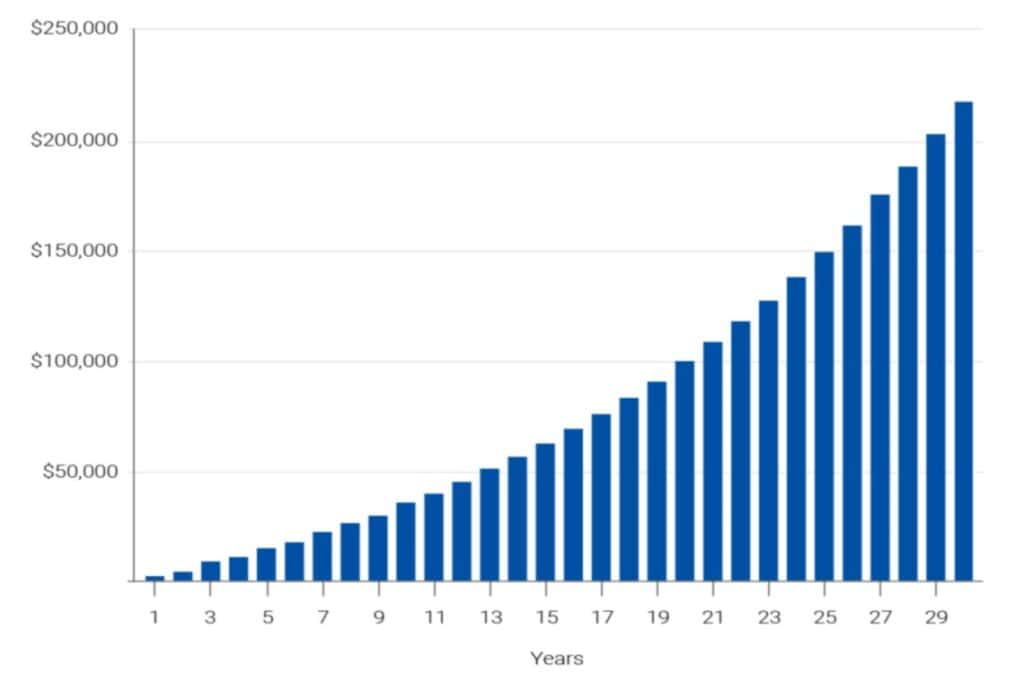

You might be wondering—what’s the big deal about two more years? Well, if your RRSP earns 5% annually, two more years of tax-sheltered growth can make a real difference.

For example:

A $500,000 portfolio growing at 5% annually would grow by $51,250 over two extra years.

You delay your taxable income, potentially keeping more OAS and GIS benefits.

You get extra time to plan how and when to draw your money.

In short, more time = more control over your retirement.

Waiving Mandatory Withdrawals for Smaller Accounts

Not every retiree has a $1 million nest egg. Many Canadians have RRIF accounts under $200,000. Forcing withdrawals from these small accounts can push people into higher tax brackets—when they may not need the income yet.

SIMA’s reform would:

Help protect modest savings for future health or housing needs

Allow retirees to withdraw only when necessary

Lower tax burdens for those living on fixed incomes

For the average Canadian, this change could mean thousands of dollars saved over the course of retirement.

Why This Reform Reflects a New Reality

Here’s the truth: Canadians are living longer than ever. The average lifespan today is about 82 years—and many live well into their 90s. But our RRSP and RRIF rules were designed decades ago, when retirement lasted just 10 to 15 years.

Today:

Retirement can stretch 25–30 years

Healthcare costs are rising

Inflation is chipping away at fixed incomes

This reform finally aligns our financial rules with real life. It gives you more time, more choices, and more confidence in your long-term plan.

What You Should Do Next

These changes aren’t official yet—but they’re gaining attention. Here’s what you can do now:

Talk to your financial advisor about your RRSP/RRIF timeline

Consider income-splitting, TFSA contributions, or delay CPP

Review whether early RRIF withdrawals could help or hurt your tax situation

Stay informed—policy updates are expected in the coming months

RRSP reform isn’t just for financial advisors to worry about. It’s for you—the Canadian who wants to retire comfortably and confidently.

Final Thoughts

This RRSP reform could be a game-changer. By adjusting outdated rules and giving more freedom to retirees, SIMA’s proposal opens the door to better retirement outcomes—especially for pre-retirees in their 50s and 60s.

If you’re nearing retirement, now’s the time to plan smarter. This might just be the reform that saves your future.

Find out more at aifinancial.ca

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More