What's a good credit score and how to get one?

For those who aiming to live in Canada for a long time, especially new immigrants and young adults just entering the workforce, it’s essential to understand the importance of a good credit score in addition to basic knowledge of work, savings, and taxes. A good credit report is crucial for everything from applying for a credit card to making installment payments, and from buying a car to obtaining a mortgage for a home. Your credit score and report play a significant role in these activities.

What’s in this article?

The Importance of Credit Scores and How They Work

Your credit score is a critical component of your financial health. It impacts your ability to secure loans, the interest rates you’ll pay, and even your job prospects and service contracts. Here’s a closer look at why credit scores matter and how they work.

Why Credit Scores Matter

- Loan Approval and Interest Rates:

Your credit score determines whether you can obtain a loan and at what interest rate. A higher score means better loan terms and lower interest rates, while a lower score can result in higher costs or even denial of credit.

- Employment Opportunities:

Potential employers may check your credit score to gauge your reliability and financial responsibility. A poor credit score can negatively impact your job prospects, especially in positions that require financial trustworthiness.

- Service Contracts:

Service providers, such as phone, cable, and utility companies, often review your credit score to determine if you need to pay a deposit and how much it will be. A higher score can mean lower or no deposits.

- Housing Deposits:

When renting an apartment, landlords might check your credit score to assess the risk of non-payment. A good score can result in lower security deposits and better rental terms.

- Credit Card Terms:

Lenders frequently review your credit score to decide whether to adjust your credit card’s interest rate or credit limit. A strong credit score can lead to more favorable terms.

How Credit Scores Work

Credit scores are calculated based on your credit history and are influenced by several factors:

- Payment History:

This is the most significant factor, accounting for about 35% of your score. It reflects your track record of paying bills on time. Late payments, defaults, and bankruptcies can severely impact your score.

- Credit Utilization:

This measures how much of your available credit you’re using. High utilization rates can negatively affect your score. It’s generally recommended to keep your credit utilization below 30%.

- Length of Credit History:

The longer your credit history, the better. This factor considers the age of your oldest account, the age of your newest account, and the average age of all your accounts.

- Types of Credit:

Having a mix of different types of credit (credit cards, mortgages, car loans, etc.) can positively impact your score. It shows lenders you can manage various credit products responsibly.

- New Credit Inquiries:

Applying for several new credit accounts in a short period can lower your score. Each application triggers a hard inquiry, which can slightly decrease your score temporarily.

Maintaining a good credit score is essential for financial stability and access to opportunities. By understanding how credit scores work and managing the factors that influence them, you can improve your financial health and secure better terms on loans and services.

How to know my credit score?

In Canada, two major agencies provide credit reports: Equifax and TransUnion. Both require a fee for their services. However, many banks offer the option to check your credit score for free through their online banking platforms. (Canadians can check their Equifax credit report and credit score for free by registering with MyEquifax, with information updated monthly.)

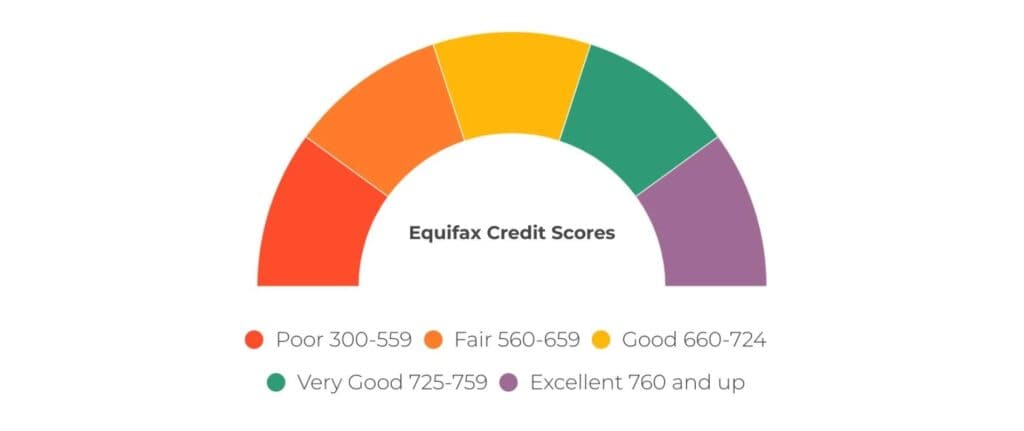

Equifax credit score ranges

Source: consumer.equifax.ca

What Equifax credit score ratings mean

Poor: You likely have a number of credit “delinquencies” or you may not have had the chance to build up your credit history. As a high-risk borrower, you will face challenges accessing unsecured credit or qualifying for favourable interest rate terms.

Fair: You may be re-establishing or building your credit but are still considered higher-risk and may still have some difficulty accessing lower interest rates or unsecured credit cards.

Good: You are likely in control of your debt picture and will likely be able to qualify for loans from a variety of lenders at competitive rates.

Very Good: You are considered a low-risk borrower and will likely qualify for most financial products with favourable rates.

Excellent: You have demonstrated responsible credit behaviour and will likely be considered the lowest-risk borrower by lenders and qualify for a wide range of loans and credit cards with the most favourable interest rates on the market.

Tips for Maintaining a Good Credit Score in Canada

Maintaining a strong credit score is essential for financial stability and can open doors to various opportunities. Here are some key practices to help you manage and improve your credit score:

- Monitor Payment History

- Always pay your bills on time, including loans and credit cards.

- Never exceed your credit card limits.

- If you can’t pay in full, at least make the minimum payment.

- Contact your lender immediately if you’re having trouble making payments.

- Pay your bills even if there’s a dispute to avoid negative impacts on your credit score.

- Use Credit Wisely

- Aim to use no more than 35% of your available credit. For example, if you have a $1,000 credit limit, keep your usage around $350 to maintain a high available credit balance.

- Calculate your credit utilization by adding up the credit limits of all your credit products (credit cards, lines of credit, loans) and keeping your usage below 35% of the total.

- Extend Credit History

- The longer you have and use your credit accounts, the better it is for your credit score.

- Transferring old accounts to new ones can negatively impact your score, as the new account is considered a new credit account.

- Keep older accounts open and use them occasionally to keep them active, ensuring no fees are associated with inactivity.

- Limit Credit Applications and Inquiries

- Too many credit inquiries can make lenders think you’re in desperate need of credit or overextending yourself.

- “Hard inquiries” affect your credit score and are visible to others reviewing your credit report, while “soft inquiries” do not affect your score and are only visible to you.

- Use Different Types of Credit Products

- Having a mix of credit products, such as a credit card, car loan, and line of credit, can improve your credit score.

- Ensure you can repay any borrowed amount to avoid damaging your credit score with excessive debt.

By following these practices, you can maintain and improve your credit score, ensuring better financial opportunities and stability in the future.

Tips from Ai Financial

What should I do to improve a poor credit score?

If your credit score is currently low, don’t worry. Ai Financial has some effective strategies to help you rebuild your credit:

- Manage Credit Card Usage:

- Stay Within Limits: Aim to use no more than 50% of your credit limit.

- Pay Early: Try to pay off your credit card balance before the due date.

- More Than Minimum: Always pay more than the minimum required payment to reduce your debt faster.

- Automate Utility Payments:

Link your utility bills (such as water and electricity) to your bank account for automatic payments. This ensures you never miss a payment and can help improve your credit score over time. - Check for Outstanding Debts:

Review your credit report to identify any unpaid or forgotten debts. Make an effort to pay off these outstanding amounts as soon as possible. This can gradually improve your credit score.

By implementing these strategies, you can start to see a positive change in your credit score, making it easier to achieve your financial goals.

I don't have enough credit record history, what should I do?

If you lack credit history, Ai Financial suggests using credit cards wisely by staying within limits, paying early and more than the minimum, and diversifying your credit with small loans or a car loan while making timely payments.

You can always talk with our advisors for more advice on your personal suitation.

Additional information:

Credit Score Check by bank:

– CIBC: Mobile Application (free)

– Scotiabank: collaborated with TransUnion (free)

– TD: N/A

– BMO: Mobile Application, Online Banking (free)

– HSBC: N/A

– National Bank of Canada: N/A

Credit Score Check by Credit Bureau Company:

– Equifax

– TransUnion

– Experian

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Mutual/Segregated Funds Vs. Stocks

If you’re new to investing, it’s crucial to understand the differences between mutual/segregated funds and stocks to determine the best……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……

Retirement Investment Solutions in Canada

Ai Financial Retirement Solutions: Grow your money faster with tax-smart plans and save time with all-in-one retirement solutions.