What's New with TFSAs in 2025: Must Read for Smart Families

As we head into 2025, the Tax-Free Savings Account (TFSA) remains one of the most powerful tools for Canadian families looking to build wealth and save for the future. With new updates and opportunities on the horizon, it’s the perfect time to explore how these changes can help you maximize your savings—whether you’re planning for a vacation, your children’s education, or retirement. Here’s a look at what’s new and how these updates can benefit you and your family’s financial journey.

2025 is right around the corner – Don’t forget to check out AIFinancial on leveraging investment funds to further achieve your investment dreams

CRA confirms TFSA contribution limit for 2025

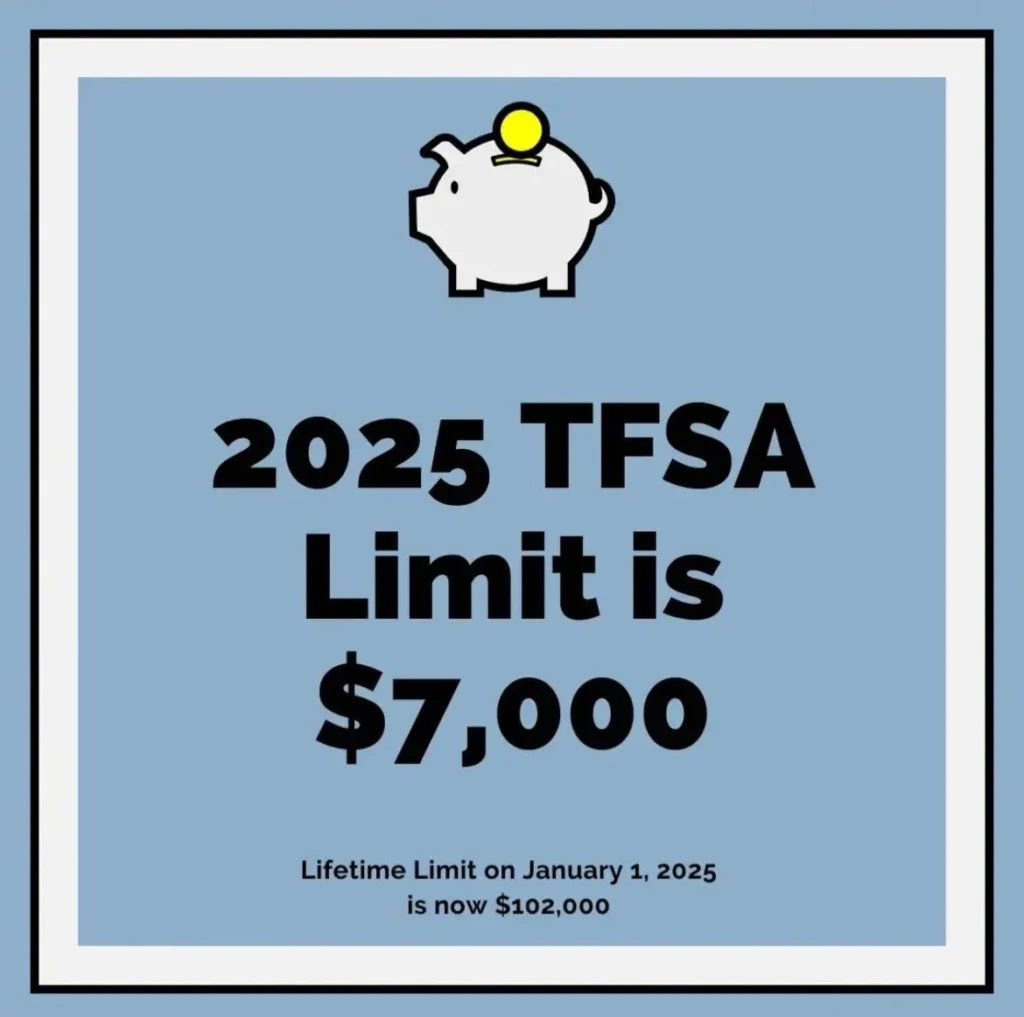

One of the most notable updates for 2025 is the increase in TFSA contribution room. Parliament has approved an additional $7,000, so in 2025, you’ll be able to contribute $7,000 more to your TFSA compared to 2024. If your TFSA was fully maxed out in 2024, you’ll have $7,000 in additional room to contribute next year. If you had some room left, you’ll see it increase by $7,000.

What is a TFSA?

A Tax-Free Savings Account (TFSA), introduced in 2009, allows Canadians aged 18+ with a valid SIN to save and invest money tax-free. Contributions are not tax-deductible, but earnings and withdrawals are tax-free.

TFSAs can be offered as deposits, annuity contracts, or trust arrangements by banks, credit unions, insurance companies, or trust companies.

Eligibility includes Canadian residents and non-residents aged 18+, though non-resident contributions incur a 1% monthly tax. Unused contribution room accumulates from the year you turn 18.

Why Open a TFSA?

A TFSA is a flexible and tax-efficient way for Canadians to save and invest money. One of its biggest advantages is that any income earned within the account- whether from interest, dividends, or capital gains — grows tax free.

TFSAs are versatile and are good for short and long term goals. Whether you’re saving for a vacation, a down payment on a house, or even retirement, TFSA offers the freedom to use that money with no penalties. You can also invest in options like mutual funds, segregated funds, stocks, and bonds to help grow your savings.

TFSA withdrawals are not taxed, which makes them better for short-term goals or emergencies. Any unused contribution room carries forward to future years. While TFSAs are straightforward, there are specific rules about contributions limits and withdrawals that you should be aware of to avoid penalties.

The TFSA Limit

- The CRA has confirmed that the annual TFSA contribution limit for 2025 is $7,000.

- Your contribution limit starts the year you turn 18 and TFSA’s were introduced in 2009.

- The Lifetime Limit on January 1, 2024 is now $102,000.

- You can carry forward any unused contribution room from previous years.

- If you contribute more than your total contribution room, the Canada Revenue Agency (CRA) will charge you a penalty of 1% per month on the excess amount.

- You can withdraw from a TFSA at any time.

- There are no limits as now how much you can withdraw from your TFSA account

- You can withdraw from your TFSA at any time

- Withdrawals from your TFSA are not taxed as long as you are not engaging in day trading or conducting business activities.

Set Up Your Spouse as the TFSA Successor Holder, Not Just a Beneficiary

Naming your spouse as the beneficiary of your TFSA isn’t the best option. While they inherit the funds, the account loses its TFSA status, and future earnings become taxable if their own TFSA contribution room is full.

Instead, designate your spouse as the Successor Holder. This way, they inherit the TFSA, retaining its tax-advantaged status without impacting their own TFSA room. Only spouses can be named as Successor Holders, making it the smarter choice for maximizing the benefits of a TFSA.

The Misconception About Using a TFSAs

A common misconception about TFSAs is that contribution room only increases over time. While unused room carries forward and new room is added annually, poor investment performance can shrink your contribution room. For instance, if you invested $57,500 in stocks that grew to $100,000 but later dropped to $6,000, withdrawing the funds would reduce your contribution room. In extreme cases, if investments become worthless, the TFSA contribution room could be reduced to zero. To avoid this, it’s important to choose solid investments that preserve your room and assets.

How to Maximize Your TFSA

To get the most from your TFSA, it’s crucial to invest wisely. Here are a couple of strategies:

Coordinate with Other Accounts: You can use tools like a Home Equity Line of Credit (HELOC) or RRSP tax refunds to fund your TFSA. By doing so, you can boost your contributions and potentially grow your wealth.

Leverage Combined Investments: Combining TFSA contributions with investment loans can maximize returns. By withdrawing investment loan profits into your TFSA, the future growth within the TFSA will be tax-free. This strategy, when done correctly, can lead to significant wealth accumulation over time.

By strategically managing your TFSA, you can unlock its full potential and grow your savings tax-free. For personalized advice on how to invest wisely and maximize your TFSA, consult with a financial advisor.

You may also interested in

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……