Discover how a Canadian family achieved 239% returns using strategic...

Read MoreUnlock Massive Growth with Smart RRSP Investment Tips

Today, we turn to a major capital event that draws global attention: the Berkshire Hathaway shareholders meeting. Hosted by chairman and CEO Warren Buffett, it’s often dubbed the “Woodstock of Capitalism” for its significant influence on the investment world.

Held at 8:30 a.m. on May 3 in Buffett’s hometown of Omaha, Nebraska, this year’s meeting attracted nearly 19,000 attendees eager to hear his insights on investing, the economy, and life.

AiF Interpretation: What can we learn from this?

What insights can we gain from the Berkshire Hathaway shareholders meeting? How should we adjust our future investments?

The AiF team studied the core content of the conference in depth and found that its essence can be summarized into two major themes:

- Investment direction : Which industries and fields should capital flow to?

- Principles of investment : How to adhere to effective investment logic in the changing times?

In the following content, we will sort out and analyze these two sections one by one.

Buffett's investment direction

Invest in the United States, invest in Japan, invest in stocks, invest in US dollars, invest in industries, and invest in life.

1. Invest in the United States

When asked if he remained optimistic about the U.S., Buffett said yes—despite ongoing changes. He reflected on America’s transformation from an agricultural nation to an economic powerhouse and called being born in the U.S. the greatest luck of his life. Citing the country’s resilience through the Great Depression, world wars, and the atomic crisis, he reaffirmed his belief that the U.S. remains the best place for long-term investment.

2. Invest in Japan

Buffett said Japan’s rate hike won’t affect his investments and pledged not to sell shares in the country’s five largest trading firms for the next 50 years. He’s invested $20 billion so far and wished he had invested more, showing strong confidence in the Japanese market.

3. Invest in stocks instead of real estate

Buffett sees real estate as slower and more complex than stocks, which offer speed, transparency, and liquidity—like trading 20,000 Berkshire shares in seconds. That’s why he prefers stocks.

Many worry investment loans might hurt mortgage approval, seeing them as a burden. But few ask if a mortgage limits future investments. In reality, it’s often the mortgage that restricts credit flexibility. For long-term wealth, credit should go to assets with growth potential.

4. Invest in US dollars

On U.S. dollar depreciation, Buffett said he won’t invest in currencies he expects to weaken. He continues to trust the dollar and the U.S., and won’t shift heavily into foreign currencies unless the U.S. faces extreme changes—showing his confidence in the dollar’s long-term stability.

5. Investment industry: Insurance as the core

Buffett places high value on the insurance industry, especially property and casualty insurance. Through GEICO, he gained low-cost float to invest elsewhere and boost returns. He avoids life insurance due to high payouts, low float efficiency, and higher risk. GEICO, he noted, was his first major success and the foundation of his insurance investment empire.

The essence of leverage: float is the “ investment leverage” of the insurance industry

Let’s look at a core industry for Buffett: insurance.

In insurance, premiums are liabilities—called float—not immediate profits. While some funds are reserved for claims, the rest can be invested, creating low-cost leverage.

Insurers use policyholders’ money to invest and boost returns—much like AiF’s Investment Loan strategy. Though “float” and “leverage” seem different, they work the same way.

Buffett focuses on property and casualty insurance, like auto and home, due to its stable, controllable float. He avoids life insurance, where claims can spike and float can turn negative—GEICO’s is currently -2.2%. Unlike high-risk private equity firms, Buffett sticks with steady, long-term strategies.

Core revelation: Only by understanding leverage can we truly understand Buffett’s wealth code

Buffett’s wealth came less from stock picking and more from using GEICO’s float—leveraging others’ money to boost returns. He mastered both investing and building a system for low-cost leverage. This is the core of AiF’s Investment Loan concept: helping clients build their own “float system” to grow assets without using extra cash.

Autonomous driving and the insurance industry: change or continuation?

At the 17th question of the Berkshire Hathaway shareholders meeting, a shareholder asked how autonomous driving might impact GEICO’s insurance business. Ajit Jain said it won’t change pricing logic in the short term, as premiums are still based on human driving errors and there’s not enough data yet for new models.

Buffett added that the question reminded him of Berkshire’s early textile days, where he failed to foresee industry decline. It taught him that change is constant and often unpredictable—investing, like sports, involves uncertainty and occasional missteps.

While autonomous driving is advancing, Buffett believes its impact on insurance is minor compared to the collapse of the textile industry. He sees tech progress as a force for improving life and efficiency, not destroying industries.

At the Berkshire Hathaway shareholders meeting, he highlighted insurance’s importance multiple times, underscoring its central role in his strategy. AiF also values the insurance sector, especially principal-guaranteed funds, as key tools for stable, efficient leverage in today’s market.

Buffett focuses on property and casualty insurance, not life insurance, because its claim cycle is more predictable. Life insurance carries concentrated, uncertain risks, making float harder to retain. In contrast, property insurance provides stable, long-term float—key to Buffett’s strategy of sustainable low-cost leverage.

6. Investing in life: Buffett’s sixth investment direction

At the Berkshire Hathaway shareholders meeting, a young attendee asked where to start with investing. Buffett praised the question and said the most important investment isn’t in stocks, but in the people around you.

He advised building friendships with those you respect and admire, as surrounding yourself with sincere, like-minded people is life’s greatest wealth. Success, he added, comes from learning from the truly wise—not just the rich—and encouraged young people to keep doing the right thing until they find the right companions.

In 1951, while taking Graham’s course, Buffett learned Graham had invested in GEICO. He visited GEICO uninvited and, after a four-hour talk with the chairman’s assistant, invested all his $10,000—his first all-in move. It earned him a 50% return in a year and launched his investment career.

Buffett called it the most important afternoon of his life. GEICO became his first major success and the foundation of his insurance empire, with float as the starting point for leveraged returns.

Buffett emphasized choosing a career based on passion and long-term commitment: “Find what you’d do for life, and give it your all. Don’t follow the crowd or work with people who go against your values.”

He recalled longtime colleagues like Sandy Gottesman and Walter Scott as examples of true success, saying being with great people matters more than short-term gains.

With a smile, he added: “Maybe some people live long because they’re around good people—or maybe it’s the Coke,” joking as a Coca-Cola shareholder, and noting real happiness comes from doing what you love.

Buffett's investment principle: Patience + volatility = returns

At this Berkshire Hathaway shareholders meeting, Buffett emphasized two core investment principles: one is that investment requires patience, and the other is that market fluctuations are opportunities rather than risks.

Principle 1: Patience is the cornerstone of investing

In the 8th question, someone asked: “Are there times when you can be less patient in investing?” Buffett’s answer was to wait patiently for opportunities, but once a reasonable opportunity arises, act quickly.

He pointed out that Berkshire has gained huge profits at many key moments precisely because of its ability to respond quickly. “You don’t want to be ‘patient’ on important transactions, but you should act decisively.” He said that there is no need to tolerate empty talk that will never come true, and there is no need to hesitate for opportunities that are truly valuable.

This is exactly the same as the principle that AiF has long adhered to – “quiet as a virgin, swift as a rabbit” .

Principle 2: Market fluctuations are investment opportunities, not retreat signals

In the 15th question, the audience asked whether the recent market volatility provided investment opportunities. Buffett responded very calmly: “It’s nothing. Really nothing.”

He pointed out that the fluctuations in the past 30 days, 45 days, and even 100 days do not constitute a pressure for a mature investor. He cited historical data as an example: Berkshire’s stock price has fallen by more than 50% less than three times in the past 60 years, and behind these declines, the company has no fundamental problems.

Buffett stressed that the market decline is not a reflection of risk, but an amplification of emotions.

AiF reminded investors on April 4, the day the market plunged: This is not a crisis, but a market maker’s wash. People who really understand investment should have confidence in panic, rather than exit passively.

Your investment philosophy should adapt to the world, not the world to you.

Buffett further explained with a historical analogy: “When I was born in 1930, the Dow was 240, and then it fell to 199. People were horrified at the time, but now the Dow has broken through 41,300.” This shows that as long as time is long enough, social wealth will continue to accumulate and be reflected in the stock market.

He reminded those who are anxious about the short-term rise and fall of assets: ” You should change your investment philosophy instead of trying to make the market change for you. “

Summary: Real investors rely on time and structural fluctuations to obtain excess returns

The fluctuations in the financial market are a window for value investors to filter out. Short-term sentiment washes out speculators, leaving behind true long-termists. If you have enough patience and a correct understanding of market fluctuations, you will understand:

Time + volatility + firm values = wealth.

As Buffett emphasized at the annual Berkshire Hathaway shareholders meeting: We do not predict every move of the market, but as long as the direction is correct and the principles are adhered to, the returns will eventually come.

How does AiF achieve long-term and stable investment for customers?

After sharing Buffett’s investment insights, let’s return to a key question: How does AiF help clients invest professionally?

We align with Buffett’s belief that not investing leads to poverty, but chasing quick riches often leads to scams. Today’s market is full of “high-yield traps” and fake experts. In such an environment, trusting professionals is the safest choice.

With over 25 years of experience, AiF specializes in public principal-guaranteed fund investments within the insurance industry—echoing Buffett’s focus on insurance as a stable, value-driven sector.

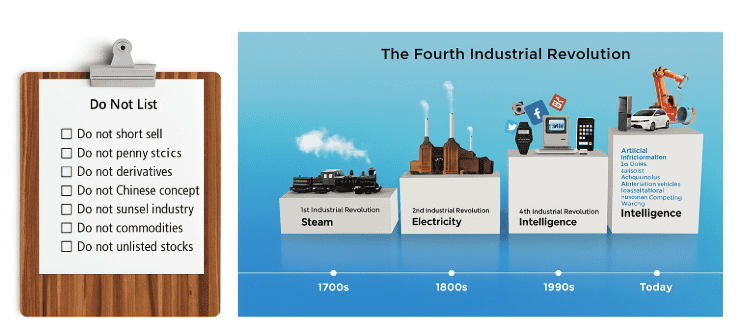

Why do we advocate ” investing in funds” rather than ” investing in individual stocks” ?

because:

- Buying individual stocks = buying probability , which is a typical speculative behavior;

- Buying a fund = buying a structure , which is a long-term strategy based on stock selection and asset allocation by professional institutions.

AiF recommends clients to make investments through public principal-guaranteed funds , with the help of insurance company endorsements and product bottom-line guarantee mechanisms, thus balancing security and market returns.

Leverage support: using chickens to lay eggs and leveraging growth

AiF also offers investment loan services, applying Buffett’s “float” logic to help clients boost returns by using other people’s money.

As we often say: borrow the hen (loan), and keep all the eggs (returns).

In today’s inflationary, volatile environment, smart resource allocation and leverage are key—and this is where AiF excels, backed by a mature, proven system.

- We do not recommend stock speculation and do not encourage chasing ups and downs;

- We adhere to the investment framework of long-term, structure, security and leverage;

- We focus on creating a risk-resistant and growth-oriented wealth system for our clients through insurance-type principal-guaranteed funds.

You don’t need to chase the market, you just need to stand in the right direction and let professionals help you steadily earn the dividends from this major trend of the industrial revolution.

Online Q&A

Q1 : If the investment loan account is profitable, when is it appropriate to “ stop profit” ? How does the company recommend controlling risks?

A : In AiF’s long-term investment philosophy, we do not emphasize “stop profit” in the traditional sense. If the direction of the bid is correct, we encourage customers to hold it for a long time to allow the income to continue to roll and the interest to grow.

But if you need to use funds, you can flexibly sell part of the profit share without affecting the long-term growth of the overall account. For example:

- If you initially hold 10,000 units of the fund, the current price is 1 CAD, and the total value is 10,000 CAD;

- You need to withdraw $5,000 and can sell 5,000 units;

- If the fund price rises to $2, you only need to sell 2,500 units to get the same amount of cash.

This is why we do not advocate “stop profit”, but suggest customers to withdraw money as needed without interrupting the growth curve . This is also one of the effective ways to control risks.

Q2 : Regarding “ principal-guaranteed funds” , how are principals guaranteed? What is the guaranteed ratio?

A : Principal protection funds usually have two types of protection mechanisms:

- Death guarantee : If an investor dies due to an accident, the insurance company will pay compensation according to the guaranteed principal ratio. For example:

- The investment loan is 100,000 dollar, and the fund market value drops to 50,000 dollar;

- If the customer holds 75% principal protection insurance, the insured amount will be 75,000 dollar;

- The client’s family only needs to bear a loss of 25,000 dollar, avoiding major financial losses.

- Principal protection at maturity : When the loan contract matures (usually 10 or 20 years), if the market value is lower than the principal protection line, the insurance company will make up the difference. The principal protection ratio can be 75%, 100%, etc., depending on the product selected.

Q3 : Can the interest on investment loans be deducted from taxes? If I sell part of it, do I need to repay the principal in advance?

A : First of all, please be sure to consult a licensed accountant for tax advice. We do not provide tax advice .

Regarding tax deductions: Tax bureau policies have changed frequently in recent years. Some loan interest may be tax deductible, but it is not guaranteed to be fully applicable. Please refer to the CRA policy of the year.

Regarding principal repayment:

- Investment loans are usually structured for a long term (e.g. 20 years);

- Customers can cancel early at any time without penalty ;

- If you do not cancel it actively, the loan will automatically renew;

- Selling part of the fund does not mean that the principal must be repaid . Whether the principal is returned is decided by the customer.

Q4 : Some people suggest using triple leverage ETFs such as TQQQ for long-term investment. What do you think?

A : AiF strongly recommends not investing in leveraged ETFs , especially TQQQ products.

Here are the reasons:

- TQQQ is a structural leveraged ETF, with volatility magnified 3 times, which is prone to value erosion in the long-term compounding structure;

- Leverage is divided into “good leverage” and “bad leverage”:

- Good leverage: amplifying long-term positive returns (such as the principal-guaranteed fund + investment loan structure provided by AiF);

- Bad leverage: amplifies short-term volatility and losses and fails to control risks;

- TQQQ is a typical “bad leverage”: it is extremely difficult to recover the investment when the market falls, and long-term holding often leads to serious losses .

If a “financial advisor” recommends that you hold a large position in such products for a long time, it means that he or she has no understanding of the risk structure at all. It is not recommended to follow such advice .

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More