Discover how a Canadian family achieved 239% returns using strategic...

Read MoreSmart Investing, Real Wealth: A Couple’s 218% Growth Story

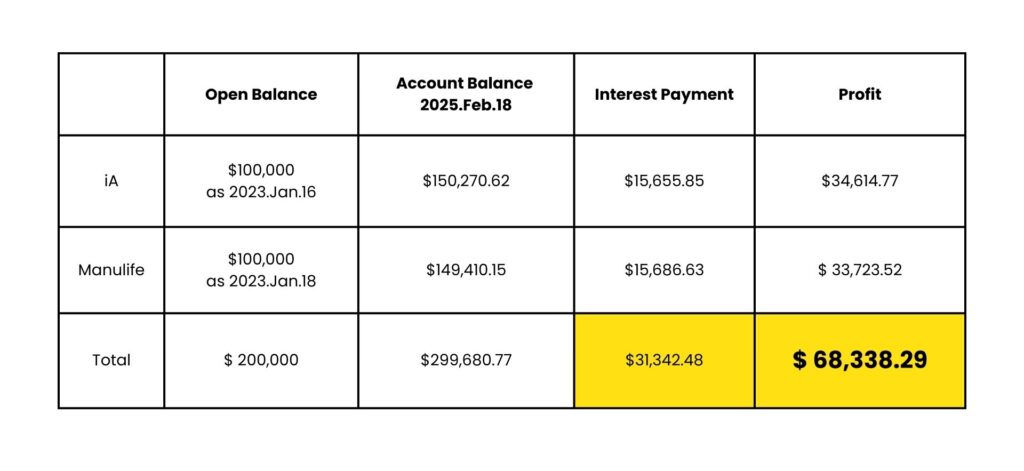

🚀 Wealth Growth Journey of an 80s-Era White-Collar Couple: $200K Investment Loan, $68K Net Profit in 2 Years, and a 218% Total Return!

👫 Elite Education + Corporate Careers + Home & Car—Yet Still Facing Cash Flow Anxiety?

This 80s-born couple moved to Canada as international students 20 years ago. After graduating from a top university, they landed stable jobs at major corporations, enjoying a comfortable life. However, after the pandemic, they felt the pressure of rising mortgage costs and inflation. Concerned about job security and retirement, they began looking for ways to grow their wealth steadily and alleviate future financial stress.

💡 That’s when they decided to try “liquid passive investing” and let their money work for them!

After thorough research, they partnered with Ai Financial (AiF) in January 2023 and successfully secured a government-approved “Investment Loan”—

✅ No collateral

✅ No down payment

✅ No income proof required

✅ No asset verification

✅ Interest-only payments with lifetime renewability

📌 Investment Strategy:

✅ Loan: The couple jointly secured $100K each from B2B Bank and Manulife Bank, totaling $200K in investment loans.

✅ Investment: They invested entirely in segregated funds from iA & Manulife to ensure capital protection and stable returns.

✅ Tech-Driven Management: AiF’s AI & big data asset management system optimized returns through smart, strategic allocation.

✅ Expert Team: With 25 years of financial market expertise and an average 21.6% annual return over the past decade, AiF provided solid investment guidance.

📈 Stunning Returns in Just 25 Months:

✅ Investment Loan Principal: $200,000

✅ Total Portfolio Value: $299,680.77

✅ Interest Paid: $31,342.48

✅ Net Profit: $68,338.29

✅ Realized Total Return: 218%! 🎉

Investment Performance Breakdown:

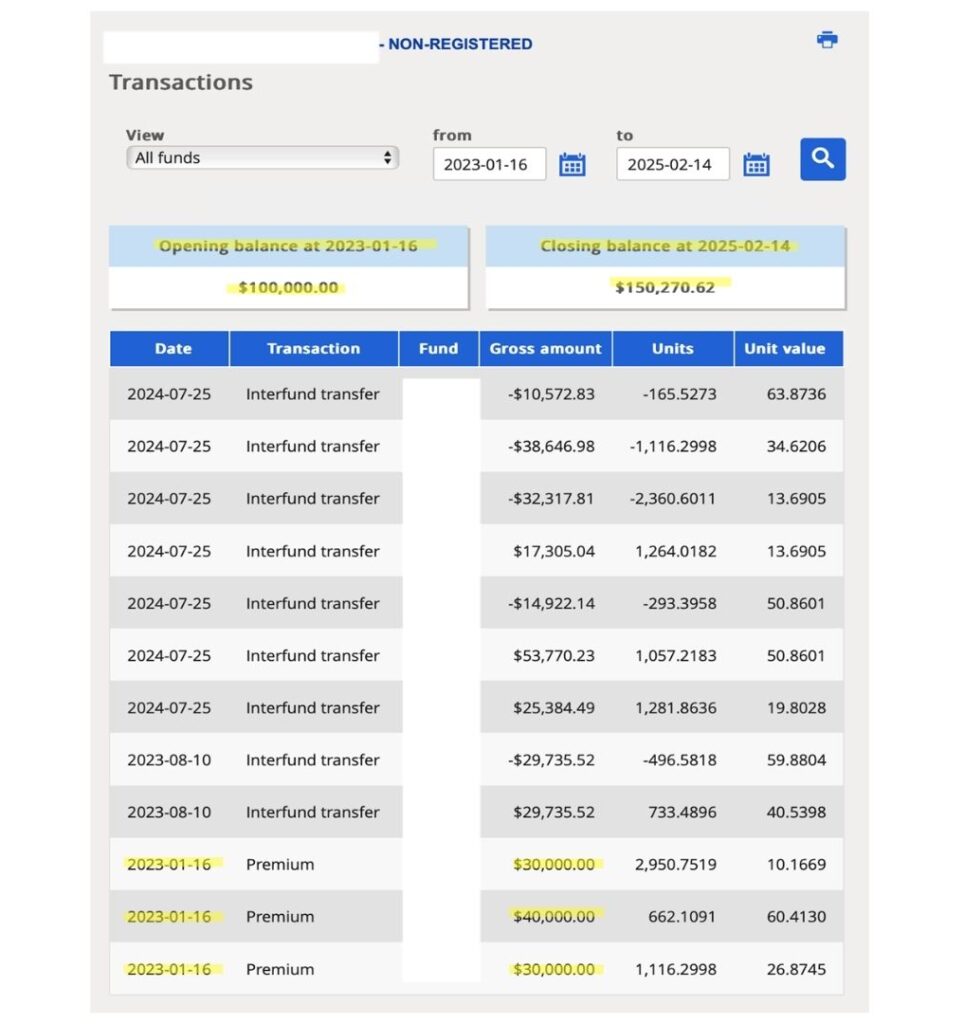

- iA Segregated Fund:

- Loan Approval Date: January 16, 2023 ($100K)

- Value as of February 14, 2025: $150,270.61

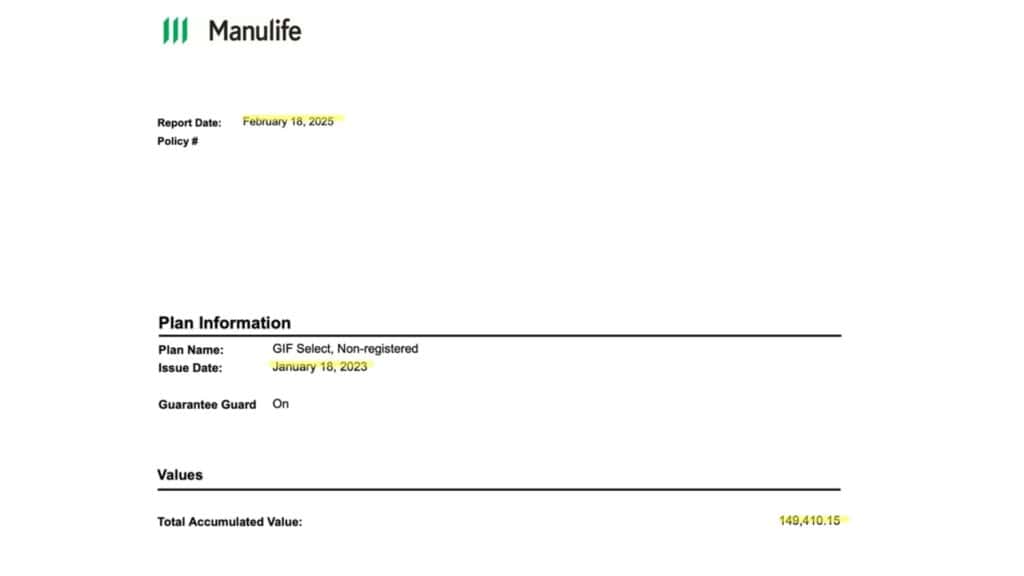

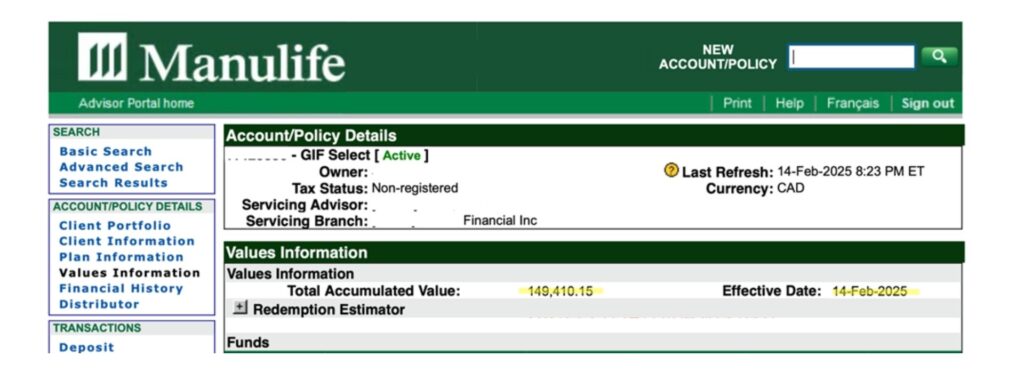

2. Manulife Segregated Fund:

- Loan Approval Date: January 18, 2023 ($100K)

- Value as of February 14, 2025: $149,410.15

🎯 Blown Away by the Results, the Couple Is Now Scaling Up Their Investment Strategy!

🔹 They plan to sell their investment property within 1-2 years and fully transition into segregated funds to maximize passive income.

🔹 Their goal? Build at least $2M in wealth through steady investing, leveraging time and compounding to secure financial freedom and a stress-free retirement!

✨ The Key to Success: Smart Choices Matter More Than Hard Work!

Their journey proves that choosing the right investment strategy makes wealth growth inevitable.

💰 Your Wealth Growth Story Can Be Just Like Theirs!

With government-backed investment loans, AiF’s cutting-edge technology, and expert management, you, too, can put your money to work and unlock your financial potential!

📩 Want to learn more? Contact an AiF investment advisor today and explore your wealth-building opportunities!

The 2025 Winter Promotion is in full swing! Successfully apply to get approved for a $200,000 investment loan to receive an IPhone 16 Pro Max! More offers are available for a limited time—learn more now!

Exclusive Advantages of Ai Financial

- Convenient Loan Application

- Ai Financial collaborates with multiple financial institutions such as B2B Bank, Manulife Bank, and iA Trust to provide clients with fast loan approval services. Especially with Quick Loan, there is no need for income or asset proof, offering rapid approval and valuable support for investors lacking principal.

- Professional Investment Management

- Partnering with insurance companies like Canada Life, iA, and Manulife, Ai Financial specializes in Segregated Fund investments. By leveraging the power of compounding with leverage, Ai Financial helps clients achieve consistent and stable returns.

- Stable Investment Strategy

- Ai Financial sees through market fundamentals and advocates for long-term investment. Through compounding and time, Ai Financial helps accumulate wealth while avoiding risks associated with speculation.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More