Discover how a Canadian family achieved 239% returns using strategic...

Read MoreCase Study: How Mr. F Earned $36,000 During a 5,000-Point Dow Crash

Mr. F is a senior telecom engineer with a strong technical background and a sharp eye for emerging trends. Over the years, he actively explored stocks, options, and crypto—but realized that scattered information and solo decision-making weren’t enough for long-term success.

In 2022, he attended an AiF seminar and discovered Canada’s investment loan strategy. After careful research, he partnered with Ai Financial in early 2023.

With $170,000 in approved investment loans from B2B and Manulife, he invested entirely into capital-protected segregated funds. Supported by AiF’s AI-driven investment system and a team with 25+ years of experience, his portfolio was designed for steady, long-term growth.

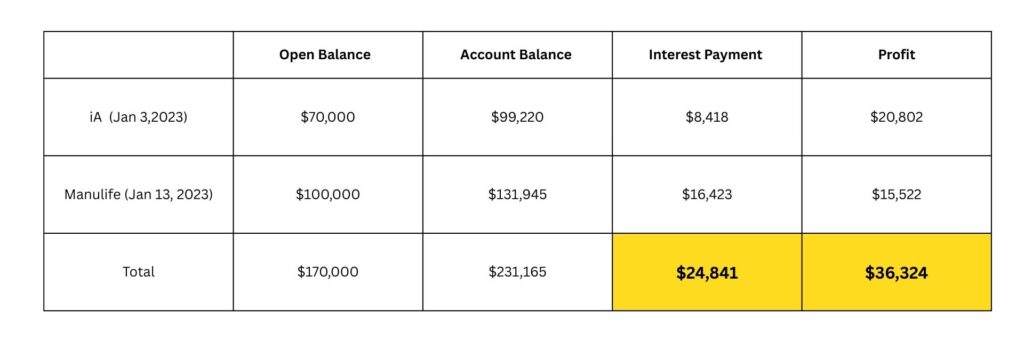

📈 As of April 12, 2025:

Investment Capital: $170,000 (fully leveraged)

Portfolio Value: $231,165

Interest Paid: $24,841

Net Profit: $36,324

Leverage ROI: 146%

Even as the Dow dropped over 5,000 points, Mr. F stayed calm and came out ahead—proving that long-term planning and structured execution always beat emotional decisions.

Breakdown by Fund:

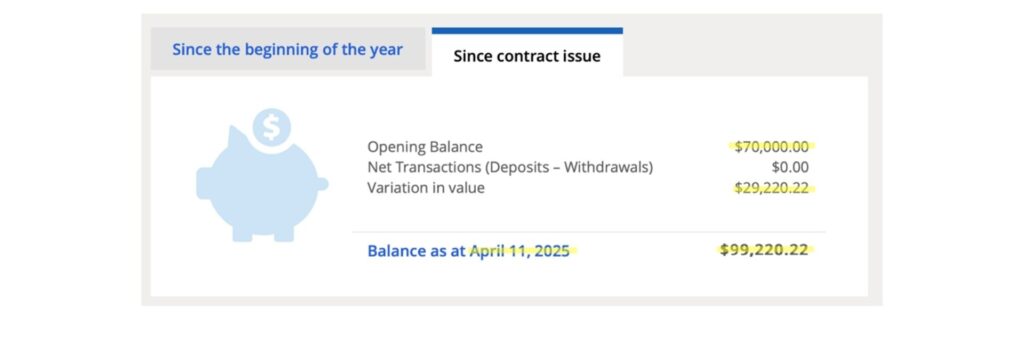

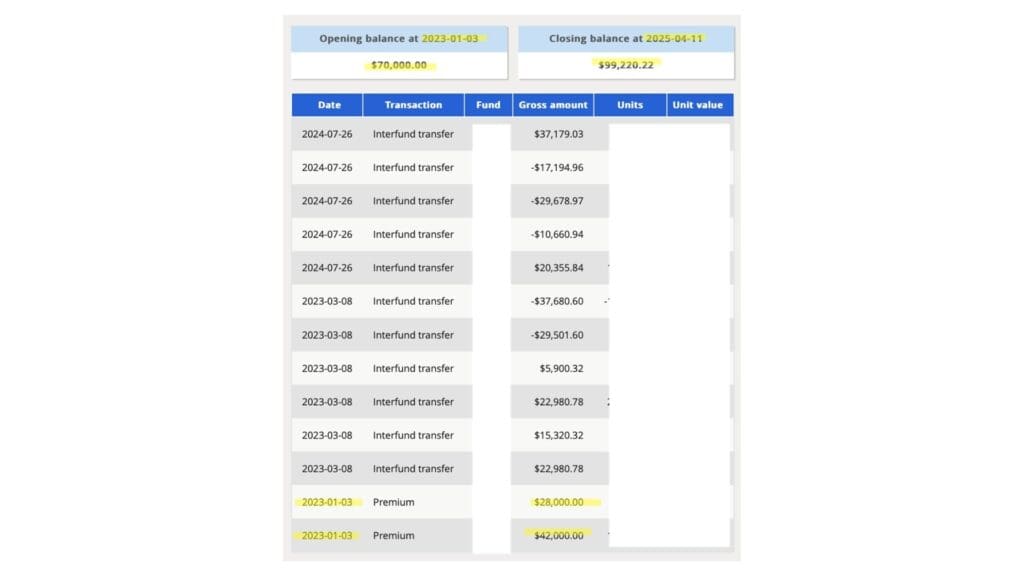

iA Segregated Fund:

– Loan: $70,000

– Market Value: $99,220

– Interest Paid: $8,418

– Net Profit: $20,802

– ROI: 247%

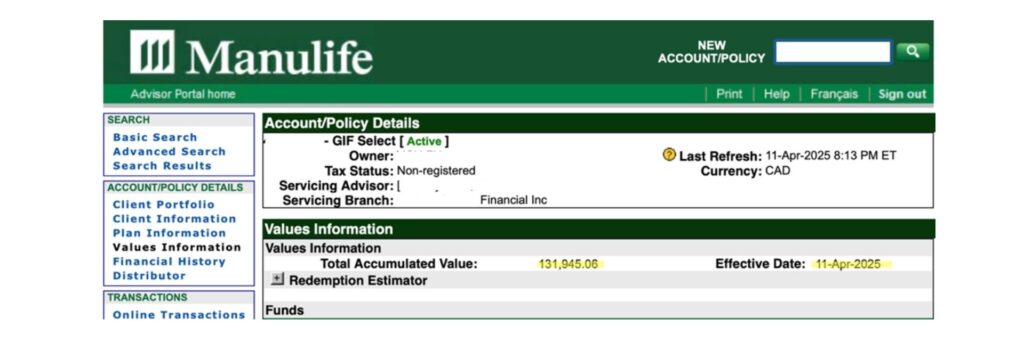

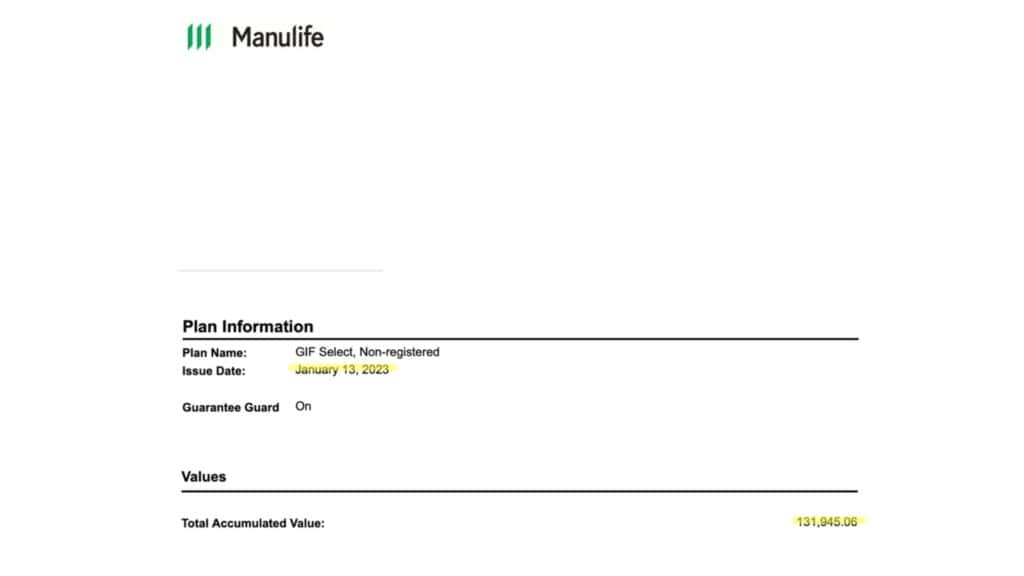

Manulife Segregated Fund:

– Loan: $100,000

– Market Value: $131,945

– Interest Paid: $16,423

– Net Profit: $15,522

– ROI: 94.5%

Weathering the Storm

Between February and April 2025, U.S. markets saw one of the sharpest declines since March 2020. The Dow plunged over 5,000 points in a single month, triggering widespread panic.

But while most investors were losing sleep—and money—Mr. F’s strategy delivered strong, positive returns. His portfolio remained stable and resilient throughout the storm.

For Mr. F, this wasn’t luck. It was planning.

As an engineer, he knows how much expertise matters when uncertainty hits. By choosing Ai Financial, he gained a structured financial roadmap and professional-level execution.

His case proves one thing:

Sustainable wealth isn’t built on hype. It’s built on clarity, structure, and expert support.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More