Discover how a Canadian family achieved 239% returns using strategic...

Read MoreInterest Rate Cut: What It Means for Real Estate and Stocks

On September 18, 2024, the Federal Reserve announced its first interest rate cut in four years, lowering the interest rate from 5.5% to 5%. This article will explore the impact of the interest rate cut on the real estate market and the stock market.

What is Interest?

Interest is the fee that a borrower pays for the use of borrowed funds or assets, usually calculated as a percentage of the loan amount, also known as the interest rate. It is an additional fee on top of the loan amount, or principal.

Interest Rate

The interest rate of a loan depends on the risk assessment of the borrower. Borrowers with low risk usually get lower interest rates, and vice versa. When applying for a mortgage, different banks may have different risk assessments for the same borrower, which results in different interest rates.

Interest is the cost of using funds for borrowers, while for lenders, interest is their return. The higher the interest rate, the higher the cost of using the same amount of funds. This includes both personal and business loans. Repayment can be a one-time repayment, or you could choose to pay in installments.

Types of Interest

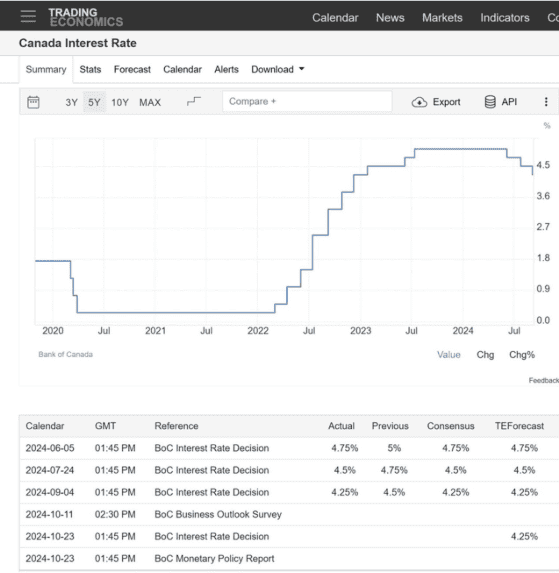

There are two main types of interest: simple interest and compound interest. Although many people have heard of these terms, they may not be clear about the difference between the two. Most mortgages use simple interest, which means interest is calculated only on the principal. However, some loans use compound interest, where interest is applied to the principal and accumulated interest.

Calculations

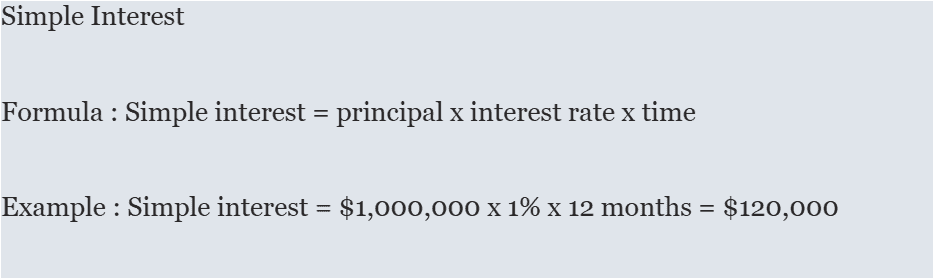

Below is an example of how simple interest is calculated. This is a typical simple interest calculation below:

Next, let’s look at compound interest. Still based on the previous example, the loan amount is 1 million, the interest rate is 1%, and the loan period is 12 months. According to the compound interest formula, the result is 126,820. Compared with simple interest, compound interest is 6,820 dollars more.

In simple terms, simple interest is lower, while compound interest is higher due to the cumulative effect. For borrowers, simple interest is more advantageous, while for investors, compound interest is more cost-effective.

The impact of interest rate cuts on the housing market

The first rate cut took place on September 18. As we all know, the Fed’s policies are highly consistent and it will not easily adjust interest rates frequently in a short period of time. For example, the 2022 rate hike cycle lasted only two years. Once the rate cuts are initiated, the future policy direction is basically clear, indicating that the rate cuts will continue.

Canada’s real estate market

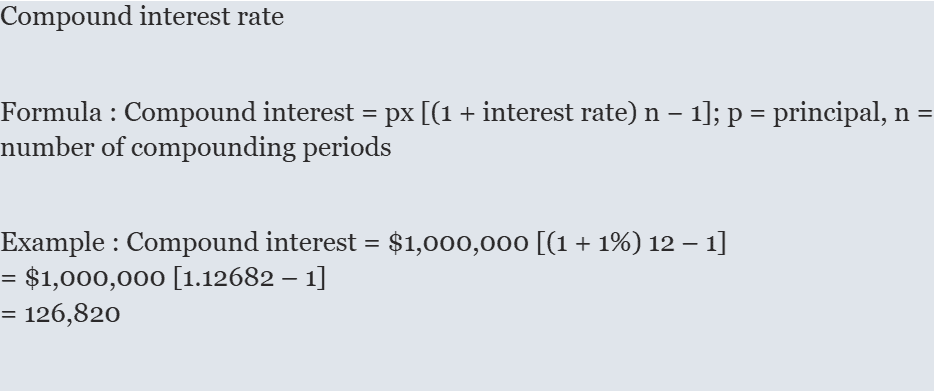

Canada’s pace of interest rate cuts is significantly faster than that of the Federal Reserve. For example, starting with the first rate cut on June 5 this year, the interest rate was reduced from 5% to 4.75%. Subsequently, on July 24, it was reduced by another 25 basis points to 4.5%. The most recent rate cut occurred on September 4, with the interest rate further reduced to 4.25%.

Canadian mortgages

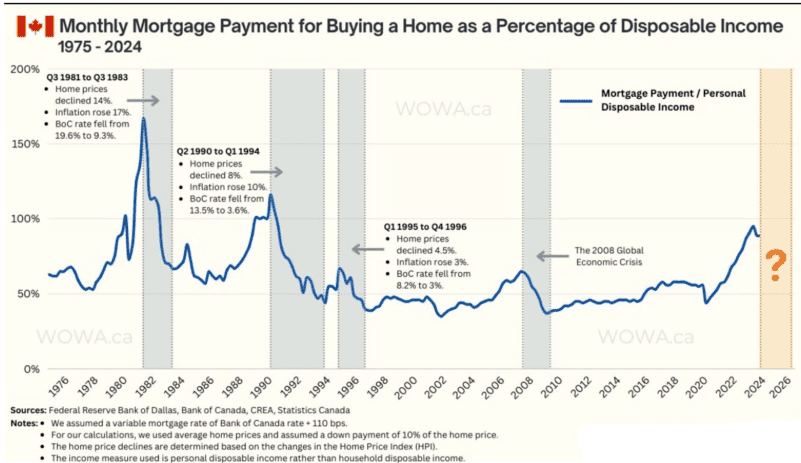

In theory, a fall in interest rates should lead to a fall in the cost of mortgages, but this is not the case in reality. By comparing the proportion of income and mortgages, we can find that mortgages are still at a high level.

Despite the reduction in interest rates, the proportion of household income to mortgage loans is still high. For individuals, the key is not the absolute amount of the loan, but the proportion of the loan to income.

Why did Canada cut interest rates?

The reason why Canada has cut interest rates several times ahead of schedule is that people’s income levels are not enough to support high mortgage costs. By cutting interest rates, it seems to have relieved the pressure on the surface. However, the reality is that the proportion of mortgage loans to income is still too high, causing many people’s cash flow to be firmly locked up by real estate.

Even if mortgage loans are reduced, falling house prices mean that many people’s home equity have decreased, which in turn affects their home line credit. When house prices fall and banks tighten their credit policies, many people find that their cash flow has problems, and some people have even stopped cash flow. This is because the current downward trend of house prices is already very obvious.

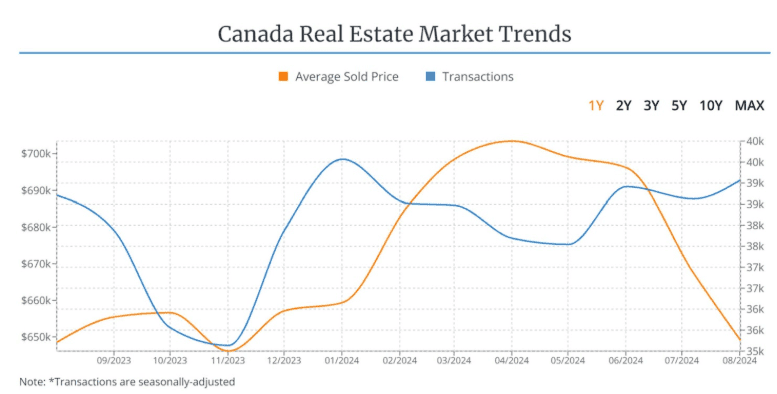

Let’s look at this chart. The orange line represents the average house price in Canada, and the blue line represents the transaction volume. Starting from June this year, with the continuous interest rate cuts in June, July and September, everyone expected that house prices would rise accordingly. However, the actual situation is just the opposite. Not only did house prices not rise, but they fell sharply.

Now someone may ask, does the drop in housing prices mean that it is a good time to buy at the bottom? Let’s look at the blue line, which represents the transaction volume. It can be seen that although housing prices have fallen by 10%, the transaction volume is increasing. What does this mean?

Market trends

Normally, falling house prices would cause sellers to be reluctant to sell and wait for prices to rise again. However, what we see here is an increase in transaction volume, indicating that some people are aware of the problems in the real estate market and are choosing to sell their properties as soon as possible, and others have to sell their homes due to a break in cash flow. Regardless of the reason, the increase in transaction volume is in sharp contrast to the decline in prices, indicating that more people are exiting the real estate market.

It is clear from the chart that housing prices have fallen by about 10% since their peak, from an average transaction price of nearly $40,000 to around $35,000. This clearly shows that Canada’s real estate market is facing significant pressure.

House prices

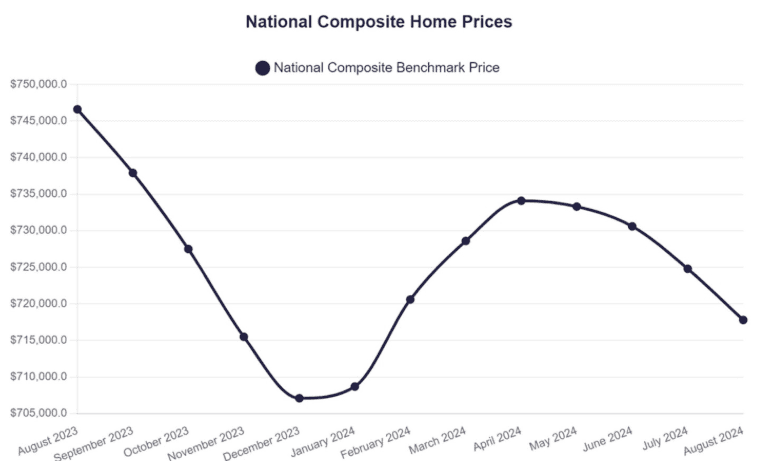

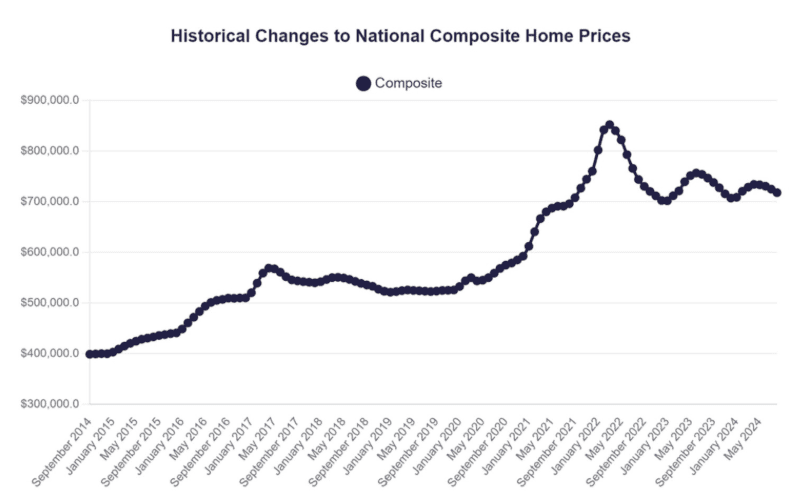

Let’s take a look at the peak of the real estate market, which occurred around May 2022. As you can see, house prices did not continue to hit new highs, but began to fall. Even though there were several rebounds during the period, the rebounds were getting weaker.

Some people may think that two years is not enough to explain the problem, so let’s look at the facts. Since 2022, the Federal Reserve has started a cycle of interest rate hikes, and house prices have fallen accordingly. As seen in the chart, there is a correlation between interest rate hikes and falling house prices.

Now, although we have entered the interest rate reduction channel, housing prices have not rebounded, but continue to fall.

Employment rates

In 2022, the economic rebound after the epidemic made the North American economy perform strongly, especially in the job market. At that time, the unemployment rate was very low, as everyone had an income and could easily cope with mortgage loans. However, by 2024, the situation had changed significantly. The unemployment rate climbed to 6.7%, and the overall economy began to decline.

Even though some people could still afford their mortgages, whether their income can be sustained in the long term is a huge question. Confidence in the real estate market has begun to collapse, and more owners are forced to sell their properties because they can no longer afford them. This is a major issue that we must pay attention to at the moment.

Housing Trends

Although interest rates have fallen, this has not brought about the expected rise in house prices. The real problem is not the interest rate, but the cash flow break. Many people are unable to support their mortgages due to unemployment or reduced income, and even a rate cut cannot ease their financial pressure. What everyone needs is not lower interest rates, but higher cash flow.

Judging from the market trend, housing prices are in a downward channel. Although the transaction volume is increasing, this reflects more of a lack of market confidence. The interest rate cut has not changed the overall downward trend of the market.

The core problem at present is that the economy is in a downturn, the unemployment rate is rising, and the cash flow is tight, which makes it difficult for the real estate market to rebound.

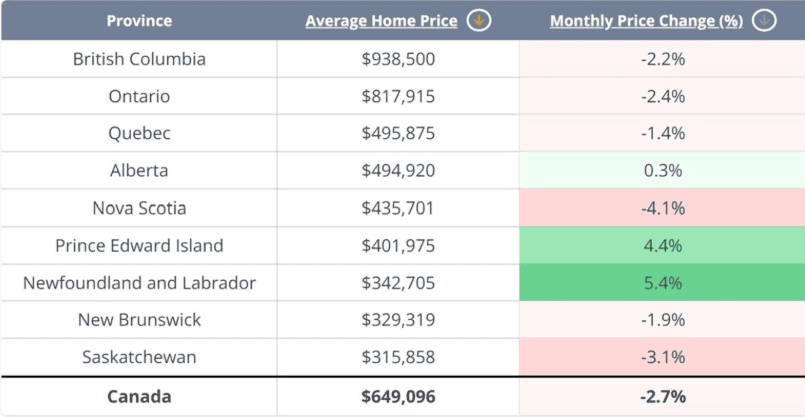

Let’s look at the housing prices in August. Although the statistics for September have not yet been released, the data for August has already shown a trend. Through the monthly price change, we can see that housing prices in Canada’s three major provinces – British Columbia, Ontario, and Quebec – have fallen across the board. British Columbia fell by 2.2%, Ontario fell by 2.4%, and Quebec fell by 1.4%. Although housing prices are rising in some small provinces, overall, the national average housing price fell by 2.7% in August. This decline indicates that the downward trend in the real estate market has begun, and that this trend is likely to continue.

Let’s take a look at the peak of the real estate market, which occurred around May 2022. As you can see, house prices did not continue to hit new highs, but began to fall. Even though there were several rebounds during the period, the rebounds were getting weaker.

Some people may think that two years is not enough to explain the problem, so let’s look at the facts. Since 2022, the Federal Reserve has started a cycle of interest rate hikes, and house prices have fallen accordingly. As seen in the chart, there is a correlation between interest rate hikes and falling house prices.

Now, although we have entered the interest rate reduction channel, housing prices have not rebounded, but continue to fall.

Macroeconomics

In 2022, the economic rebound after the epidemic made the North American economy perform strongly, especially in the job market. At that time, the unemployment rate was very low, as everyone had an income and could easily cope with mortgage loans. However, by 2024, the situation had changed significantly. The unemployment rate climbed to 6.7%, and the overall economy began to decline.

Even though some people could still afford their mortgages, whether their income can be sustained in the long term is a huge question. Confidence in the real estate market has begun to collapse, and more owners are forced to sell their properties because they can no longer afford them. This is a major issue that we must pay attention to at the moment.

Summary (real estate)

Although interest rates have fallen, this has not brought about the expected rise in house prices. The real problem is not the interest rate, but the cash flow break. Many people are unable to support their mortgages due to unemployment or reduced income, and even a rate cut cannot ease their financial pressure. What everyone needs is not lower interest rates, but higher cash flow.

Judging from the market trend, housing prices are in a downward channel. Although the transaction volume is increasing, this reflects more of a lack of market confidence. The interest rate cut has not changed the overall downward trend of the market.

The core problem at present is that the economy is in a downturn, the unemployment rate is rising, and the cash flow is tight, which makes it difficult for the real estate market to rebound.

The impact of interest rate cuts on the stock market

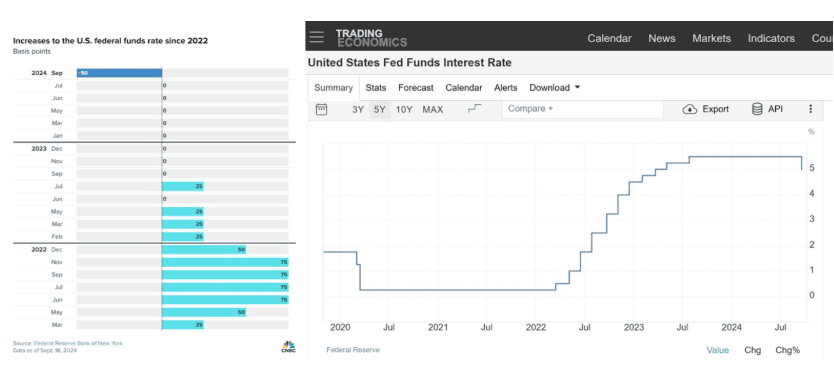

Interest rate changes

The left picture shows the process of the Fed’s rate hikes to rate cuts. The Fed first raised interest rates in March 2022 by 25 basis points, gradually reaching a maximum of 5.5%. In 2023, the Fed raised interest rates four more times, each time by 25 basis points. After a series of fierce rate hikes, it was not until September 2023 that the Fed cut interest rates for the first time, by 50 basis points. This move shows that the current market liquidity is tight and the capital chain of many institutions and individuals has been broken, forcing the Fed to take more aggressive rate cuts.

Interest rate trends

The chart on the right shows the trend of interest rate changes. Starting from March 2022, the Fed raised interest rates 11 times, eventually raising the interest rate to 5.5%. It was not until September 2023 that the interest rate was lowered from this high point to 5%. This set of data clearly reflects the evolution of the Fed’s monetary policy and its response to market liquidity.

Overall, the interest rate cut means that the market’s concerns about the economic outlook have intensified, which will directly affect the performance of the stock market.

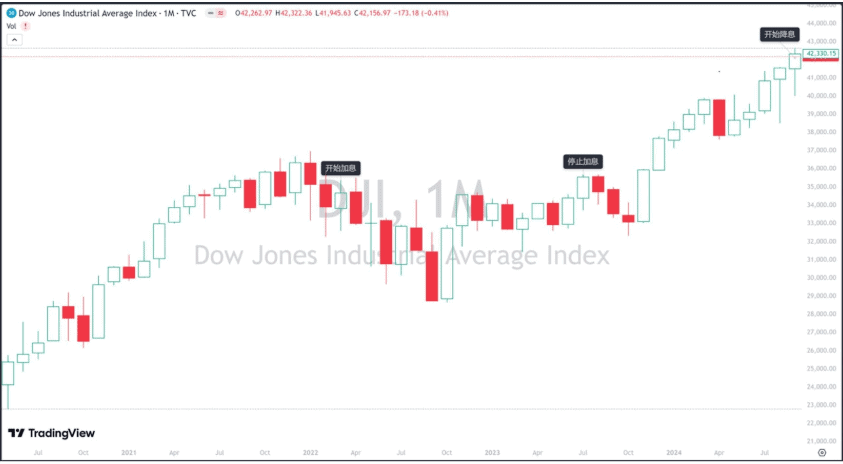

Short-term

Let’s look at this monthly chart of the Dow Jones Index in the United States. Each column represents a month. In March 2022, the Federal Reserve began to raise interest rates, and the flow of funds in the market began to tighten. In the short term, we saw that the index continued to fall after the rate hike, from March to September. In October 2022, the market began to rebound and continued to rise until the rate hike stopped in August 2023. This process lasted about 17 months.

Medium Term

During this period of rate hikes, the stock market did fall in the short term. However, in the medium term, as the market adapted and adjusted, the stock market recovered and exceeded the high point in March 2022 when the rate hikes stopped. This shows that despite the short-term pressure, the stock market still has the potential to rise in the medium term.

After the rate hikes were stopped, the market was initially full of uncertainty about future trends, leading to another three-month correction. However, the market soon realized that the Fed had truly stopped raising rates, confidence was restored, and the bull market phase began.

Summary (Stocks)

In summary, interest rate cuts lead to increased market cash flow, which in turn attracts more buying and growth in the market. When the economy slows, the Federal Reserve lowers the federal funds rate to stimulate financial activity and promote economic growth. The effect of rate cuts is the opposite of rate hikes. Lower interest rates are seen as a catalyst for growth, facilitating borrowing by individuals and businesses, thereby increasing profit potential and economic vitality. Consumers increase their consumption expenditures, while companies can operate, acquire and expand at lower costs, promoting future profitability.

Many people are facing unemployment, which has prompted the Federal Reserve to implement interest rate cuts. After the interest rate cut, borrowing costs are reduced, which increases disposable cash in the market, stimulates consumption and investment, and thus drives up the stock market. Therefore, investors and economists generally believe that the interest rate cut will promote the stock market to enter a bull market stage, and the growth of corporate profits will further push up stock prices. This series of changes shows that the interest rate cut not only injects vitality into the economy, but also provides a solid foundation for the recovery of the stock market.

How should we invest?

Through data analysis, we conclude that the real estate market has come to an end, and the recovery of the stock market prompts us to adjust our investment strategy.

The key to investment lies in the direction, and being eager to make money may lead to wrong decisions or even fall into scams. Therefore, investors must act with caution. It is crucial to cooperate with professionals who understand investment, because they can help you choose the right investment direction.

With the advent of the Fourth Industrial Revolution, artificial intelligence and emerging technologies have changed the traditional investment landscape. Investors should pay more attention to future investment opportunities, especially those closely related to technological innovation. Relying on the guidance of professionals can reduce risks and increase the probability of investment success.

In this context, principal-guaranteed funds and investment loans are considered ideal investment tools. Mutual funds and principal-guaranteed funds provide relatively stable returns and are suitable for risk-averse investors. Investment loans allow you to borrow money for investment at simple interest while obtaining potential negative returns.

More about principal protection funds >>>

More about investment loans >>>

To sum up, in the face of changes in the economic environment and rapid technological development, ordinary investors need to keep a clear head, rely on the guidance of professionals, combine tools such as principal protection funds and investment loans, and scientifically plan investment strategies to achieve long-term wealth appreciation.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More