Discover how a Canadian family achieved 239% returns using strategic...

Read MoreOne Canadian Economy Act: Breaking Barriers and Building a Unified Market

Canada has passed the One Canadian Economy Act (C-5), a landmark law that opens the way for freer trade, easier labour mobility, and faster infrastructure development nationwide.

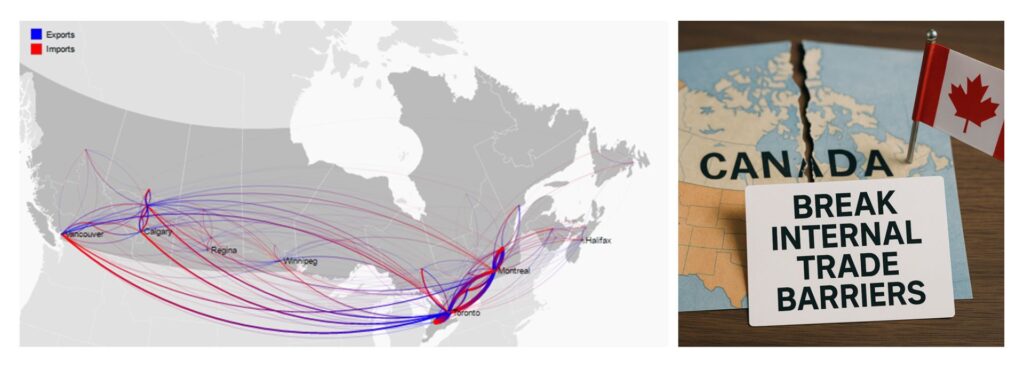

For decades, Canada’s economy has not functioned as a truly unified whole, but rather as 13 provinces and territories operating independently. Differences in provincial laws have made it difficult for capital, goods, and even talent to move freely across borders. This fragmented economic framework has significantly constrained national productivity and growth potential.

The One Canadian Economy Act was introduced as a direct response to these structural challenges. It is built on two core pillars:

Free Trade and Labour Mobility in Canada Act (FTLMCA) — Establishes a system of interprovincial mutual recognition, allowing goods, services, and labour to move more freely nationwide while reducing duplicate approvals and regulatory burdens.

Building Canada Act — Creates a fast-track and more transparent process for national-interest projects such as energy corridors and interprovincial infrastructure, ensuring these strategic undertakings are delivered more efficiently.

When Prime Minister Mark Carney first advanced this reform, he noted that dismantling provincial trade barriers could lift Canada’s GDP growth to more than 4%, placing it among the fastest-growing economies in the G7. While many considered the goal overly ambitious at the time, the passage of the Act has made the growth potential of economic integration increasingly tangible.

At a meeting held in Saskatchewan this June, the federal government and provincial premiers reached consensus on the need to accelerate major infrastructure and interprovincial projects. The Act enshrines two key commitments:

Mutual recognition across provinces: If a product or service is legally compliant in one province, it is deemed compliant at the federal level, avoiding duplicative review.

Accelerated pathway for national projects: Strategic projects in the national interest benefit from faster, more transparent approvals while still upholding environmental standards and Indigenous rights.

Taken together, the Act aims to create a truly unified Canadian market, strengthening the environment for jobs, investment, and long-term economic growth.

In the following sections, we will provide a five-part analysis covering the Act’s core provisions, its impact on businesses and individuals, and the investment opportunities it creates.

Part I: Free Trade and Labour Mobility in Canada Act (FTLMCA)

The Free Trade and Labour Mobility in Canada Act (FTLMCA) is one of the central components of the One Canadian Economy Act. Its purpose is clear: to remove the institutional barriers that prevent goods, services, and labour from moving across provinces, and to finally establish a unified national market.

Four Baselines: Freedom with Order

This law does not represent unrestricted liberalization; rather, it promotes free movement while safeguarding the public interest. It sets out four clear “red lines”:

Health must be protected

Safety cannot be compromised

Social well-being must be considered

The environment cannot be sacrificed

In other words, interprovincial free movement is not an unregulated opening, but rather a process carried out within a framework that safeguards key social boundaries.

In addition, the law stipulates that if it conflicts with other federal or provincial legislation, the FTLMCA and its accompanying regulations take precedence. This makes it the “final authority” for Canada’s internal market, providing the highest level of legal certainty nationwide.

Core Mechanism I: Mutual Recognition of Goods

One of the most closely watched features of the Act is the mutual recognition mechanism for goods. Its principle is straightforward:

If a product is legally produced, sold, and used in one province, it should be deemed compliant across the country, without requiring businesses to undergo duplicate approvals.

This reduces compliance costs for companies and shortens time-to-market for products.

For example, the food and beverage industry has long struggled with provincial differences. Ontario and British Columbia generally require English packaging, while Quebec mandates French as the primary language. As a result, companies have often been forced to design three different versions of packaging for the same product—raising costs and sometimes delaying market entry by months or even years.

Another well-known example is the 2012 “Free Beer Case.” A resident of New Brunswick was fined $300 for bringing several cases of beer purchased in another province back home. The case was eventually appealed all the way to the Supreme Court of Canada, which upheld provincial restrictions on alcohol transport. What seemed like a trivial rule became a national controversy, highlighting the persistence of interprovincial trade barriers.

With the adoption of the mutual recognition mechanism, these barriers will now be gradually dismantled.

Core Mechanism II: Mutual Recognition of Services

Beyond goods, professional services are also included in the mutual recognition framework. In the past, businesses seeking to operate across provinces had to reapply for licenses. For instance, an engineering consulting firm or a financial advisory company that was fully compliant in Ontario could not simply begin operating in British Columbia or Quebec.

Under the new law, once a business is recognized by regulators in one province, it can obtain a federal comparability designation, granting it access to the national market.

This provision will significantly improve the efficiency of interprovincial expansion, particularly for industries such as consulting, financial services, and architectural design, which rely heavily on professional accreditation.

Core Mechanism III: Mutual Recognition of Professional Qualifications

Core Mechanism III: Mutual Recognition of Professional Qualifications

For individuals, the mutual recognition of professional qualifications represents a major breakthrough. For years, many Canadian professionals—such as doctors, nurses, lawyers, engineers, and financial advisors—were restricted to practising only in the province where they were licensed. To work in another province, they often had to reapply, and in some cases even retake examinations. This not only limited career development but also worsened regional labour shortages.

The new law explicitly requires federal regulators to recognize licenses issued by the provinces. Once a professional submits an application, they may be granted a nationwide “comparable license.” This means, for example:

A nurse licensed in Ontario can relocate to British Columbia without having to sit for a new exam.

An engineer licensed in Quebec can have their credentials recognized directly in Saskatchewan.

This mechanism not only enhances professional mobility but also helps businesses and public institutions address persistent talent shortages.

Implementation and Oversight

To ensure the effective implementation of the FTLMCA, the Act introduces two key safeguards:

Liability protection: Institutions or individuals acting in good faith to apply the mutual recognition provisions are granted limited liability, even if errors occur. This reduces hesitation at the enforcement level and encourages regulators to act decisively.

Review mechanism: The law requires a full review after five years, with results submitted to Parliament. This ensures the framework can adapt to changes in Canada’s economic and industry conditions, maintaining both flexibility and long-term effectiveness.

In summary, the Free Trade and Labour Mobility in Canada Act (FTLMCA) not only addresses the long-standing fragmentation of Canada’s internal market but also, through mechanisms of mutual recognition, labour mobility, and scheduled reviews, creates a more open and efficient national marketplace for both businesses and individuals.

Part II: Building Canada Act

The core of the Building Canada Act lies in creating a “fast yet stable” pathway for National Interest Projects (NIP): on the one hand, accelerating projects that are of strategic significance to the country, and on the other, ensuring that environmental protection and Indigenous rights are substantively safeguarded.

I. Strategic Positioning and Scope of NIPs

The legislative objective is clear: to prioritize projects of national strategic importance that can significantly boost productivity and resilience. These include, but are not limited to:

Interprovincial trade corridors and logistics infrastructure — lowering transportation costs and eliminating bottlenecks in the flow of goods.

Energy and resource projects — strengthening energy security and supply stability.

Manufacturing and transportation supply chain upgrades — supporting industrial transitions and technological modernization.

Northern and remote area development — integrating underdeveloped regions into the national economic landscape.

Such projects deliver more than economic output and investment; they also create a large number of high-quality jobs, strengthening household incomes and supporting regional balance. At the same time, the law makes it explicit that acceleration cannot come at the expense of environmental protection or Indigenous rights.

II. NIP Listing Mechanism: Four Gateways, Rigid Procedures + Transparency

Clear standards (Cabinet definition): The federal Cabinet must first establish the criteria for what qualifies as a National Interest Project, to avoid arbitrariness.

Gazette publication (30 days): Proposed projects must be published in the Canada Gazette for no fewer than 30 days, allowing the public, industry, and stakeholders to provide feedback.

Provincial/territorial consultation and consent: If a project involves areas of exclusive provincial jurisdiction—such as land or natural resource management—it must obtain written consent from the relevant provincial or territorial government. This ensures respect for provincial autonomy and reduces potential conflicts later on.

Public registry disclosure: Once listed, the project must be entered into a public registry that includes its description, the rationale for its designation as an NIP, its budget, and its implementation timeline, ensuring accountability and public oversight.

Key point: An NIP is not designated at the whim of government but rather through a chain of steps—standards definition → public consultation → provincial negotiation → registry disclosure—that ensures both rigor and transparency.

III. Deemed-Favourable Presumption: Reducing Uncertainty, Without Skipping Due Process

Once a project is listed as an NIP, certain federal determinations related to it will be deemed “favourable to project advancement.” This does not amount to an automatic approval, but it provides a clear policy endorsement and a positive signal:

Investors gain confidence to commit capital, and contractors are more willing to begin work, reducing the hesitation caused by regulatory uncertainty.

Environmental assessments and Indigenous consultations remain mandatory. The shift is from questioning whether the project can proceed to determining how it can proceed quickly and responsibly.

IV. Consolidated Conditional Instrument: One Certificate for Many, with a 5-Year Validity

To streamline approvals, the law authorizes the issuance of a Consolidated Conditional Instrument, which integrates multiple federal permits into a single document:

One certificate, multiple authorizations: Instead of applying separately to several federal departments, a project proponent can rely on a single consolidated document, provided it upholds all underlying legal standards.

Five-year validity: If the project has not commenced substantive work within five years, the instrument expires, preventing long-term “permit hoarding” and ensuring resources are not locked up without progress.

This mechanism reduces duplication, shortens timelines, and ensures that acceleration does not devolve into stagnation.

To address the long-standing challenge of multiple permits and duplicative applications, the law authorizes designated ministers to issue a Consolidated Conditional Instrument, which combines several federal approvals into a single certificate:

One certificate, multiple authorizations: Substantive standards are not lowered; rather, separate legal requirements are consolidated into one document.

Five-year validity: If substantial work has not begun within five years, the certificate expires, preventing projects from “holding a spot” without moving forward.

Impact: Significantly reduces repetitive approvals and administrative costs, creating a compliance framework that maintains standards while accelerating processes.

V. Acceleration ≠ Lack of Transparency: Dual Requirements of Disclosure and Parliamentary Oversight

To ensure the “fast track” does not devolve into opaque decision-making, the law requires that at least 30 days before issuing a Consolidated Conditional Instrument, the government must publish four categories of information:

All conditions attached to the certificate;

Full texts of assessments and studies;

Opinions of relevant departments, including reasons for any not adopted;

A comparison table showing what the normal process would have been had the project not been designated as an NIP.

In addition, parliamentary oversight is mandated: the government must report to both Houses of Parliament, and relevant ministers may be required to appear before hearings to explain why certain projects were fast-tracked while others were not. In short, the process is designed to operate in full public view, with speed grounded in trust and accountability.

VI. Ongoing Review: 180-Day Progress Reports + 5-Year Comprehensive Review

Every 180 days: The government must report project implementation progress to Parliament, creating a semi-annual “health check.”

Every 5 years: A full review of the law’s effectiveness must be conducted and submitted to Parliament, ensuring alignment with economic and industrial realities.

Summary: Three Pillars, From 5+ Years to ≤ 2 Years

Pillar 1: Listing mechanism — Clear standards, 30-day publication, provincial consultation, registry disclosure; compliant and transparent.

Pillar 2: Simplified approvals — Deemed-favourable presumption + Consolidated Conditional Instrument (multi-permit integration, 5-year validity); reduces uncertainty and increases efficiency.

Pillar 3: Mandatory transparency and accountability — Information disclosure, parliamentary oversight, 180-day reports, 5-year review; faster but still stable.

The policy objective is explicit: compress project approval timelines from more than five years to about two years, enabling nationally strategic projects to move forward quickly, with full oversight and long-term credibility. This is the “institutional fast track” that the Building Canada Act provides in support of economic integration.

Part III: Impact on Businesses and Workers

The two pillars of the One Canadian Economy Act—the Free Trade and Labour Mobility in Canada Act and the Building Canada Act—represent not only structural reforms, but also bring tangible benefits for businesses and workers.

Benefits for Businesses: Lower Costs, Faster Expansion

For years, Canada’s market was effectively divided into 13 provincial markets. To enter multiple provinces, the same product often required repeated testing, certification, and approvals—wasting time and adding costs. Many small and medium-sized enterprises abandoned cross-provincial expansion altogether, leaving the country without a truly unified market.

With the passage of the Act:

Unified standards, nationwide recognition: Businesses no longer need to undergo repeated certifications, significantly lowering compliance costs.

Time and labour savings: Approval processes that once took months or even years are now compressed.

Greater certainty in interprovincial expansion: Companies have stronger confidence to extend operations nationwide, rather than remaining confined to a single province.

Even more importantly, once a project is designated as a National Interest Project (NIP), it immediately benefits from the deemed-favourable presumption. This shortens approval timelines from five years or more down to less than two years, greatly enhancing investment certainty and operational feasibility—particularly beneficial for large-scale industries such as energy, transportation, and manufacturing.

Benefits for Workers: Nationwide Mutual Recognition of Professional Qualifications

Another breakthrough lies in its impact on professionals and skilled trades. In the past, doctors, nurses, engineers, accountants, lawyers, financial advisors, and similar professionals were restricted to practising only in the province where they held a license. To work in another province, they often had to reapply—and in some cases, even retake exams.

With the new law in place:

Nationwide recognition of professional qualifications: Federal regulators are required to recognize licenses issued by the provinces.

Smoother interprovincial employment: Licensed professionals only need to apply once to receive a nationwide “comparable license.”

Greater career flexibility: Professionals can move freely across the country without the burden of repeated certification, saving both time and cost.

This not only facilitates individual career development but also helps alleviate chronic labour shortages in many sectors. For example, healthcare systems and engineering projects will benefit from a larger pool of qualified talent.

A Win-Win Structural Reform

Overall, the Act creates a dual benefit for both businesses and workers:

For businesses: Lower compliance costs, faster expansion, and significantly shorter approval cycles for major projects.

For individuals: Mutual recognition of professional qualifications creates more job opportunities, greater career flexibility, and smoother labour mobility.

It is this two-way benefit that makes the One Canadian Economy Act a true structural breakthrough—unlocking business vitality while improving the efficiency of labour allocation.

Part IV: Impact on Individuals and Families

Beyond businesses and professionals, the One Canadian Economy Act also brings far-reaching benefits to ordinary individuals and households. These gains are reflected in employment opportunities, income levels, consumer choice, and, in the long run, greater regional equity and wealth accumulation.

More Jobs, Higher Household Income

With the accelerated rollout of National Interest Projects (NIPs), a wave of large-scale infrastructure, energy, and construction initiatives will be launched. These projects are typically extensive in scope and long in duration, meaning they will create a substantial number of stable, high-paying jobs.

For individuals, this translates into noticeably more employment opportunities; for families, the benefits are reflected in tangible income growth. Young professionals, in particular, stand to gain the most. Thanks to nationwide mutual recognition of professional qualifications, a newly licensed engineer, doctor, or accountant who faces limited opportunities in their home province can now freely pursue careers in other provinces. This increased mobility not only broadens career options but also enhances overall job security.

Greater Consumer Choice, Lower Cost of Living

The Act promotes the gradual harmonization of goods and services standards across provinces. Products that consumers previously could purchase only in certain regions will now circulate more easily nationwide. This brings two direct outcomes:

More diverse choices: Store shelves will feature a wider range of products from across the country.

More competitive pricing: Increased interprovincial competition compels businesses to improve quality and service, while reduced compliance and transportation costs help bring prices down.

The result: households can buy more—and better—goods and services with the same amount of money. In other words, purchasing power rises and quality of life improves.

Regional Equity and Long-Term Stability

For decades, Canada’s economic growth has been concentrated in major cities and coastal provinces, while northern and resource-based communities often saw limited investment. By accelerating the rollout of National Interest Projects, the new Act is expected to bring more infrastructure and capital to these underserved regions, helping to narrow regional development gaps.

This shift not only allows remote communities to share in the benefits of growth but also strengthens Canada’s overall competitiveness and economic stability over the long term. For families, this macro-level stability directly supports pension security and wealth accumulation: the more stable the economy, the stronger the foundation for retirement planning and long-term financial well-being.

From Macro Opportunities to Personal Wealth

In summary, the Act not only addresses systemic economic barriers at the national level but also translates into real benefits for individuals: more jobs, higher household incomes, lower living costs, and greater long-term wealth accumulation. It creates a more favourable environment for Canadians, but ultimately, turning policy-driven certainty and growth potential into personal wealth depends on individual investment choices.

Part V: Investment Opportunities and Ai Financial’s Strategy

The passage of the One Canadian Economy Act is not only a structural reform at the macroeconomic level—it also creates new opportunities for investors. Whether this policy-driven certainty and growth potential can be transformed into household and personal wealth depends largely on choosing the right investment tools and strategies.

Investing Requires Professionalism: Avoid the Temptation of Quick Gains

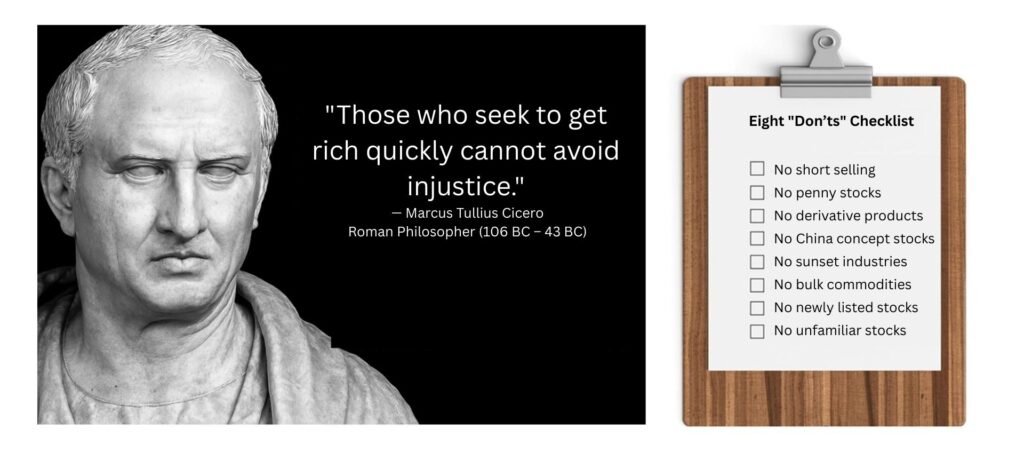

In today’s global economic environment, currency continues to lose value, and relying solely on wages is no longer enough to keep pace with inflation. Investment has become an essential path to growing household wealth. However, the pursuit of “getting rich quick” is fertile ground for scams. With the rise of the internet and social media, fraudulent investment schemes are proliferating, making it more important than ever for ordinary investors to exercise caution.

Against this backdrop, professional investment management is critical. With over 25 years of hands-on experience, Ai Financial has developed a set of “principles of what not to do”, guiding clients away from high-risk speculation and keeping them on a disciplined path toward long-term wealth growth.

Bridging Macro Policy and Personal Investment

Historically, Ai Financial’s strategies have leaned toward global allocation, particularly in U.S. markets. But with the enactment of the One Canadian Economy Act, Canada’s national strategic projects are entering a new phase of opportunity. These projects typically require substantial financing, and one of the primary funding channels is through segregated funds with guarantees.

Participating Through Segregated Funds

For individual investors, the most prudent way to capture the benefits of this policy shift is by investing through publicly available segregated funds with guarantees. This approach offers two key advantages:

Principal protection: Segregated funds guarantee 75%–100% of principal at maturity or upon death, reducing risks from market volatility.

Long-term growth: Because these funds channel capital into national strategic projects, they provide both stability and exposure to Canada’s broader economic expansion.

Leveraged Loan Investing Combined with Segregated Funds

A more strategic approach is to combine leveraged loan investing with segregated funds:

Leverage effect: Investors need only pay interest while gaining access to a larger pool of investable capital.

Risk control: Since the underlying investment is a segregated fund, the principal is protected and overall risk remains manageable.

Amplified returns: With limited personal resources, investors can still participate in financing Canada’s national projects and steadily accumulate wealth.

Conclusion: Policy Tailwinds + Financial Tools = Wealth Growth

The One Canadian Economy Act establishes an institutional fast track for economic growth and creates new opportunities for personal investing. But to truly transform these macro-level tailwinds into household wealth, investors must rely on the right financial tools and a long-term strategy.

At Ai Financial, our core philosophy is to leverage policy-driven opportunities in combination with disciplined tools—segregated funds and investment loans—to help clients protect their principal while achieving sustainable wealth growth.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More