Discover how a Canadian family achieved 239% returns using strategic...

Read More$17,913 Profit in a Down Market—Here’s How

Over a decade ago, Leo came to Canada as an international student. After earning a degree in IT, he secured a position at a major tech firm. His income was stable and life was comfortable. However, post-pandemic inflation and rising mortgage costs made him realize the urgent need to grow wealth steadily—to guard against future job risks and ensure a more secure retirement.

💡 That’s when he decided to try a “high-liquidity, passive investment” strategy—letting his money work for him.

After thorough research, Leo partnered with Ai Financial (AiF) in January 2023. He successfully obtained a $200,000 investment loan with:

- No collateral required

- No down payment

- No income or asset proof needed

- Interest-only payments, with lifelong renewability and no requirement to repay the principal

Investment Strategy:

✅ Loans: $100,000 each from B2B Bank and Manulife Bank (total $200,000)

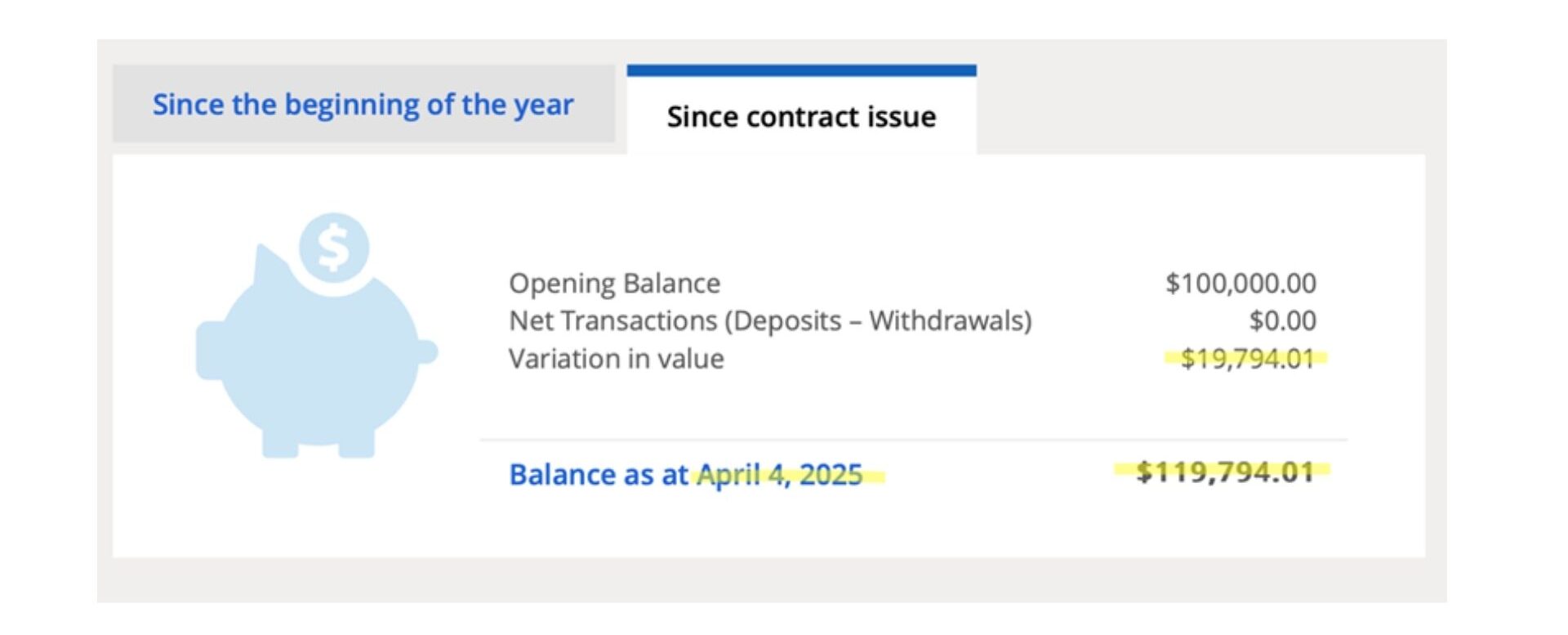

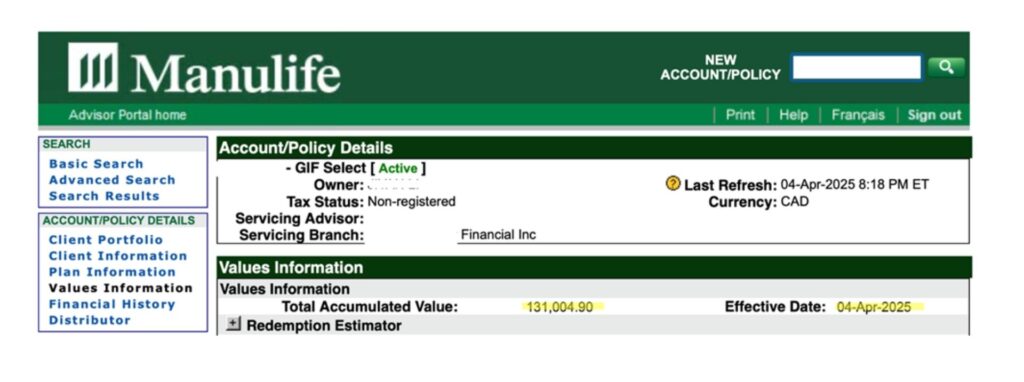

✅ Investment: 100% invested in principal-protected segregated funds (iA & Manulife) to ensure safety and steady returns

✅ Technology: Backed by AiF’s AI-driven portfolio management and big data analytics for efficient capital deployment

✅ Expertise: A team with 25 years of hands-on market experience in North America, with a 10-year average return of 21.6%

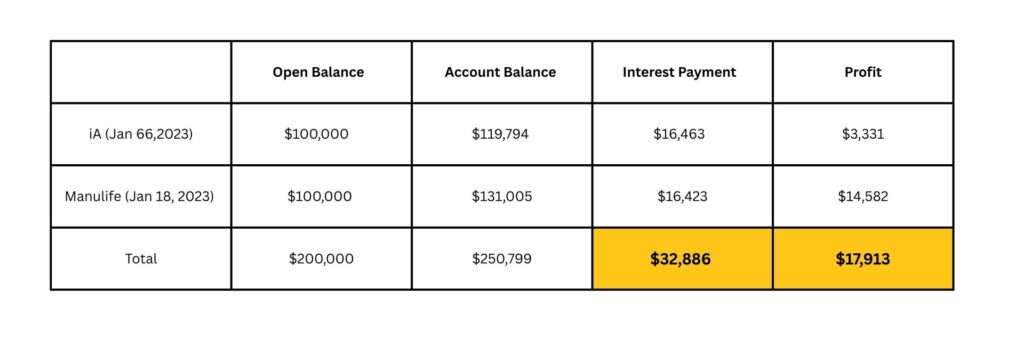

As of April 6, 2025:

📈 Investment Principal: $200,000 (fully from loan)

📈 Total Market Value: $250,799

📉 Interest Paid: $32,866

✅ Net Profit: $17,913

📊 True Return on Investment: 54.5%

Even amid the sharp U.S. stock market correction between February and April 2025—especially the 2,200-point plunge of the Dow Jones on April 4, the largest single-day drop since March 2020—Leo’s investment still yielded excellent results.

This is more than just a financial win—it’s a real-world example of what smart planning and professional strategy can achieve with the right partner.

IA $100,000 Investment Loan Returns:

Manulife $100,000 Investment Loan Returns:

This loan offers the following advantages:

✅ No collateral required

✅ No down payment

✅ Interest-only payments, no need to repay principal

The loan is invested into large-cap public mutual funds, ensuring capital safety while enabling steady growth.

🔹 Rethink traditional retirement—move one step closer to financial freedom!

Many Canadians rely on government pensions to support their retirement, but pensions are limited and face growing uncertainty.

With investment loans + professional financial planning, more people can build wealth earlier and enjoy a freer, more secure retirement.

📈 Partner with Ai Financial—let your wealth outpace time ⏳💰

The future is already here. Seize the opportunity and start planning your financial growth today.

Let smart investing become your tool to enhance life and optimize retirement.

📩 Want to learn more? Contact an AiF advisor now and start your journey to financial success!

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More