Discover how a Canadian family achieved 239% returns using strategic...

Read MoreHow an Investment Loan Helped This Couple Grow $250K into $540K in 7 Years

Intro:

In a time of high inflation and market volatility, many people felt uncertain about the future. But with Ai Financial’s guidance, one couple turned long-term discipline and professional strategy into over $540,000 in assets — starting from zero.

2017: Where It All Began — 40x Returns Sparked a Mindset Shift

In 2017, James and Emily joined an Ai Financial investment workshop led by CEO Mr. Feng. James applied Feng’s “simplicity-first” strategy — and achieved a 40x return.

That single experience reshaped their understanding of investing and gave them strong trust in AiF’s team. Soon after, they became Ai Financial clients and committed to a structured path to wealth growth.

Despite market shocks over the next 7 years:

- 2020: COVID crash with 4 circuit breakers

- 2022: Prolonged downturn for 9 straight months

- 2025: April’s historic 2,200-point plunge

…their investments doubled.

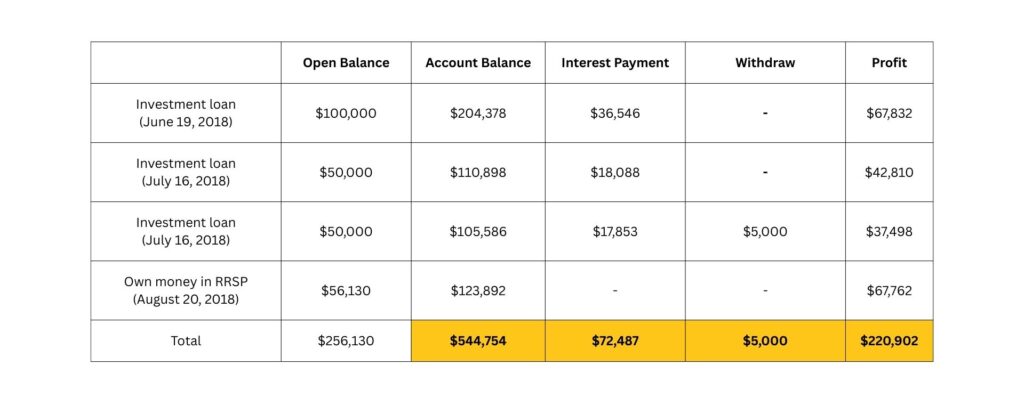

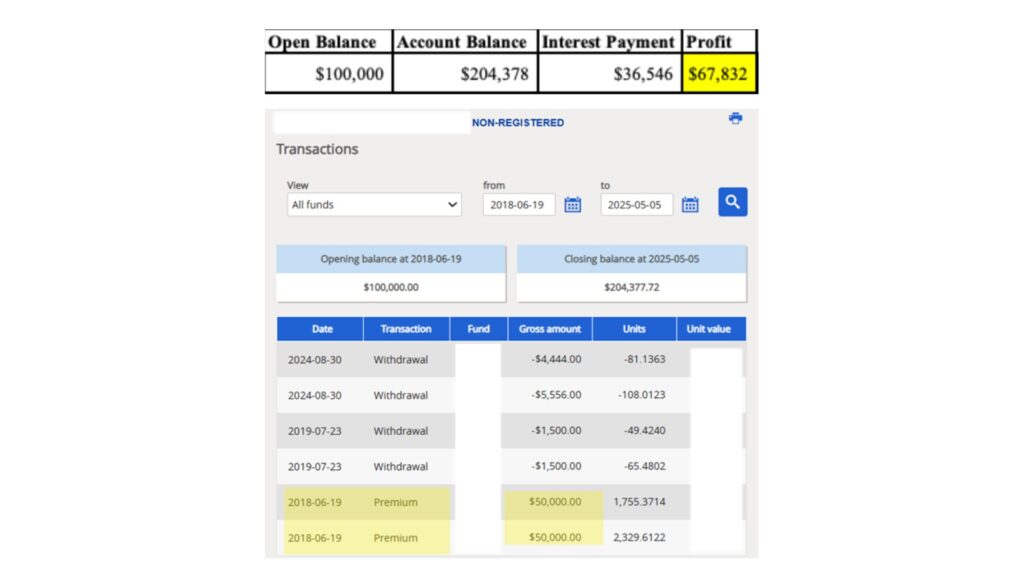

Phase 1: $100K Joint Investment Loan — Starting Their Journey

In June 2018, with AiF’s full support, the couple took out a $100,000 joint investment loan and invested into IA segregated funds.

- Principal: $100,000 (loan)

- Market value (2025): $204,378

- Interest paid: $36,546

- Net profit: $67,832

- ROI: 186%

Phase 2: Customized Investment Plans & Diversified Accounts

To reduce risk and maximize return, AiF built a personalized investment plan for each spouse.

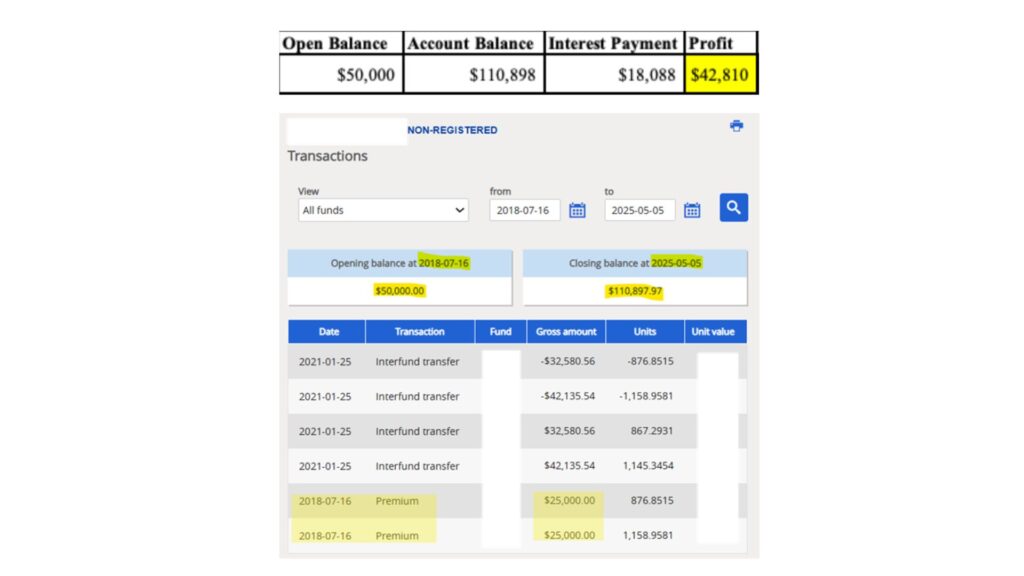

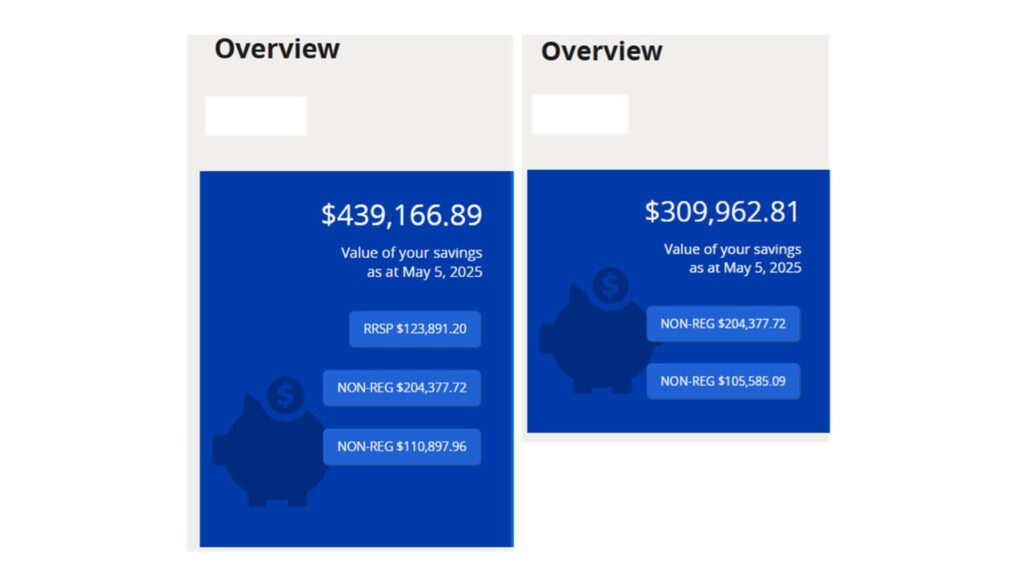

Emily’s Strategy:

- $50,000 IAT loan in July 2018

- Value in May 2025: $110,898

- Net profit: $42,810

- ROI: 237%

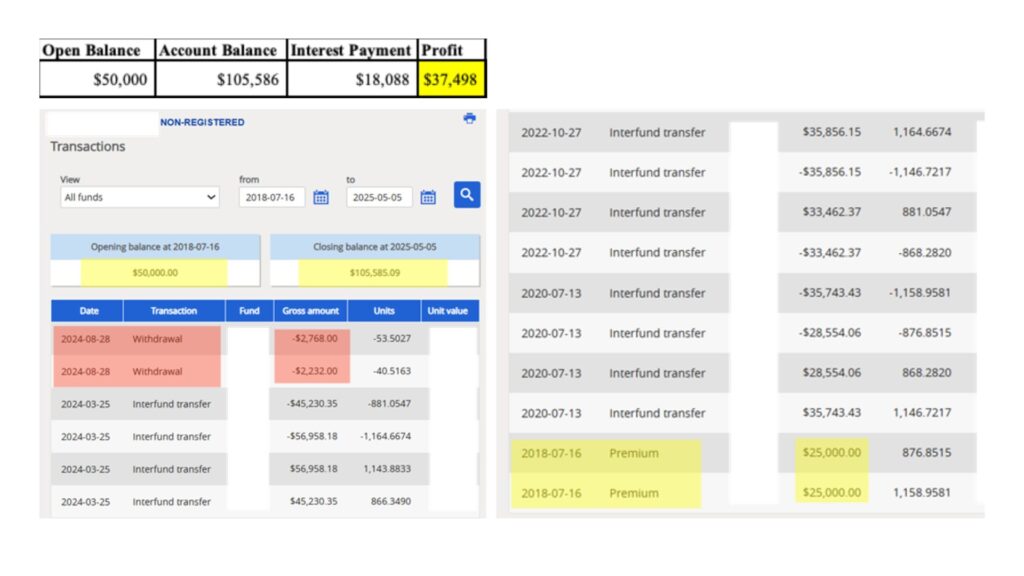

James’s Strategy:

- $50,000 IAT loan in Aug 2018

- Withdrew $5,000 in 2024

- Value in May 2025: $105,586

- Net profit: $37,498

- ROI: 207%

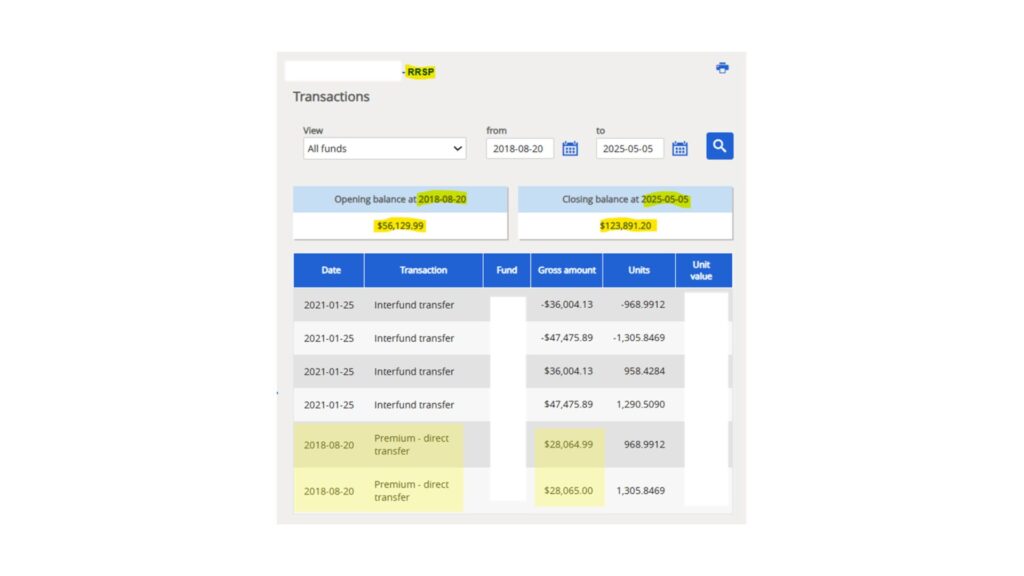

RRSP for Long-Term Retirement Growth

In August 2018, Emily opened an RRSP account with AiF’s advice to plan for the future:

- Initial investment: $56,130

- Value in 2025: $123,892

- Return: 121%+

Total Portfolio Value as of May 2025

- Emily’s combined accounts: $439,167

- James’s combined accounts: $309,963

Together, their investment results far exceeded expectations — all while navigating uncertain and turbulent markets with calmness and trust.

⭐️ What Made the Difference? AiF’s Expertise + Strategic Planning

Their results weren’t based on luck or timing — they were built on professional strategies, long-term planning, and AiF’s ability to adapt to market changes.

At AiF, we don’t promise miracles. We deliver growth by helping clients:

- Use investment loans responsibly

- Diversify across accounts

- Avoid costly mistakes

- Regularly rebalance and adjust their portfolios

📩 Want to build your own 7-year roadmap? Let’s plan your next move together.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More