Discover how a Canadian family achieved 239% returns using strategic...

Read MoreMom’s Investment Success with AiF: 150% Return in 22 Months, Easing Financial Pressure!

Through AiF’s investment loan, Ms. Y achieved steady portfolio growth, earning nearly $40,000 in net profit over 22 months—helping to ease financial stress.

📈 A Strategic Approach to Wealth Growth

As a dedicated mother managing household responsibilities, Ms. Y found it challenging to secure a full-time job. However, rising interest rates, inflation, and increasing costs for her children’s extracurricular activities put additional pressure on her finances.

💡 How can one accelerate wealth growth while managing financial stability?

💡 How can future cash flow concerns be addressed?

Determined to find a solution, Ms. Y immersed herself in investment education, attending financial courses and personally trading stocks, forex, and options. Despite her efforts, her returns remained inconsistent, failing to provide the financial security she sought.

🔹 Expertise Matters

After careful research, Ms. Y partnered with Ai Financial (AiF) in May 2023 and secured a $200,000 government-backed investment loan with these advantages:

✅ No collateral required

✅ No upfront payment

✅ Interest-only payments with no principal repayment obligation

She allocated the funds into well-established public mutual funds, prioritizing capital protection while ensuring steady growth.

⏳ Stable Growth Over 22 Months

Over this period, Ms. Y not only received consistent returns but also withdrew nearly $20,000 in profits to cover household expenses during tight financial months. After accounting for interest payments, she still netted close to $40,000—significantly easing her financial burden.

📊 A Smart Investment for Financial Security

By leveraging professional financial planning and a structured investment approach, Ms. Y secured stable returns, allowing her to navigate market fluctuations with confidence.

🔹 Investment Strategy Breakdown

✅ Loan Amount: $100,000 each from B2B Bank and Manulife Bank (Total: $200,000)

✅ Investment Allocation: 100% in IA & Manulife segregated funds, ensuring capital protection and steady growth

✅ Technology-Driven Strategy: AiF’s AI-powered asset management optimizes returns with data-driven decision-making

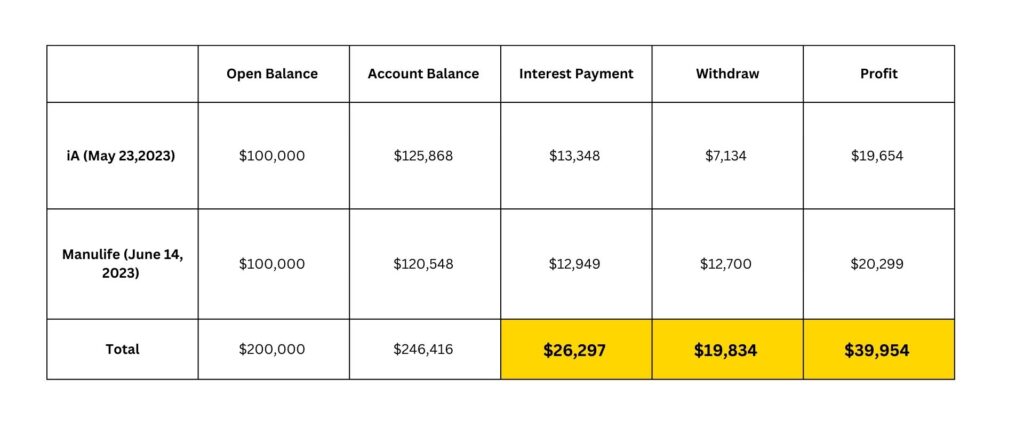

💰 22-Month Investment Results 🎯

📊 Performance Overview

✅ Investment Loan: $200,000

✅ Portfolio Value: $246,414

✅ Total Interest Paid: $26,297

✅ Net Profit: $39,954

✅ Profits Withdrawn: $19,834

🚀 Realized Return: 150% 🎉

In just 22 months, Ms. Y achieved stable growth, withdrew profits for family expenses, and continued building long-term wealth. This success highlights the power of professional financial planning and strategic investment—backed by Ai Financial’s expertise.

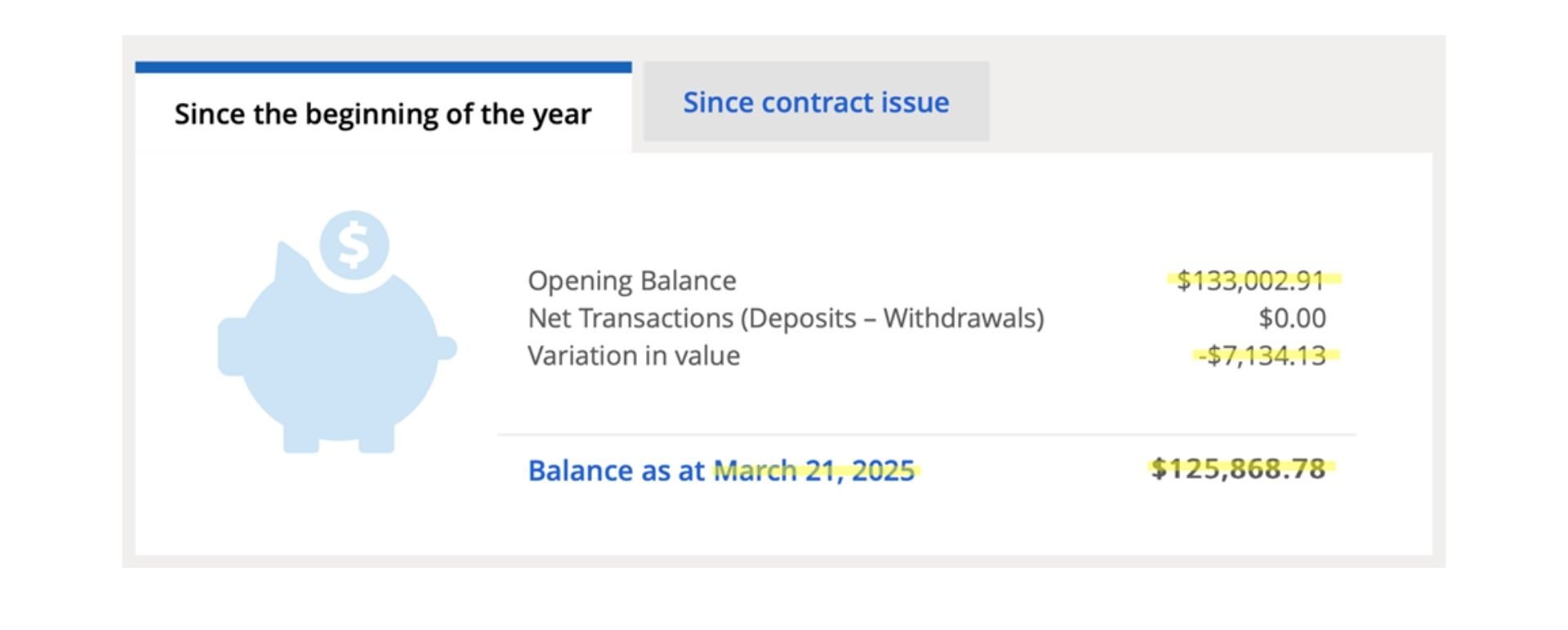

IA $100,000 Investment Loan Returns:

📊 Investment Overview

✅ Investment Loan: $100,000

✅ Current Portfolio Value: $125,868

✅ Total Interest Paid: $13,348

✅ Net Profit: $19,645

✅ Profits Withdrawn: $7,134

🔥 Realized Return: 147% 🎉

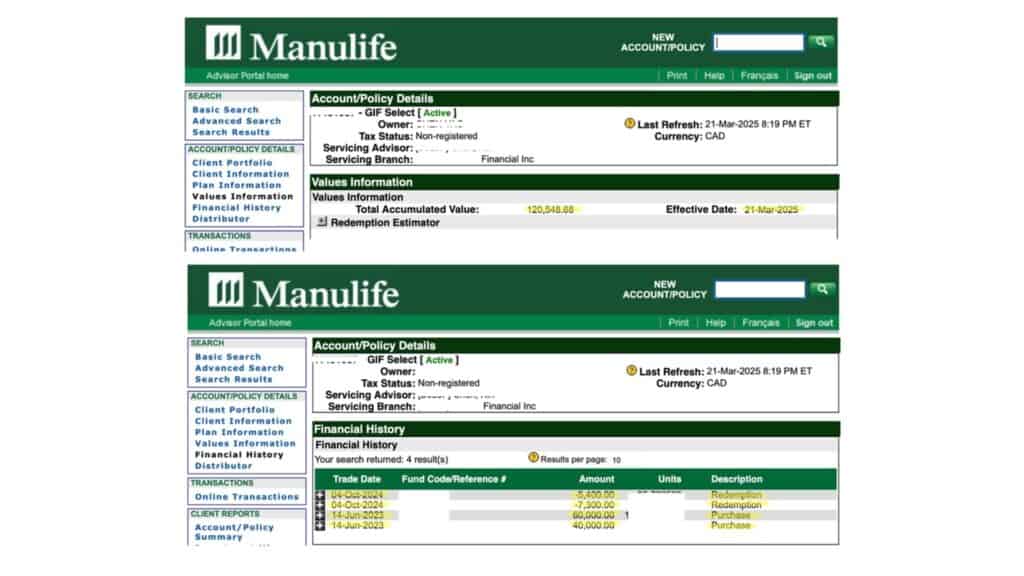

Manulife $100,000 Investment Loan Returns:

📊 Investment Overview

✅ Investment Loan: $100,000

✅ Current Portfolio Value: $120,548

✅ Total Interest Paid: $12,949

✅ Net Profit: $20,299

✅ Profits Withdrawn: $12,700

🔥 Realized Return: 156% 🎉

📢 Investment Case Summary: Boosting Wealth Growth and Optimizing Retirement Planning through Financial Investment!

Y’s investment journey demonstrates the power of professional investing and smart planning. In just 22 months, she used Ai Financial’s investment loan to achieve steady growth and optimize cash flow, leading to significant improvements in her family’s financial situation.

💡 This success story shows us that wealth growth can be more efficient!

✅ Low-barrier, high returns: No collateral, no down payment—just pay the interest and leverage a large investment to enjoy capital growth benefits.

✅ Steady returns: Invest in large public mutual funds to ensure the safety of funds while maintaining attractive returns.

✅ Optimized cash flow: Flexibly withdraw profits to relieve short-term financial pressure while building long-term wealth.

🔹 Changing traditional retirement concepts and advancing financial freedom!

Many Canadians rely on government pensions for their retirement, but pensions are limited and could face greater challenges in the future. Investment loans, paired with professional financial planning, can help more people build wealth earlier and achieve a freer, worry-free retirement lifestyle.

📈 Join Ai Financial and let your wealth outpace time ⏳💰

The future is here—seize the opportunity and start planning for your wealth growth today. Make financial investment a key tool to enhance your life and optimize your retirement!

📩 Want to learn more? Contact an AiF investment advisor now to start your wealth growth journey!

Why Choose AiF?

🚀 Exclusive Leverage Investment Solutions: Easily apply for investment loans through partnerships with major financial institutions like B2B Bank, Manulife Bank, and iA Trust!

📌 No Income or Asset Proof Required: Perfect for investors who lack initial capital but want to maximize returns!

📈 Stable Investment with Long-term Compounding: AiF focuses on Segregated Fund investments for long-term growth, making profit a certainty rather than speculation or a game of chance!

💡 25 Years of Practical Experience in North American Financial Markets: We precisely navigate the market and understand the essence of investing!

With leverage investment, choosing the right partner is more important than just effort. Choose AiF, the professional institution that turns investing into a true wealth-building tool.

The 2025 Winter Promotion is in full swing! Successfully apply to get approved for a $200,000 investment loan to receive an IPhone 16 Pro Max! More offers are available for a limited time—learn more now!

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More