Discover how a Canadian family achieved 239% returns using strategic...

Read MoreShe Achieved Steady Growth with Segregated Funds and Secured a $200,000 Investment Loan!

Client Story

Ms. E, a 90s-born graduate from a top Canadian university, started her career in accounting and quickly founded her own firm, achieving her first financial milestone.

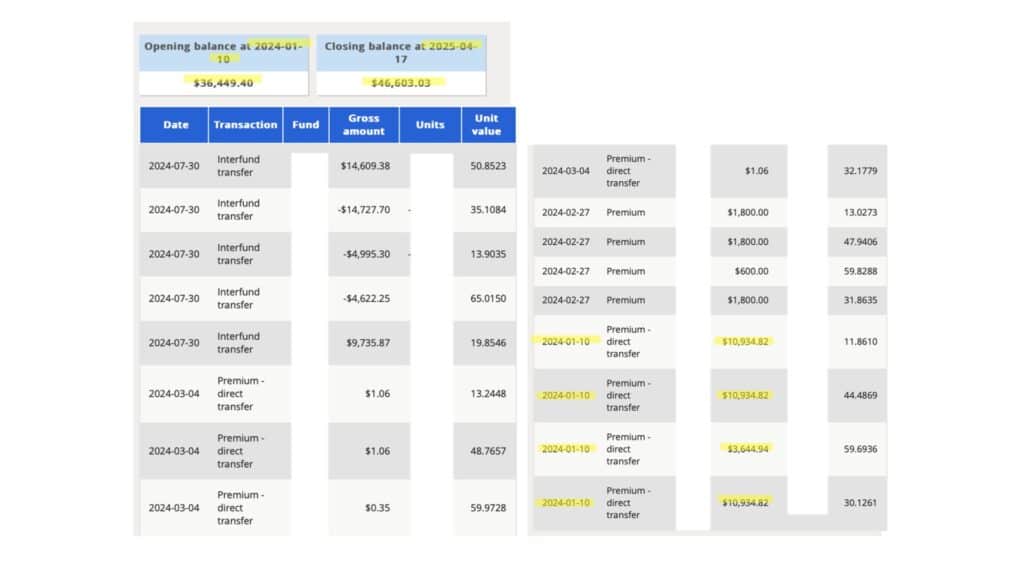

With her business thriving, she sought better ways to grow her personal wealth. After testing various investments across multiple institutions with disappointing results, she was introduced to Ai Financial in early 2024. Impressed by their 10-year average annual return of 21.6%, she transferred one of her registered accounts for professional management.

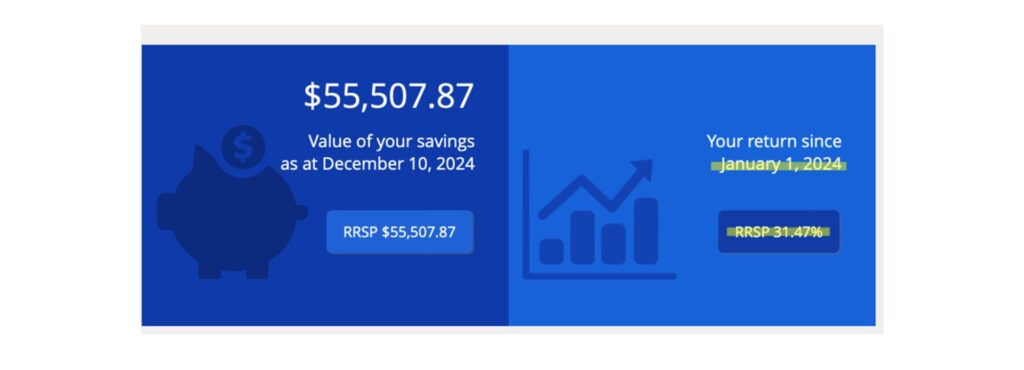

By the end of 2024, her account achieved an annualized return of 31.47%, far exceeding her previous experiences.

Confident in Ai Financial’s expertise, Ms. E expanded her strategy in early 2025 by securing a $200,000 investment loan—endorsed by the Canadian government—and invested fully into segregated funds focused on U.S. blue-chip companies.

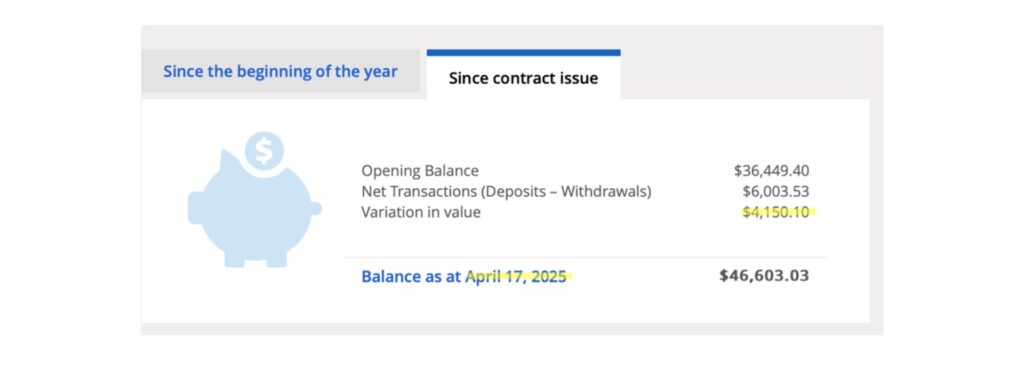

Even during the rare Dow Jones downturn in April 2025, her portfolio remained resilient, maintaining over $4,000 in profits.

For Ms. E, investment success is about common sense, discipline, and choosing the right partners—not luck. Today, she is firmly committed to her long-term journey with Ai Financial toward multiplied wealth.

Ms. E’s Investment Strategy

- Process of Elimination: She tested small investments across several institutions, eliminated underperformers, and ultimately chose Ai Financial based on consistent performance.

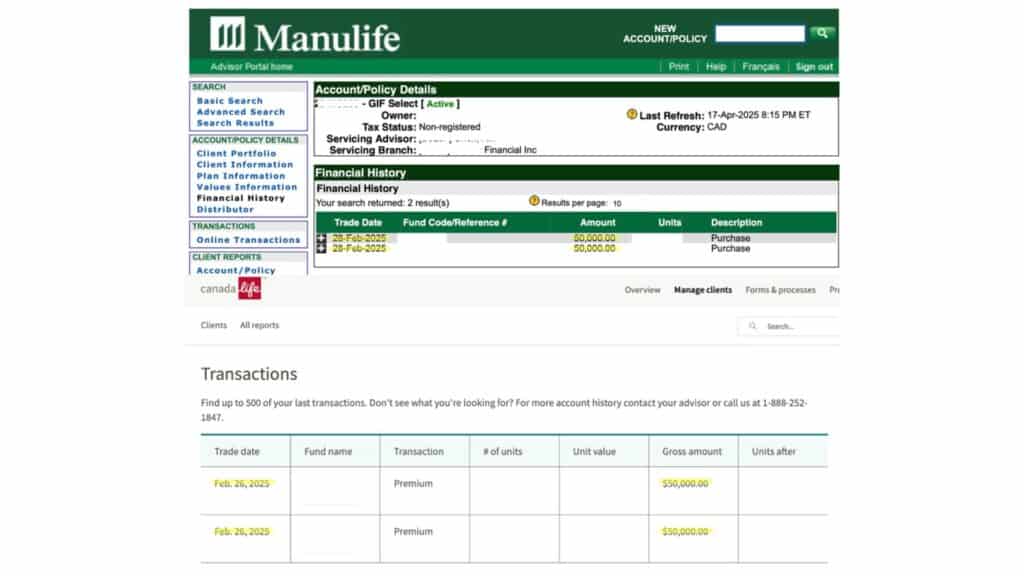

- Leveraged Investment: Secured $200,000 in loans—$100,000 each from B2B Bank and Manulife Bank.

- Safe Investment: 100% of the loan funds invested in segregated funds from iA and Manulife, ensuring capital protection and steady returns.

- Technology-Driven Management: Powered by AiF’s AI and big data asset management for optimized efficiency.

- Experienced Team: 25 years of real-world financial market expertise and a 10-year average return of 21.6%.

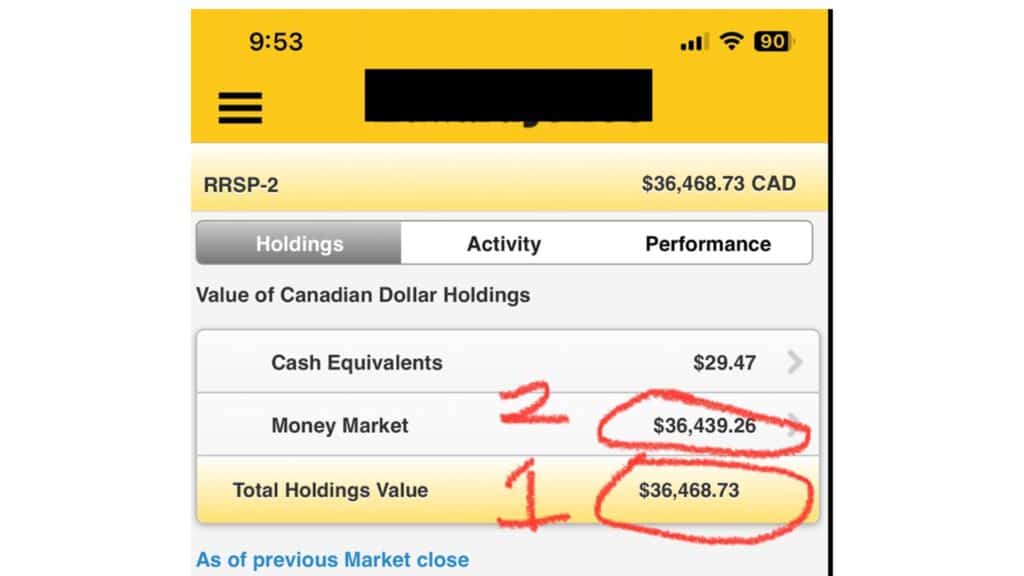

Ms. E’s accounts at other financial institutions.

After transferring her account to AiF, Ms. E achieved a 31.47% return in less than one year.

Despite the Dow Jones dropping below 5,000 points in April 2025, Ms. E’s account remained profitable, with over CAD $4,000 in gains as of April 27, 2025.

Through a rigorous process of elimination, Ms. E confirmed AiF’s investment advantages. In February 2025, she partnered with AiF and successfully secured a CAD $200,000 investment loan.

Advantages of the Investment Loan

- No collateral required

- No down payment needed

- Interest-only payments, no principal repayment required

- Funds invested into large, publicly traded segregated funds for safety and stable growth

A New Approach to Retirement and Wealth Building

Traditional retirement plans relying solely on government pensions may not be sufficient in the future. Combining investment loans with professional financial planning empowers individuals to accumulate wealth earlier and enjoy greater financial freedom in retirement.

Join Ai Financial and let your wealth outpace time!

The future is already here. Take control today and turn smart investments into a better life and a stronger retirement plan.

Interested? Contact an AiF advisor and start your journey toward smarter wealth growth!

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More