Discover how a Canadian family achieved 239% returns using strategic...

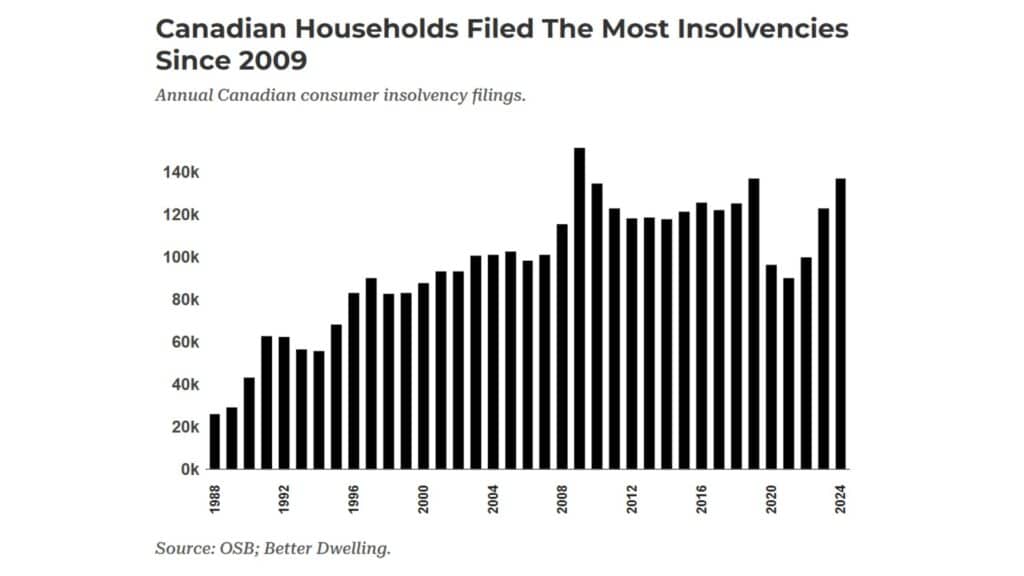

Read MoreCanadian Households Filed The Most Insolvencies Since 2009

Data shows that in 2024, consumer insolvency filings in Canada reached 137,300, marking an 11.4% increase from 2023. This is the second-highest annual insolvency count in history, surpassed only by the 2009 recession. Moreover, the growth rate over the past two years is second only to the surge during the Global Financial Crisis.

Despite official economic data revisions suggesting a stronger-than-expected economy, the sharp rise in consumer insolvencies tells a different story. Not only has Canada recorded its second-highest insolvency level, but the growth rate is also comparable to the financial crisis era. If consumers are struggling in a supposedly “strong” economy, a future recession could bring even greater financial distress. This trend also signals rising risks for mortgage defaults.

AiF Insight: No investment, no wealth.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More