Discover how a Canadian family achieved 239% returns using strategic...

Read More2025 Canada National Risk Assessment on Money Laundering and Terrorist Financing

The Government of Canada recently released the 2025 National Risk Assessment (NRA) on Money Laundering and Terrorist Financing. This report is not only a key policy document for regulators and financial institutions but also directly impacts the financial security of every investor.

In recent years, scams and cybercrimes have surged — from fake calls posing as banks or tax authorities to fraudulent investment platforms promising “high returns.” These crimes drain public wealth, and the stolen money is often funneled through complex financial networks to appear “clean,” re-entering the system as legitimate funds.

This is the essence of money laundering. It is not confined to organized crime; it can involve anyone whose bank account is compromised or who invests through unregulated platforms. Similarly, terrorist financing occurs when legitimate-looking donations are redirected to fund illegal activities. Even small contributions sent to the wrong source can have serious consequences.

What Is the National Risk Assessment (NRA)?

To combat these risks, the Canadian government periodically conducts a National Risk Assessment, a comprehensive review of the country’s financial system to identify vulnerabilities and improve safeguards.

The 2025 NRA focuses on three questions:

- What criminal activities pose the greatest risks to Canada’s financial system?

- Which sectors or products are most vulnerable to misuse?

- How could these risks affect economic and social stability?

Lecture Overview

This presentation highlights four key areas:

- The purpose and scope of the NRA

- Major findings from the 2025 report

- Lessons for individual investors

- Ai Financial’s risk-aware investment strategies

By understanding the report’s findings and real-world cases, investors can recognize that working with licensed, compliant, and professionally regulated institutions is essential to protect their assets and achieve sustainable growth.

Part I: The Fundamentals and Purpose of the National Risk Assessment (NRA)

1. Understanding the Basics: Starting with “Money Laundering”

Before examining the 2025 Canada National Risk Assessment on Money Laundering and Terrorist Financing, it is essential to understand several key concepts. Only by grasping these foundations can we fully comprehend the purpose and significance of the report.

1.1 Definition and Mechanism of Money Laundering

Money laundering refers to the process of disguising illegally obtained funds as legitimate income through a series of complex transactions and transfers. The goal is to conceal the true origin of the money—turning “dirty money” into “clean money.”

For example, a drug dealer holding large amounts of cash cannot simply deposit it in a bank without being asked about its source. To “legitimize” these funds, criminal organizations employ various methods such as:

- Inflated business revenue: Opening a restaurant that serves only 10 tables a day but reporting 50, 80, or even 100 tables’ worth of sales, thereby mixing illegal cash into its declared income.

- Casino transactions: Exchanging cash for casino chips, gambling briefly, then redeeming the chips for checks or electronic transfers to disguise the money’s origin.

- Real estate purchases: Buying properties with illicit funds, holding them for a short period, and then selling them to make the proceeds appear as “investment income.”

- Cross-border trade and shell companies: Moving funds through offshore accounts, fake export businesses, or shell corporations to obscure their source and make tracing difficult.

In reality, such activities are far more common than most people imagine. Many small, unprofitable businesses—like restaurants or convenience stores that somehow stay open for years—may in fact be part of money-laundering networks.

While the methods vary, the essence remains the same: to conceal the true origin of criminal proceeds and integrate them into the legitimate financial system.

1.2 Terrorist Financing: Legal Funds for Illegal Purposes

In contrast, terrorist financing refers to the use of legally obtained funds to support illegal terrorist activities. In simple terms, money laundering turns illegal money into legal-looking money, whereas terrorist financing turns legal money into illegal actions.

The amounts involved in terrorist financing are often relatively small, but the consequences can be devastating.

For instance, an individual might donate a few hundred dollars to what appears to be a charitable organization online, unaware that the funds are diverted midstream and end up in a terrorist group’s account. Even a small contribution of a few dollars can be used to purchase weapons, explosives, or materials for violent acts.

Although the total sums are much smaller than those involved in drug trafficking or fraud, terrorist financing is classified as a high-level risk because it endangers not only economic stability but also national and public security.

In short:

- Money laundering is the economic cancer that erodes financial integrity.

- Terrorist financing is the social explosive that threatens safety and stability.

2. The Concept and Significance of the National Risk Assessment (NRA)

To address the growing threats of money laundering and terrorist financing, the Government of Canada regularly conducts a comprehensive review of the national financial system. This process is known as the National Risk Assessment (NRA).

The NRA functions much like a “health check” for the country’s financial system:

- A doctor examines a patient’s blood pressure, heart, and liver function;

- The government examines which parts of the financial system are strong and which are vulnerable;

- It identifies which risks are most severe and which industries are most exposed;

- And it provides targeted recommendations for prevention and response.

This report helps both the government and the public understand:

- Which criminal activities pose the greatest threats to Canada’s financial stability;

- Which financial products, sectors, or institutions are most susceptible to criminal exploitation;

- What economic and social consequences may arise if these risks are not effectively mitigated.

The NRA’s analytical framework is based on three key dimensions:

- Threat: Who creates the risk — such as drug traffickers, fraud syndicates, or transnational criminal networks.

- Vulnerability: Which components of the financial system are weakest or least regulated — for example, banks, private corporations, or cryptocurrency channels.

- Consequence: What could happen if risks escalate — including economic disruption, declining public trust, and potential withdrawal of foreign investment.

In essence, the National Risk Assessment serves as a strategic tool for Canada to identify, measure, and manage financial system risks before they evolve into systemic crises.

3. The Evolution of Canada’s Three National Risk Assessments

1. 2015: Establishing the First National Risk Framework

Canada’s first National Risk Assessment (NRA) was released in 2015, marking a milestone in the country’s financial governance.

It introduced a unified risk identification framework, systematically assessing the vulnerability of different industries and sectors to money laundering and terrorist financing.

This report was equivalent to giving the national financial system its first full “CT scan”—it defined the key indicators for risk diagnosis and laid the methodological foundation for future assessments.

2. 2023: A Comprehensive Shift in Risk Structure

The second NRA, published in 2023, revealed a major transformation in how money laundering and terrorist financing were being conducted, driven primarily by two developments:

- The explosion of online scams:

Criminal groups increasingly used social media and instant messaging platforms to reach thousands of potential victims at minimal cost. Fake customer service representatives, fraudulent investment websites, and AI-generated voice scams spread rapidly across digital channels. - The rise of virtual assets:

Cryptocurrencies such as Bitcoin and Ethereum created new pathways for cross-border money laundering. Traditional physical cash transfers were replaced by instant, anonymous digital transactions, making it significantly harder for law enforcement to track illicit funds.

This report warned that financial crime had shifted from physical operations to digital and transnational forms, fundamentally changing the risk landscape.

3. 2025: The Rise of AI and Transnational Risks

The 2025 NRA, Canada’s most recent assessment, highlights an even more complex and technology-driven risk environment.

In addition to traditional crimes such as drug trafficking, fraud, and smuggling, the report identifies three emerging areas of concern:

- AI-driven fraud:

Technologies such as voice cloning, deepfakes, and synthetic video generation are being used by criminals to impersonate relatives, friends, or trusted figures, deceiving victims into transferring money or making false investments.

Several cases in Canada have already been reported where individuals received urgent “family member” calls, only to discover later that the voices were AI-generated fakes. - Transnational criminal networks:

Money laundering operations now span multiple jurisdictions, exploiting legal loopholes and regulatory inconsistencies between countries to obscure the flow of funds and evade detection. - Opaque financial structures:

Criminals increasingly rely on trusts, shell companies, and offshore accounts to hide the identities of true beneficiaries, creating significant challenges for regulatory transparency and investigation.

The 2025 report concludes that financial risks are becoming more advanced and interconnected. While technology enhances efficiency, it also opens new channels for exploitation and concealment, demanding more adaptive and coordinated regulatory strategies.

4. Threats, Vulnerabilities, and Consequences: The Three-Layer Risk Framework

The NRA organizes its findings into three analytical dimensions that together explain how financial risks emerge and spread:

1. Threats

- Drug trafficking organizations: Massive cash flows make them a primary source of traditional money laundering.

- Fraud syndicates: From phone scams to AI-driven deception, their stolen funds must quickly enter the financial system to appear legitimate.

- Transnational criminal networks: By exploiting differences in international laws, they move funds through multiple countries to evade tracking.

2. Vulnerabilities

- Banks and financial institutions: Weak compliance or monitoring systems act like a weakened immune system—making them easy entry points for illicit funds.

- Private companies and crypto platforms: Limited disclosure and regulatory oversight often turn these sectors into loopholes that criminals exploit.

3. Consequences

- Economic: The influx of laundered money distorts market prices. For instance, Canada’s housing market has long been suspected of absorbing significant illegal funds, inflating property values and making housing less affordable for ordinary families.

- Social: Public trust in banks and investment institutions declines, weakening overall investor confidence.

- International: Countries with high money-laundering risk may face capital flight, loss of reputation, or even international sanctions.

At a macro level, money laundering acts as an invisible toxin within the financial system.

If allowed to penetrate deeply, it corrodes economic integrity, worsens wealth inequality, and undermines the foundation of a fair and stable investment environment.

5. Real-World Cases: Money Laundering and Fraud Are Closer Than You Think

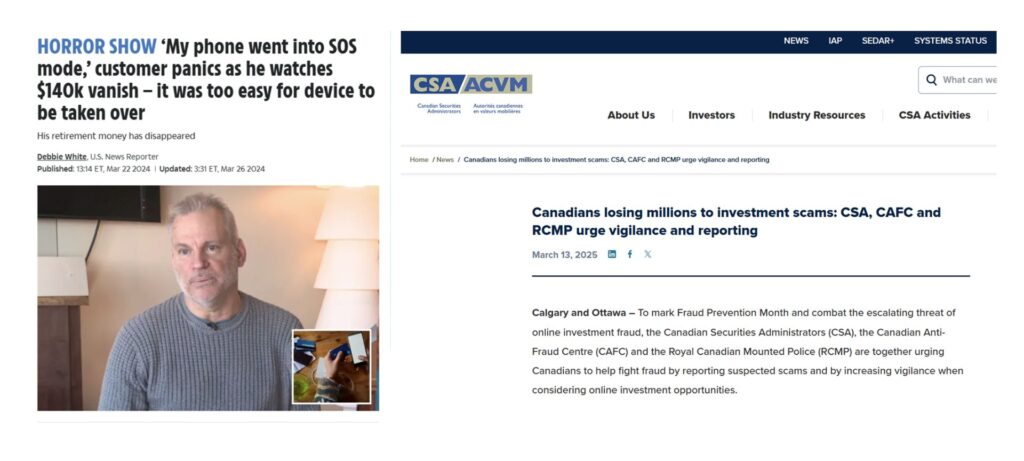

SIM Card Replacement Scam

Criminals often obtain victims’ personal information and impersonate them when contacting telecom companies to request a SIM card replacement.

Once they gain control over a victim’s phone number, they can intercept bank verification codes, reset passwords, and transfer money out of the account.

A real case in Canada involved a couple who lost CAD 140,000 after their phone number was hijacked. Within hours, the stolen funds were converted into cryptocurrency and transferred overseas, making recovery nearly impossible.

Investment Scams and Ponzi Schemes

Fraudulent investment platforms often lure victims with promises of “high returns, low risk, and expert management.”

In 2024 alone, Canadians reported investment scam losses exceeding CAD 310 million, involving more than 4,000 cases.

Most scams spread through social media ads, email solicitations, or influencer endorsements, making them appear credible and legitimate. Once the funds are received, they are quickly funneled through multiple accounts and cross-border transfers, vanishing without a trace.

For many victims, recovery is virtually impossible.

6. Key Takeaways for Investors

Money laundering and terrorist financing are not distant, abstract problems—they exist in every financial transaction, every investment decision, and even small personal donations.

Ordinary investors can reduce their exposure to these risks by following a few essential principles:

- Verify institutional legitimacy

Ensure the investment company is regulated, has a verifiable business address, and provides access to real, licensed advisors. - Keep detailed transaction records

Retain contracts, email correspondence, chat messages, and payment receipts. These documents are critical for protecting your rights in case of disputes or fraud. - Be cautious of “guaranteed” high returns

Products promising high profits with low or no risk are almost always deceptive. Any return that significantly exceeds market averages should raise immediate suspicion. - Invest only through compliant, regulated channels

For example, segregated funds issued by insurance companies or investment loan products offered by licensed financial institutions provide both regulatory oversight and capital protection.

By staying vigilant, conducting due diligence, and partnering with legitimate institutions, investors can safeguard their wealth and avoid becoming part of the financial crime ecosystem.

Part II: Key Findings of the 2025 Report

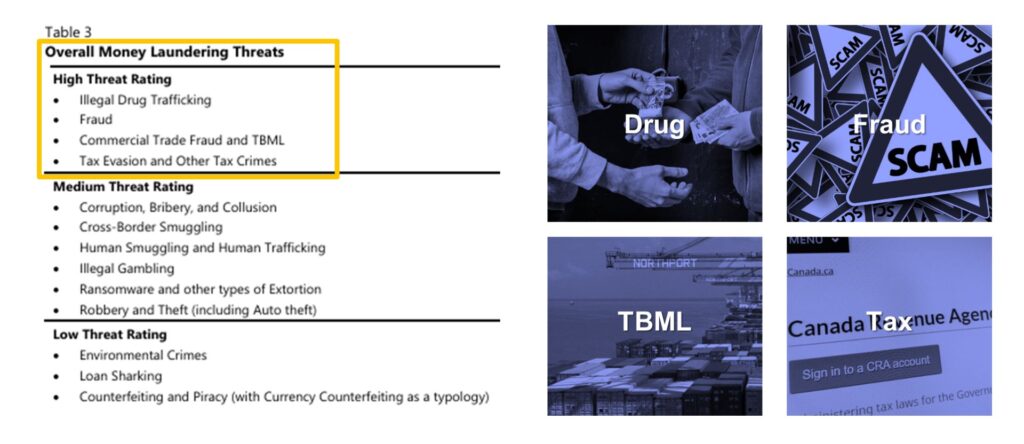

1. The Four Major Threats Identified in 2025

According to Canada’s 2025 National Risk Assessment (NRA) on Money Laundering and Terrorist Financing, the country’s financial system faces four primary threats:

- Drug Trafficking

- Fraud

- Trade-Based Money Laundering (TBML)

- Tax Crimes

These four categories represent the main sources of illicit funds entering Canada’s financial system.

Among them, drug trafficking and fraud remain the two most significant threats, posing long-term risks to financial stability and the investment environment.

(1) Drug Trafficking: A Cash-Driven Systemic Risk

Drug trafficking continues to be one of the largest generators of illegal income in Canada, producing billions of dollars annually, primarily in cash.

Because cash transactions are anonymous and difficult to trace, they form the foundation of many money laundering schemes.

Criminal groups often use cash-intensive businesses to disguise illicit earnings:

- Inflating revenues: Opening restaurants, convenience stores, or car washes that appear legitimate but report far higher sales than reality—e.g., 15 tables a day recorded as 100. The excess is illegal cash disguised as business income.

- Frequent closures and reopenings: Many small businesses operate for only 2–3 years before shutting down and reopening under new names or ownership, allowing continuous “money rotation.” This explains why some local restaurants seem to change ownership so often.

- Casino laundering: Converting cash into casino chips and later redeeming them for cheques or transfers, transforming anonymous money into “traceable” but seemingly legal funds.

- Real estate: Using illicit cash to buy property, later reselling it to create the appearance of legitimate capital gains.

Together, these tactics form a sophisticated ecosystem designed to reintegrate illegal money into the economy under the guise of normal business activity.

(2) Fraud: Rising in Volume, Evolving in Sophistication

Data from the Canadian Anti-Fraud Centre (CAFC) shows that in 2024, Canadians lost CAD 638 million to various scams.

However, only 5–10% of victims typically report their cases, suggesting the true losses may reach several billion dollars.

The main categories include:

- Online and phone scams: Criminals impersonate bank officers, immigration agents, or “financial advisors” to trick victims into transferring funds.

- Investment fraud: Fake platforms promise “high returns with low risk,” especially those claiming to trade cryptocurrencies.

- Romance scams: Fraudsters build emotional relationships online and then request money—this single category caused CAD 58 million in losses in 2024.

- Identity theft: Stolen personal information is used to access bank or brokerage accounts. CAFC recorded 9,487 identity theft cases in 2024—still believed to be heavily underreported.

- Loan and mortgage fraud: Criminals file fake loan applications or use shell companies and proxy accounts to integrate illicit funds into real estate markets.

Three emerging fraud trends:

- Diversification of methods: Traditional phone scams have evolved into AI-driven schemes using voice cloning, video deepfakes, and synthetic media.

- Expanding scale: Investment scams alone caused over CAD 310 million in losses in 2024, with 60% linked to cryptocurrency fraud.

- Lower entry barriers: Fraudsters no longer need to operate from within Canada—a single laptop or smartphone is enough to target victims worldwide.

In short, the 2025 NRA warns that fraud has become more global, more digital, and far harder to detect, requiring both institutional vigilance and public awareness.

2. The Most Vulnerable Sectors

The 2025 National Risk Assessment (NRA) identifies several key areas of vulnerability within Canada’s financial system.

Due to their high transaction volumes, structural complexity, and limited regulatory transparency, these sectors are especially susceptible to exploitation by criminal organizations:

- Major Banks

Although heavily regulated, large banks process millions of transactions daily, functioning as the financial system’s “highways.”

In such enormous data flows, even a handful of suspicious transactions—say, 10 out of 10,000—can easily go undetected in real time.

As a result, major banks remain classified as highly vulnerable institutions within the risk assessment framework. - Private Companies and Trust Structures

Complex ownership layers and beneficiary arrangements often obscure who truly controls the funds.

Many of these entities act merely as intermediary accounts, making it extremely difficult for regulators to trace money flows. - Crypto Assets and Virtual Currency Exchanges

The anonymity, borderless nature, and peer-to-peer transfers of cryptocurrencies make them ideal vehicles for laundering or concealing illicit proceeds.

Without transparent disclosure, regulators find it nearly impossible to distinguish legitimate investment from illegal fund movement. - Money Service Businesses (MSBs)

Cross-border remittance and payment firms—especially those handling frequent small-value transactions—are often exploited for smurfing, where criminals break large sums into smaller transfers to evade detection. - Real Estate Sector

Over recent years, Canadian real estate has become a high-risk channel for money laundering.

The inflow of illegal funds inflates property prices, displacing first-time buyers and widening wealth inequality.

3. Industries with Rising Risk Ratings

The 2025 report highlights several sectors where risk levels have risen significantly compared with previous assessments:

|

Industry |

Risk Level |

Key Factors |

|

Virtual Assets & Crypto Exchanges |

Very High |

High anonymity and cross-border mobility; extremely difficult to regulate |

|

Real Estate Sector |

High |

Stable channel for money laundering; illicit funds drive up housing prices |

|

Currency Exchange & Remittance Firms |

Medium–High |

Frequent small cash transactions and weak identity verification |

|

Accounting & Audit Services |

Medium |

May provide a “legitimate cover” for illicit transactions if misused |

|

Private & Offshore Funds |

High |

Complex layered structures obscure beneficial ownership and limit regulatory oversight |

Across these industries, the shared characteristics are clear: large transaction volumes, cross-border complexity, and challenges in verifying identities.

These factors make them the “gray zones” of the financial system—areas where legitimate finance and criminal activity most easily overlap.

4. Case Studies: Understanding Real-World Examples

Case 1: The Oshawa Investment Fraud

In Oshawa, Ontario, a man posing as a “professional financial trader” convinced clients to invest in a supposed high-return trading platform.

He collected CAD 2.5 million from two victims, transferring all funds into a fictional online investment system, and then quickly moved the money overseas.

He was later charged with investment fraud and electronic system misuse.

Lesson:

Any investment promising “guaranteed profits” or “high returns with low risk” should be treated as a red flag.

Legitimate investment platforms must have regulatory registration, transparent contracts, and verifiable representatives.

Case 2: The Bridging Finance Scandal

Bridging Finance, once considered a “star company” in Canada’s private lending sector, promised investors stable returns.

However, investigations revealed extensive financial misrepresentation and fraud.

CEO David Sharper and his partners diverted investor funds and misled clients through falsified reports.

Ultimately, most investors lost nearly all their capital.

Lesson:

Even well-known, seemingly legitimate financial institutions can pose risks.

Proper regulatory oversight and segregated client funds are essential safeguards for investment security.

Case 3: Identity Theft Combined with Telecom Fraud

In 2024, a Canadian couple received a call confirming a “SIM card replacement” from their telecom provider.

Within hours, CAD 140,000 vanished from their bank account.

Criminals had obtained their personal data, impersonated them to replace the SIM card, intercepted verification codes, and initiated transfers.

The stolen money was quickly layered through cryptocurrency channels, becoming untraceable.

Lesson:

Always complete any SIM, identity, or verification process in person.

Never share sensitive information—such as verification codes or passwords—via text, email, or phone.

5. Government Response and Regulatory Measures

To address increasingly complex financial crime networks, the Canadian government has been intensifying its anti-money laundering (AML) and counter-terrorist financing (CTF) efforts.

From 2018 to 2025, the federal government has invested over CAD 470 million toward:

- Enhancing FINTRAC’s (Financial Transactions and Reports Analysis Centre of Canada) data and analytics systems;

- Strengthening inter-agency intelligence sharing;

- Improving banks’ KYC (Know Your Customer) and transaction monitoring capabilities;

- Supporting cross-border law enforcement collaboration;

- Expanding audits and targeted supervision in high-risk industries.

However, as the report notes:

“Criminal tactics continue to evolve faster than regulatory systems.”

Even as compliance strengthens, criminal groups leverage technology and transnational coordination to stay ahead.

Thus, government regulation can reduce risk—but cannot eliminate it entirely.

6. Emerging Risk Trends

The 2025 NRA highlights three key risk trends shaping the next stage of financial crime:

- AI-Driven Scams

Artificial intelligence is increasingly used in fraud schemes.

Techniques like voice cloning, facial synthesis, and deepfake videos make fake relatives, advisors, or customer service agents appear authentic.

Victims have been tricked into transferring funds after receiving what seemed like legitimate video or voice messages from loved ones.

→ Recommendation: Use multi-factor identity verification (e.g., callback confirmation or live video validation). - Expanding Transnational Crime Networks

Money laundering has evolved from a local activity into global coordination, exploiting regulatory gaps between jurisdictions.

Multi-country fund transfers and layered structures make tracking illicit capital exponentially more difficult. - The Unintended Risk of “De-Risking”

More financial institutions, fearing compliance breaches, are closing accounts of “high-risk” clients or denying them services altogether.

However, these individuals still need financial access and often turn to underground banking systems, unintentionally fueling new money laundering channels.

Excessive caution, therefore, can create systemic blind spots in financial oversight.

Conclusion: Risk Awareness and Investment Security Must Go Hand in Hand

The 2025 National Risk Assessment makes one point clear:

Money laundering and terrorist financing are becoming more technological, transnational, and concealed.

They not only threaten the stability of Canada’s economy but also directly impact individual investors.

In this environment, the first line of defense for investors is to choose regulated, transparent, and compliant financial institutions and products.

This sets the foundation for the next two sections—Investor Insights and Ai Financial’s Strategy—which emphasize that:

Compliance is the foundation of protection, and prudent investing is the only path through risk.

Part III: What This Means for Everyday Investors

1. Why This Matters to You

When people hear terms like “money laundering” or “financial crime,” they often imagine something distant—something involving banks, corporations, or movie plots.

In reality, these crimes affect ordinary Canadians the most.

According to the latest National Risk Assessment and numerous real-life cases, the victims of financial fraud are rarely corporations—they are everyday investors, just like you.

In Canada, a growing number of people have lost life savings through a single transfer, phone call, or online click.

These crimes happen not in faraway places, but right here—through your bank, mortgage, social media, or online investment platform.

- Case 1: Ontario Resident Nearly Lost CAD 730,000

An Ontario man almost lost his entire life savings after wiring CAD 730,000 for an “investment.”

He wasn’t a wealthy entrepreneur, just a hardworking middle-class resident.

Fortunately, the fraudster made an operational error, exposing the scheme just in time to stop the transfer.

Without that accident, decades of savings would have disappeared instantly.

https://www.cbc.ca/news/canada/manitoba/bc-online-fraud-winnipeg-case-1.7150003

- Case 2: Brampton Investor Saved from CAD 170,000 Loss

A Brampton resident was persuaded to invest CAD 170,000 in a “special high-yield opportunity.”

A vigilant bank employee noticed suspicious details, alerted the authorities, and froze the transfer.

Without that intervention, the funds would have been gone within hours. - Case 3: Crypto Scam Cost Three Ontarians CAD 370,000

Three Ontario residents were drawn into a “crypto investment platform” promising 7% monthly returns and “expert management.”

Collectively, they lost CAD 370,000—one victim alone lost CAD 220,000.

All funds were transferred to overseas crypto wallets, leaving no recovery path.

These cases reveal a sobering truth:

Money laundering and fraud are not abstract risks—they are one click away from every investor.

Your account, your transfer, your investment—all could unknowingly become part of a laundering network.

2. The Government’s Safety Net & Three Key Warnings for Investors

To counter these growing risks, Canada’s regulators have built multi-layered defenses within the financial system, including:

- KYC (Know Your Client) requirements — financial institutions must verify client identities, fund sources, and transaction purposes.

- FINTRAC Reporting — any transaction exceeding CAD 10,000 in cash or showing suspicious patterns must be reported to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

- Cross-agency data sharing — banks, insurers, investment firms, and law enforcement share intelligence to trace money-laundering networks.

While these mechanisms strengthen protection, the government repeatedly reminds the public:

No system can replace personal vigilance. A safe investment environment requires both institutional regulation and individual awareness.

Here are the three key takeaways for investors:

- Avoid “Get-Rich-Quick” Promises

Any offer guaranteeing “fast profits,” “zero risk,” or “double returns in weeks” is a scam indicator.

Sustainable investing requires time, discipline, and professional analysis—not shortcuts.

Fraudsters prey on greed and impatience, turning that desire into their easiest weapon. - Work Only with Licensed and Regulated Institutions

Legitimate financial institutions are subject to regulatory audits, identity checks, and fund custody safeguards.

Investing through unregistered or offshore platforms with no transparency is equivalent to handing money to a stranger. - Don’t Trust “Influencer Advisors”

Many so-called “financial gurus” on social media have no certification or regulatory oversight.

They build credibility through luxury lifestyles, selective screenshots, and fake success stories—not actual results.

Their real income often comes from selling memberships or affiliate deals, not from successful investing.

In short:

Regulation can reduce risk, but your awareness and judgment remain the strongest defense against financial crime.

3. Case Study — The “Influencer Investor” Scam

Online investment scams have become one of the fastest-growing forms of fraud in recent years.

Unlike traditional criminals who hide in the shadows, today’s scammers pose as successful entrepreneurs, using social media to display lavish lifestyles and build false credibility.

The following case, cited in government reports and media investigations, illustrates how easily trust can be manufactured online.

Case : Canada’s “Crypto King” — A CAD 41.5 Million Illusion Behind Luxury

The central figure is a young man from Ontario known online as “Crypto King.”

He gained massive attention on platforms like Instagram and TikTok, where he showcased an extravagant lifestyle:

- Garages lined with luxury cars

- Watches worth hundreds of thousands of dollars

- Private jet trips and exotic vacations

- A sleek “investment office” projecting professionalism and wealth

To ordinary viewers, he looked like the perfect example of success through cryptocurrency investing.

He claimed to operate a crypto arbitrage trading business, promising investors:

“A guaranteed 7% monthly return — with zero risk.”

This seemingly “risk-free” opportunity attracted 150 investors, most of whom were ordinary families hoping to grow their savings — some for their children’s education, others for retirement.

But the reality was shocking:

- Total funds collected: CAD 41.5 million

- Actual amount invested in the market: less than 2%

- Remaining funds were spent on luxury cars, real estate, and private jets

When the scheme collapsed, most investors had lost their life savings.

The so-called “crypto arbitrage” was nothing more than a carefully staged illusion.

Lesson:

A genuine financial advisor will never guarantee fixed high returns or rely on displays of wealth to prove credibility.

At Ai Financial, we build trust through professional qualifications, transparent regulation, and real client results—not through image manipulation or social media spectacle.

Part IV: Ai Financial’s Investment Strategy

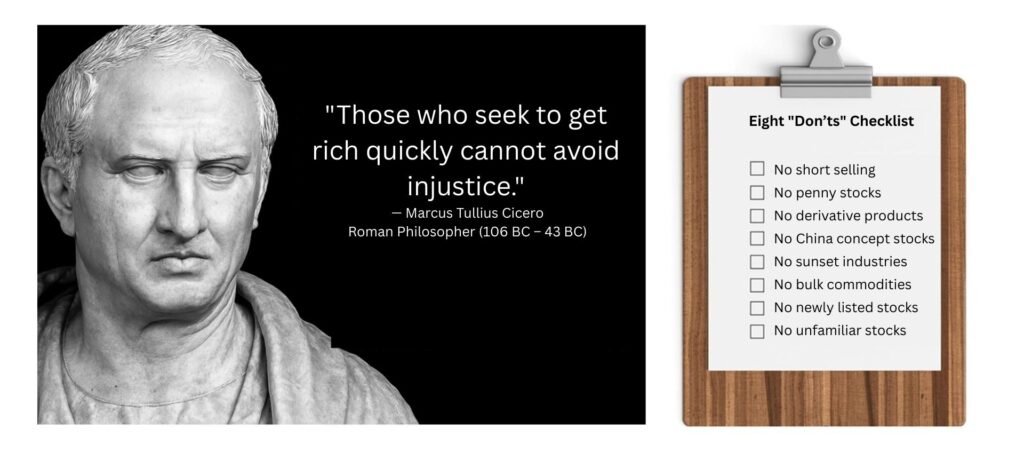

1. From Scams to Lessons — The Foundation of Steady Investing

All frauds share a common root — the desire to get rich quickly.

Scammers exploit this impatience by offering stories of “guaranteed profits,” “zero risk,” or “7% monthly returns.”

As the speaker aptly noted:

“If such investments truly existed, everyone would already be a millionaire.”

The easier something sounds, the higher the risk usually is.

Real wealth grows through:

- Choosing regulated and legitimate financial channels;

- Partnering with qualified and licensed institutions;

- Building assets through long-term, disciplined strategies.

2. Investing Is Like Medicine — It Requires Professionals

Just as you wouldn’t take medical advice from social media, you shouldn’t entrust your money to unqualified advisors.

Wealth management is not based on intuition or guesswork, but on expertise, structure, and compliance.

This is what defines Ai Financial — professional, compliant, and steady.

3. Expertise and Regulatory Strength

Ai Financial combines 20+ years of investment experience with 10+ years in Canadian financial regulation.

Our team holds dual credentials in Compliance and Anti-Money Laundering (AML).

Our founder, a veteran in both investment and regulation, once played a key role in preventing a potential terrorist attack by submitting an AML report that led U.S. authorities to intercept a car bomb in New York’s Times Square.

This case highlights how financial regulation protects not only money—but lives and national security.

Ai Financial’s advantage lies in its deep understanding of investment management and regulatory integrity, ensuring a balance between growth and safety.

4. Secure Custody: Funds Held with Regulated Institutions

Client funds are never stored within Ai Financial accounts.

All assets are held under the client’s own name at top-tier Canadian financial institutions, including:

Canada Life, Manulife, Industrial Alliance (iA), Sun Life, etc.

These companies are strictly supervised by OSFI and provincial regulators.

Even if Ai Financial ceased operations, clients’ assets would remain fully protected within those institutions.

“Your hand is in good hands.”

Your funds are always safeguarded by the most trusted system.

5. Core Strategy: Investment Loan + Segregated Fund

Ai Financial’s signature model combines Investment Loans with Segregated Funds, allowing clients to enhance returns while controlling risk.

- Leverage for Growth:

Using Quick Loan 3×1 or TFSA/RRSP investment loans, clients can invest without using existing savings. Loan proceeds go directly into insured Segregated Funds. - Built-in Capital Protection:

Segregated Funds, issued by insurance companies, guarantee 75%–100% of principal at maturity or death, protecting investors during market volatility. - Long-Term Performance:

Over the past decade, Ai Financial portfolios achieved an average annual return exceeding 20%, delivering steady, compounding growth. - Transparency and Compliance:

Every transaction requires client authorization, and accounts can be monitored anytime through partner institutions’ online platforms.

6. Global Clients and Compliance Pathways

Ai Financial also serves non-residents and international investors, helping overseas funds enter Canada’s financial system legally and securely.

All investments undergo:

- KYC (Know Your Client) verification;

- AML (Anti-Money Laundering) screening;

- Regulatory reporting to ensure full compliance.

This framework guarantees transparent, lawful, and traceable investment for all clients.

Conclusion: Steady Growth Through Compliance

From national risks to personal finance, one truth stands firm:

- Risk is everywhere—but it can be managed.

- The illusion of quick wealth fuels scams.

- True financial growth comes from discipline, regulation, and time.

As Ai Financial believes:

“Professional matters belong to professionals.

Investing is not about chasing trends—it’s about discipline, protection, and sustainable growth.”

Ai Financial will continue to prioritize regulatory integrity, professionalism, and safety, helping Canadians achieve secure, long-term wealth in an ever-changing financial world.

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More