Discover how a Canadian family achieved 239% returns using strategic...

Read MoreGlobal Economic Outlook 2025: Risks, Opportunities, and Investment Strategies

The World Bank’s Global Economic Outlook report highlights that the global economy is entering a “low growth + high uncertainty” new normal. This article explores the risks and opportunities behind this shift and discusses how Canadian households can protect and grow their wealth through investment.

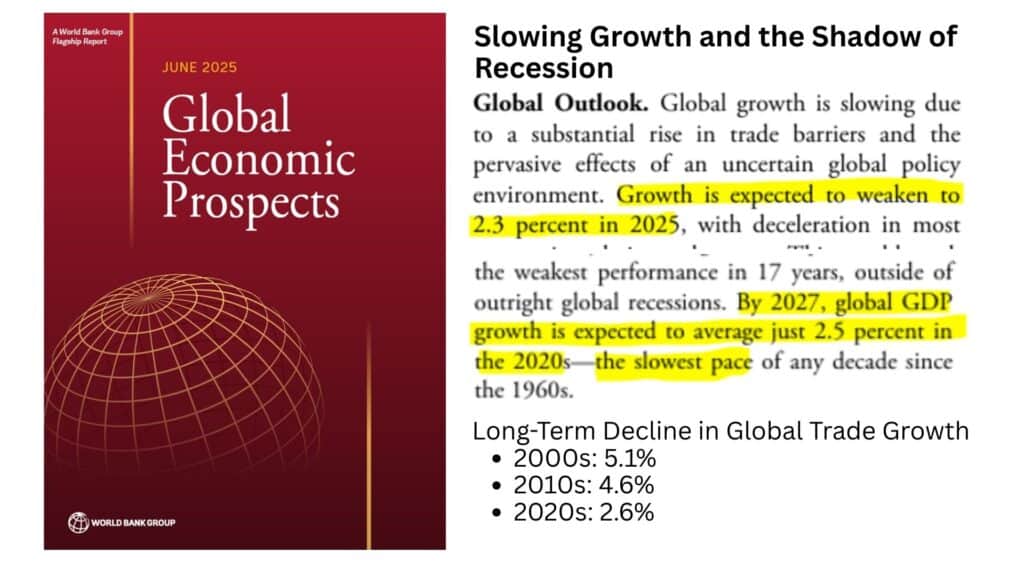

Global Economy at Its Slowest Pace in 17 Years

In June 2025, the World Bank’s latest Global Economic Outlook warned that global growth has slowed to just 2.3%—the weakest in 17 years—and is expected to stay subdued. This signals a new era of low growth and high uncertainty.

Trade frictions, rising debt, demographic shifts, and fiscal strains are fueling instability. Yet, technological innovation, industrial upgrades, and institutional reforms are emerging as new engines of growth.

At the center of this turbulence is North America. The U.S. remains resilient with strong markets, while Canada—despite short-term challenges—retains long-term potential through its resources, reforms, and capital strength.

Four Focus Areas of This Lecture

- Global Macro Environment — Understanding the background of low growth and high uncertainty.

- North American Economy — Exploring U.S. resilience and Canada’s long-term potential.

- Risks and Opportunities — Identifying challenges and possibilities in global turbulence.

- Wealth Strategies — Answering the key question: how can Canadian households protect and grow wealth in such an environment?

Part I: The Global Macro Environment

According to the World Bank’s June 2025 report, the global economy is experiencing an unprecedented slowdown. This year’s growth rate of 2.3% is the lowest since the 2008 financial crisis. Excluding extraordinary years such as the pandemic and the financial crisis, this is the weakest growth in 17 years.

What is more concerning is that this is not a temporary fluctuation but a long-term trend. The World Bank projects that between 2026 and 2027, global growth will average just 2.5%, making it the slowest decade since 1960. In other words, the era of high growth is over.

From a structural perspective, the dividends of globalization are disappearing. Trade, once the engine of global prosperity, is losing momentum. In the 2000s, global trade grew 5.1%; in the 2010s, it slowed to 4.6%; by the 2020s, halfway through the decade, it has dropped further to 2.6%. Many economists believe we have entered a deglobalization era, driven by trade frictions, high debt burdens, and climate shocks.

This trend has direct implications:

- For businesses: market expansion will become increasingly difficult.

- For households: wages will struggle to keep pace with rising prices.

- For investors: savings and fixed returns can no longer ensure steady wealth accumulation.

Thus, slowing global trade growth is not just a statistic—it is a reminder that in this era of low growth, we must rethink how to sustain asset growth.

Challenges in Emerging Markets

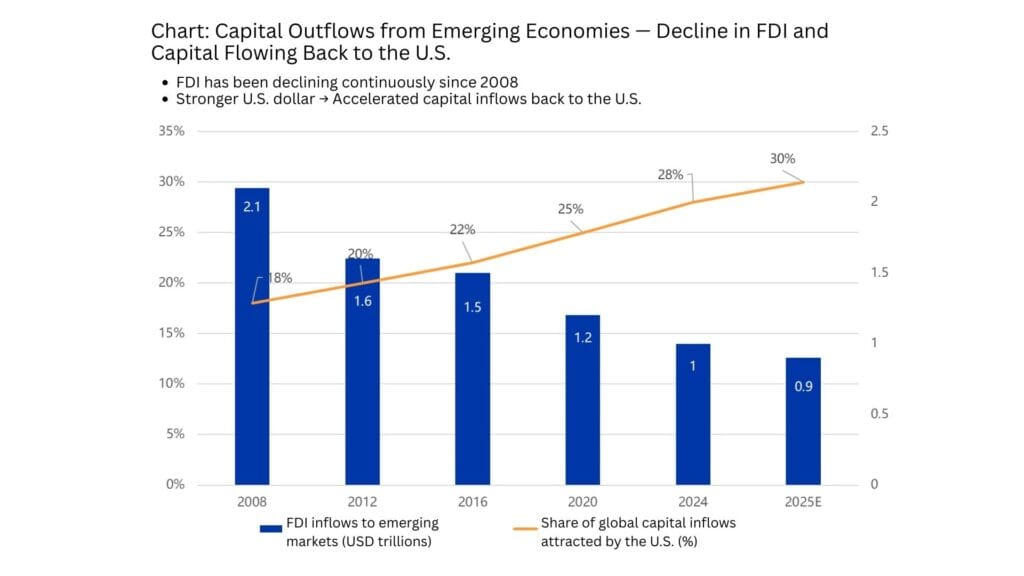

Over the past two decades, emerging markets and developing economies have been key drivers of global growth. Today, they face a “triple challenge”: capital outflows, rising debt, and climate shocks.

Capital Outflows: In 2008, emerging markets attracted $2.1 trillion in foreign direct investment (FDI). By 2025, this figure had fallen to $0.9 trillion. At the same time, funds are flowing back to the U.S.—from 18% of global FDI in 2008 to 30% by 2025. This means financing channels for emerging economies are drying up. To retain capital, many countries have raised interest rates, but this only makes corporate financing harder, increases currency depreciation risks, and fuels inflation. Capital outflows are like draining blood, weakening their economic lifeblood.

Debt Pressure: According to World Bank data, developing countries’ fiscal deficits reached nearly 6% of GDP in 2020, the highest this century. Worse, interest payments now account for more than one-third of fiscal revenue. Many countries are caught in a vicious cycle of borrowing to cover basic spending, only to face mounting repayment burdens. With global interest rates remaining high, some low-income countries are already in debt crises.

Climate Shocks: Extreme weather events such as floods, droughts, and hurricanes are increasingly common, stalling growth and in some cases reversing progress. These challenges not only weaken local economies but also spill over into the global system via financial markets and commodity prices.

By contrast, advanced markets such as North America, though slowing, remain relatively stable thanks to stronger institutions and capital markets, and may serve as safe havens amid global turbulence.

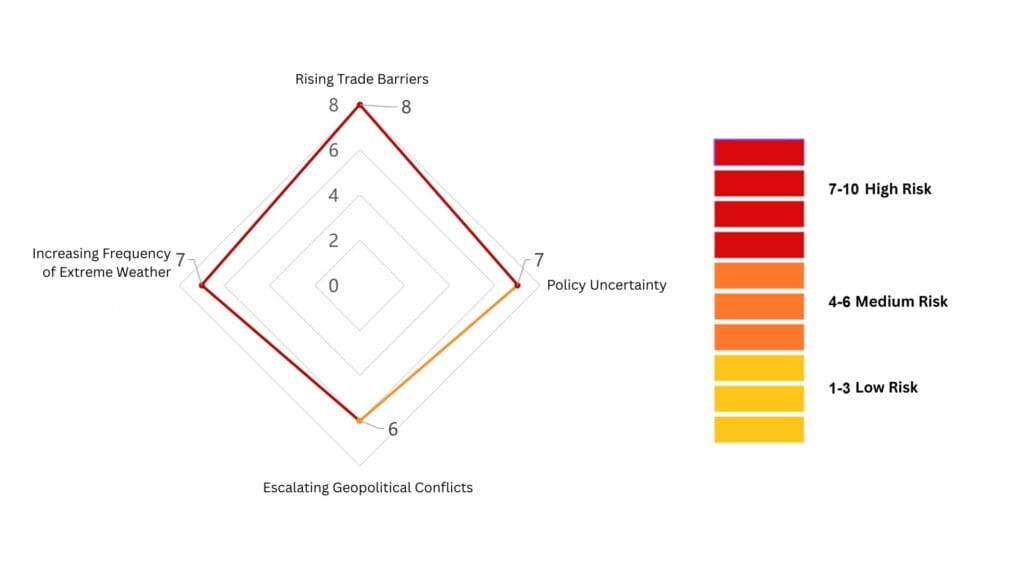

Four Global Economic Risks

The World Bank emphasizes that downside risks outweigh upside potential, with four key risks dominating the outlook:

- Rising Trade Barriers — Since 2023, the U.S., Europe, and emerging markets have all raised tariffs, disrupting supply chains, increasing corporate costs, and pushing up consumer prices.

- Policy Uncertainty — Inconsistent and frequently changing monetary and fiscal policies make it difficult for investors to predict interest rates or government spending, reducing long-term capital commitments.

- Geopolitical Conflicts — Ongoing regional conflicts from the Middle East to Eastern Europe not only cause humanitarian crises but also disrupt energy and food supplies, raising global prices and recession risks.

- Climate Shocks — Extreme weather events—floods, droughts, hurricanes—directly impact agriculture and energy, especially endangering import-dependent nations.

Each of these risks alone could cause a recession. Combined, they create a fragile global system vulnerable to shocks.

Macro Risks and Household Life

Many may believe global economic swings are distant issues. In reality, they directly affect everyday life

- Price volatility: Energy and food price fluctuations are immediately felt at the grocery store, gas station, and utility bills.

- Supply chain stress: Higher tariffs and shipping costs push up prices of imports, from electronics to daily goods.

- Eroding savings: In an inflationary environment, bank deposits and GICs fail to keep up with rising prices, reducing purchasing power over time.

- Retirement pressure: Declining pension and investment returns mean many retirees may not sustain their expected standard of living without proactive planning.

In Canada, these pressures are already evident. Wage growth is limited, living costs are rising, retirement ages are being delayed, and households are under mounting financial stress.

Conclusion

The World Bank’s report clearly shows the global economy is entering a low-growth, high-uncertainty new normal. The era of rapid growth and globalization dividends is over. In its place is weak trade, rising risks, and a fragile system.

For households, macroeconomics is no longer abstract—it is a daily reality. Savings cannot beat inflation, pension returns are shrinking, and without proactive action, living standards will inevitably decline. Already, many families are feeling suffocated by rising costs and shrinking financial flexibility.

Part II: North American Economy

When we understand the global backdrop, the next step is to shift our focus back to North America—because this is where we live, and it is at the very heart of today’s turbulence. Developments in the U.S. and Canada not only shape global economic trends but also have a direct impact on our households, jobs, investments, and retirement savings.

United States: Strong in the Short Term, Stable in the Long Term

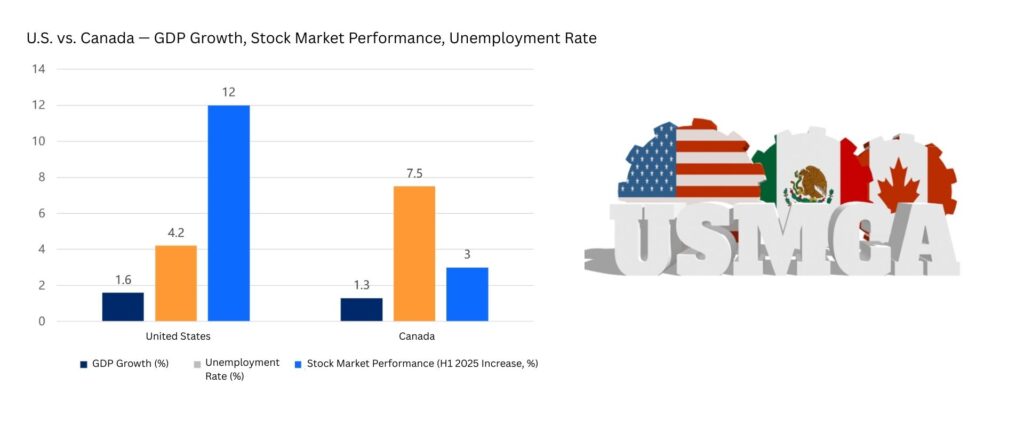

The United States remains the core driver of the global economy. In the first half of 2025, it demonstrated remarkable resilience and appears “poised for growth” in the near term. The surge of artificial intelligence has further boosted the technology sector and stock markets, making them the focus of global capital. Over the long run, the U.S. shows no significant structural weaknesses. Its innovation capacity, thriving capital markets, and steady population inflows continue to position it as a primary engine of global growth.

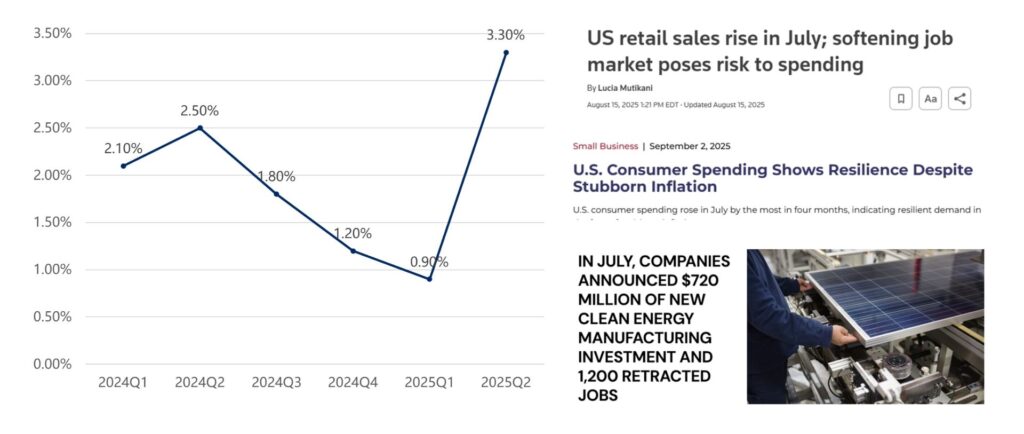

According to forecasts from the World Bank and OECD, U.S. GDP growth reached 3.3% in Q2 2025, far exceeding market expectations. The main drivers were stronger service sector consumption and rising business equipment investment. While global growth is projected at just 1.6%, the size and resilience of the U.S. economy continue to boost global confidence. Historically, the U.S. economy has shown a “sharp decline, sharp rebound” pattern—each adjustment is often followed by an even stronger recovery.

The core engine of the U.S. economy is consumption. The latest retail and service sector data show that despite persistent inflationary pressures, American households have maintained strong spending power, particularly in healthcare, tourism, and digital services. At the same time, business investment is recovering. After the 2023–2024 downturn, manufacturing has been regaining strength through technology upgrades and supply chain optimization. Capital spending in electric vehicles, clean energy, and advanced manufacturing highlights a shift toward higher-value industries.

The performance of the U.S. stock market further confirms this trend. In the first half of 2025, both the S&P 500 and Nasdaq repeatedly hit record highs, with the technology sector leading the way. Emerging industries represented by artificial intelligence—such as cloud computing, IoT, big data, and autonomous driving—have driven the market capitalization of leading companies to expand steadily, significantly boosting earnings expectations and market confidence. Importantly, this rally is not speculative, but rooted in America’s leading edge in technological innovation and the real-world application of AI. Even after several years of high interest rates, U.S. capital markets continue to attract record levels of foreign investment, standing in stark contrast to the capital outflows from emerging markets.

From a long-term perspective, the U.S. economy has several irreplaceable advantages:

Strong innovation capacity — Whether in artificial intelligence, clean energy, or biopharma, the U.S. remains at the forefront of global technological advancement.

Robust capital markets — The S&P and Nasdaq provide deep liquidity and financing channels, enabling innovations to quickly scale into industrial expansion.

Flexible labor market and population inflows — Even as tech giants cut jobs under the AI wave, overall U.S. employment continues to grow rapidly.

In summary, the U.S. economy is “poised for growth” in the short term and “stable and prosperous” in the long term. This is why global investors consistently place their confidence in America. Whether as a safe haven during turbulent times or as the leader during recovery, the U.S. continues to serve as the core engine of the global economy.

Canada: Short-Term Pressure, Long-Term Potential

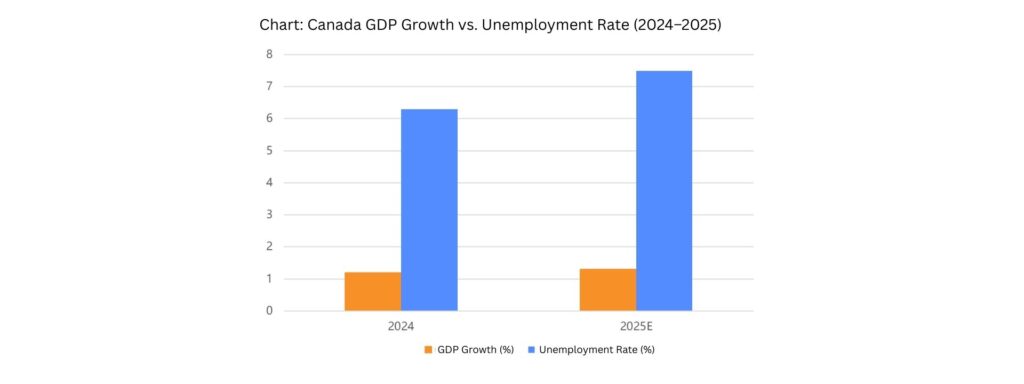

Compared with the U.S.’s strong performance, Canada’s economy in 2025 appears weak. Full-year GDP growth is projected at only 1%–1.3%, while unemployment climbed to 6.9%–7.5% in July. Job losses have been concentrated in the private sector, particularly in manufacturing and retail. Consumer confidence has declined, and household spending has tightened. From a macro perspective, Canada is indeed under short-term pressure.

However, Canada’s outlook is not pessimistic. First, Canada’s fiscal position is solid, with the lowest net debt ratio among G7 countries. This means Canada has greater policy space to implement stimulus measures when needed—whether through tax cuts, increased public investment, or even direct household support. For investors, this stability itself is a safety signal.

Second, Canada holds significant industrial potential, concentrated in three key sectors: energy, mining, and clean technology.

Energy: As a traditional energy exporter, oil and natural gas remain vital pillars of the economy. At the same time, Canada’s hydropower and wind resources provide natural advantages in the green transition.

Mining: Canada is a global mining powerhouse, with abundant reserves of lithium, nickel, cobalt, and other rare metals—strategic materials essential for renewable energy and battery industries worldwide.

Clean technology: Canada is investing heavily in green hydrogen, carbon capture and storage (CCUS), and energy storage. These sectors not only boost exports but also enhance productivity and create jobs.

In addition, Canada is making progress in institutional reforms and infrastructure investment. The recently passed Canadian Economic Act aims to break down long-standing interprovincial trade barriers, facilitating freer movement of capital, labor, and goods within the country, thereby creating a more efficient and integrated domestic market. Meanwhile, large-scale infrastructure projects are underway, with a focus on transportation, energy transmission, and digital infrastructure—laying the foundation for higher productivity and sustainable long-term growth.

From a longer-term perspective, Canada has the potential to transform into a true “growth stock.” International media such as the Financial Times have noted that if Canada fully leverages its resource base and pension capital, it could emerge as a “super economy.” Canada’s pension system is one of the largest in the world. The CPP and QPP collectively manage hundreds of billions of Canadian dollars, investing globally in infrastructure, real estate, technology, and energy projects—providing long-term funding and stability for the economy.

With energy exports, mineral wealth, clean tech innovation, and pension capital, Canada is not only a traditional resource economy but also a potential core player in the global green transition and a significant exporter of financial capital. Combined with its deep economic and geographic ties to the United States, Canada’s strategic value in global capital allocation is rising.

North American Integration: Cooperation and Convergence

Under the USMCA framework, the U.S. and Canadian economies are highly integrated. Trade, supply chains, industrial collaboration, and capital flows are deeply intertwined. While periodic frictions do arise, overall cooperation remains the main theme. This strengthens North America’s collective competitiveness and enhances the region’s ability to maintain leadership in the global economic landscape.

Taken together, the United States is currently the strongest growth engine, while Canada is a “potential stock” quietly building momentum. For investors, it is important to pay attention not only to the U.S.’s steady prosperity but also to Canada’s structural opportunities. Together, the two countries form the “dual wings” of the North American economy: one wing representing present-day prosperity and innovation (the U.S.), and the other representing long-term resources and institutional potential (Canada).

Part III: Risks and Opportunities

Having reviewed the overall trends in the global and North American economies, we now need to ask: what risks and opportunities exist in today’s environment? The World Bank’s report makes it clear—we are living in an era of turbulence, with risks accumulating and frictions increasing. Yet behind these challenges lie new opportunities for growth. For households and individuals, the key question is how to turn risks into opportunities through investment.

Key Risks

Escalating trade frictions – Whether between the U.S. and Canada or in other regions, trade tensions have become a major source of global supply chain disruptions and market volatility.

Fiscal and debt pressures – Governments around the world are facing rising debt burdens under the dual weight of high interest rates and high public spending, raising serious questions about the sustainability of public finances.

Demographic and social structural changes – In North America, younger generations face increasing pressure in the job market, struggling to secure high-paying, stable positions. Their income growth lags far behind rising living costs. At the same time, population aging is rapidly pushing up pension and healthcare expenditures, further straining public finances. This dynamic directly affects household wealth accumulation and future retirement security—meaning that when we eventually draw our pensions, many of us will feel the impact of demographic and fiscal stress.

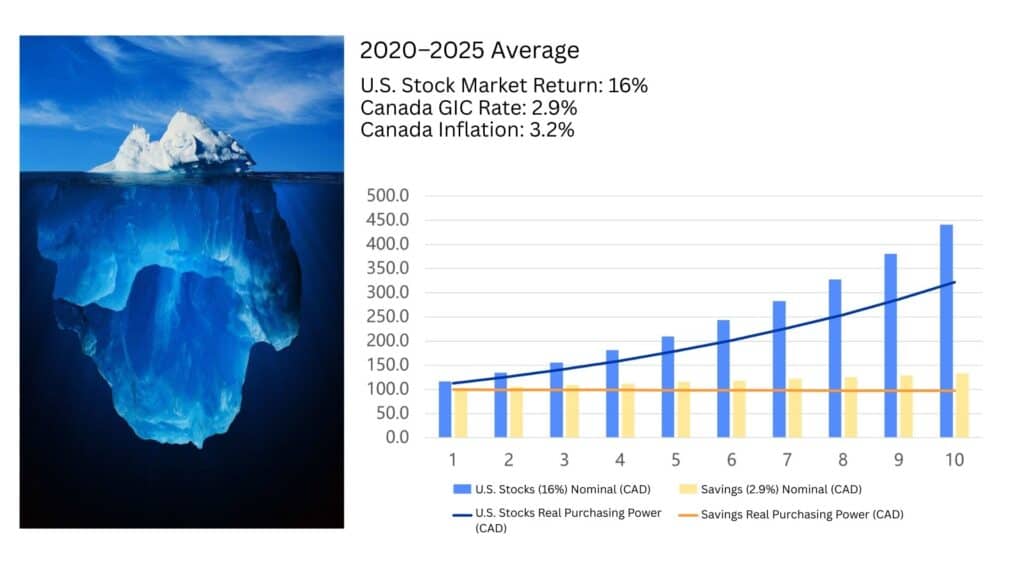

Iceberg Model: Surface vs. Substance

The lecturer used the “iceberg model” to explain how to understand risks and opportunities. Above the surface are the things we see in daily news—stock market swings, currency fluctuations, trade frictions. These surface-level events create constant anxiety, but they are merely short-term noise and cannot determine long-term direction. Beneath the surface lie the real forces that drive wealth accumulation: demographics, institutional reforms, and technological innovation. True investors must not only see the surface but also grasp the substance, focusing on long-term trends instead of being swayed by short-term volatility.

In other words, wealth accumulation does not come from chasing surface-level noise, but from harnessing the deeper forces beneath. The essence of investing is to use proper tools and allocation to transform these underlying forces into long-term growth momentum.

Risk as Opportunity

Risk itself is not frightening. In fact, every period of turbulence often opens a window for wealth redistribution. Some people, paralyzed by fear, remain stagnant while their wealth is slowly eroded by inflation and debt. Others, however, seize the moment through investment, converting risk into growth and placing themselves at the starting point of a new cycle of wealth accumulation.

Relying on savings can no longer generate real wealth growth—instead, inflation steadily erodes purchasing power. Bank deposits may appear safe, but in reality, their value is quietly declining. Only investment can serve as the true “steering wheel,” enabling families to stay on course during storms, preserve wealth, and achieve long-term growth.

Case Study: Savings vs. Investment

Let’s take an example, starting with 100 units:

Savings account (2.9% annual rate):

After 10 years, the account balance grows to 133. However, once inflation is accounted for, the real purchasing power is only 97—lower than the original 100.U.S. stock market (16% long-term average return):

After 10 years, the 100 grows to 441. Adjusted for inflation, the real purchasing power remains at 322—more than three times the starting point.

This comparison clearly shows that savings cannot truly protect wealth and will inevitably fall behind inflation. Investment, though volatile in the short term, is the only path to sustainable wealth growth in the long term.

Conclusion

In turbulent times, investment is the most reliable steering wheel we hold in our hands. Whether through dividend-paying assets, principal-protected funds, or investments in innovative industries of the future, only by building a sound investment portfolio can households and individuals transform risks into opportunities and achieve lasting wealth accumulation and growth.

Part IV: The Path Forward — AiF Investment Strategy

After analyzing the first three sections, we return to the core question: In today’s global and North American economic environment, how should individuals and families invest?

First, it must be emphasized: not investing means becoming poorer. As global debt continues to climb, it is ordinary people who ultimately bear the cost. Purchasing power is steadily declining, and savings can no longer preserve value. Even if you place 100 units in a fixed deposit, after 10 years it grows to 133. But adjusted for inflation, the real purchasing power is only 97. In other words, your money is shrinking, and you are becoming poorer. Therefore, investment is the only viable path forward.

However, investment does not mean blindly chasing wealth. The lecturer warns: the desire to get rich quickly is the breeding ground for scams. Today, scams are everywhere—especially in local communities and online—ranging from small schemes to large frauds. Once you fall into these traps and lose your principal, even future gains cannot make up for the loss.

The right approach is to leave professional matters to professionals. Ai Financial, with over 25 years of investment experience, follows a strict “do-not-touch list,” clearly defining which products are suitable and which must be avoided.

Today, humanity is entering the Fourth Industrial Revolution. This transformation signals a massive reshuffling and redistribution of wealth, and may ultimately trigger a “wealth explosion.” How can we seize this wave?

Avoid stock-picking. Investing in individual stocks is essentially speculation. You are betting on probabilities—prices may rise or fall unpredictably—and in the end, much of the money often flows back to the market.

The right approach is to invest in public principal-protected funds.

These funds are managed by professional institutions, with capital allocated to leading industries. This not only diversifies risk but also ensures growth potential.

Their principal protection mechanism safeguards your initial investment.

Most importantly, they can be combined with Investment Loans. Even with limited personal funds, investors can use leverage to participate in the market. It is like “borrowing a hen to lay eggs”—the principal is borrowed, but the profits belong entirely to you.

Through this strategy, ordinary households can also capture the wealth opportunities of the Fourth Industrial Revolution and secure a place in the coming “wealth explosion.”

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More