Discover how a Canadian family achieved 239% returns using strategic...

Read MoreHow a Couple Earned $87K Using $400K Investment Loans with Ai Financial

A couple born in the 1990s trusted Ai Financial, invested 400,000 yuan in loans, and made a net profit of 87,000 yuan in one and a half years.

Tony and Sue are a post-90s couple who came to Canada to study more than ten years ago. Like other international students, they started nine-to-five jobs after graduation and led an ordinary yet comfortable life. However, as they welcomed their first baby in mid-2024, they gradually felt the rising cost of living, increasing financial pressure, and some anxiety about their future financial situation.

Fortunately, Sue was well-prepared. A few years ago, through her cousin, she learned about Ai Financial’s services. In June 2023, with Ai Financial’s help, Sue successfully applied for a $200,000 investment loan. Working in collaboration with B2B Bank and Manulife Bank, she invested in Canadian mutual funds and segregated funds (principal-protected funds). She allocated $100,000 to Canada Life and another $100,000 to Manulife’s principal-protected funds.

After experiencing the benefits of “earning while lying down”—passive income, her husband Tony also successfully applied for a $200,000 investment loan in July 2024. He invested the funds in Canada Life and Manulife’s principal-protected funds. Now, the couple has a total of $400,000 in investment loans. In less than a year and a half, after deducting interest expenses, their net profit has exceeded $87,000.

The most delightful part is that this investment not only steadily increased their assets but also can be liquidated at any time when needed, demonstrating the excellent liquidity and stability of segregated funds.

Through Ai Financials’ professional services, Sue and Tony not only achieved asset growth but also effectively alleviated financial stress, enjoying the true joy of “earning while lying down.” Choose Ai Financials’, and you too can effortlessly benefit from financial management in the future, stepping onto the path to financial freedom.

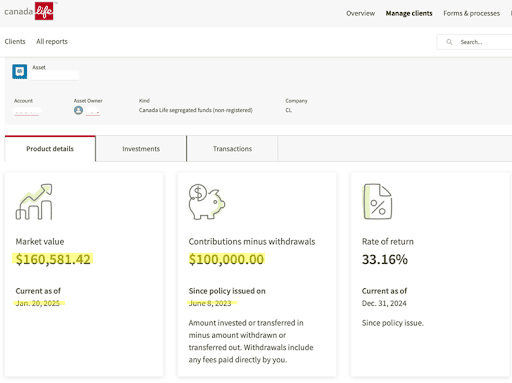

Sue Canada Life Investment Return Demonstration:

Since June 2023 to now (1 year and 7 months), the $100,000 loan investment in Canada life has yielded a profit of $60,000, with a cumulative return rate of 60.5%. After deducting $12,000 in loan interest, the actual return rate reached as high as 400%, with a net profit of $48,000

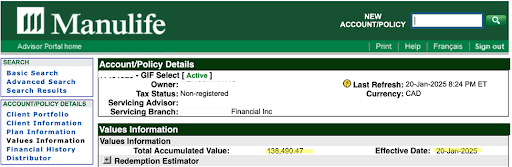

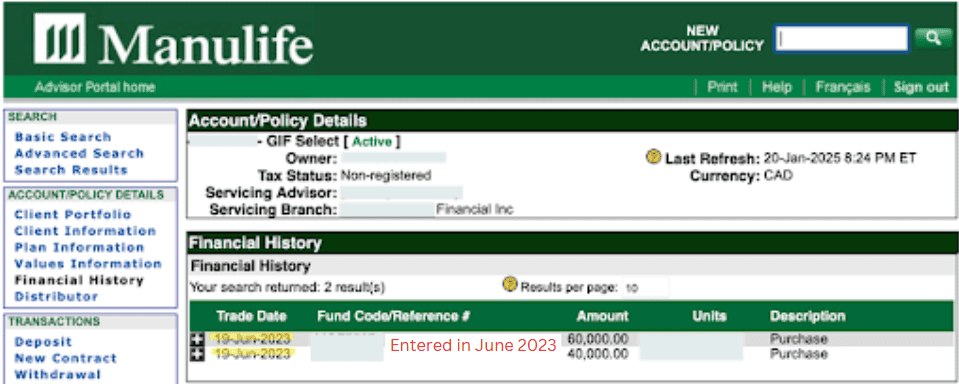

Sue Manulife Investment Return Demonstration:

From June 2023 to now (1 year and 7 months), the $100,000 loan investment in Manulife has yielded a profit of $38,000, with a cumulative return rate of 38%. After deducting $12,000 in loan interest, the actual return rate reached as high as 210%, with a net profit of $26,000.

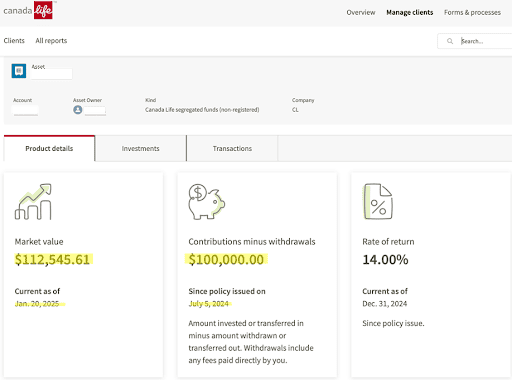

Tony Canada Life Investment Report Demonstration

Since July 2024 to now (over 6 months), the $100,000 loan investment in Canada Life has yielded a profit of $12,000, with a cumulative return rate of 9%. After deducting $3,400 in loan interest, the actual return rate reached as high as 267%, with a net profit of $9,100.

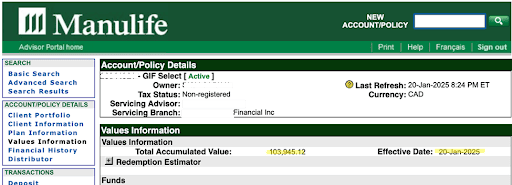

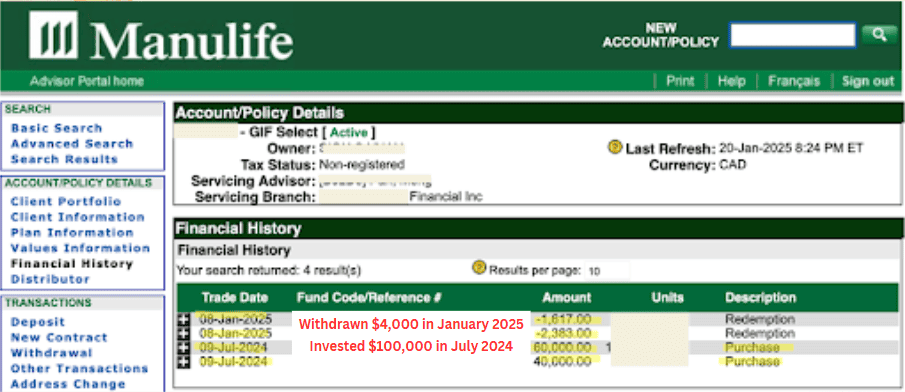

Tony Manulife Investment Report Demonstration:

Since July 2024 to now (over 6 months), the $100,000 loan investment in Manulife has yielded a profit of $7,900, with a cumulative return rate of 9%. After deducting $3,400 in loan interest, the actual return rate reached as high as 132%, with a net profit of $4,500. To supplement household expenses, Tony withdrew $4,000 in January 2025.

Sue and Tony’s journey with Ai Financial demonstrates the power of strategic investment and professional financial management. By leveraging $400K in investment loans and partnering with top financial institutions, they transformed their financial situation, turning potential stress into substantial profit. With Ai Financials’ expertise in segregated funds and leverage, they not only grew their wealth but also gained the flexibility and security to face future challenges with confidence. This success story highlights the potential for anyone to achieve financial growth with the right guidance and tools, making Ai Financial a trusted partner on the path to financial freedom.

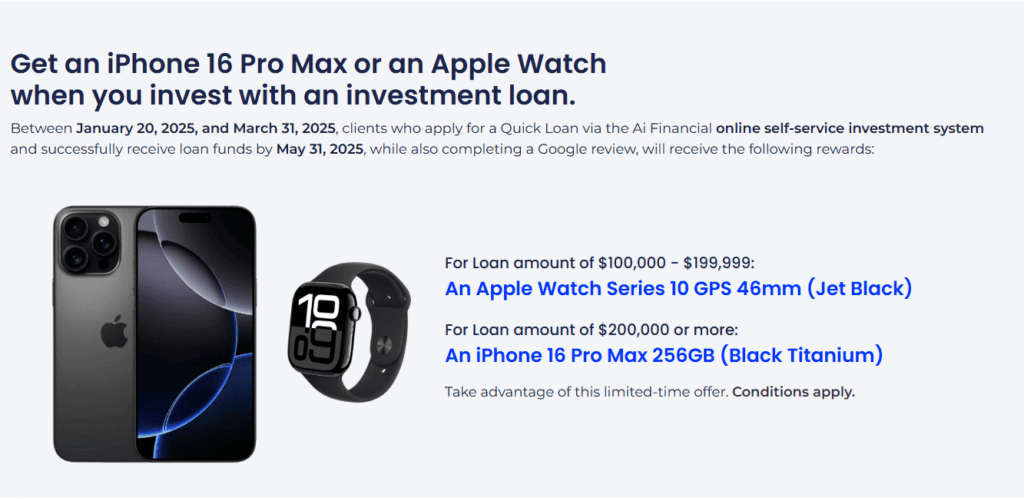

The 2025 Winter Promotion is in full swing! Successfully apply to get approved for a $200,000 investment loan to receive an IPhone 16 Pro Max! More offers are available for a limited time—learn more now!

Exclusive Advantages of Ai Financial

- Convenient Loan Application

- Ai Financial collaborates with multiple financial institutions such as B2B Bank, Manulife Bank, and iA Trust to provide clients with fast loan approval services. Especially with Quick Loan, there is no need for income or asset proof, offering rapid approval and valuable support for investors lacking principal.

- Professional Investment Management

- Partnering with insurance companies like Canada Life, iA, and Manulife, Ai Financial specializes in Segregated Fund investments. By leveraging the power of compounding with leverage, Ai Financial helps clients achieve consistent and stable returns.

- Stable Investment Strategy

- Ai Financial sees through market fundamentals and advocates for long-term investment. Through compounding and time, Ai Financial helps accumulate wealth while avoiding risks associated with speculation.

Choose Ai Financial, Make Investing Easier

Leverage-based investments require professional expertise, and with Ai Financials’ extensive experience and industry resources, countless clients have achieved significant wealth growth. Without the right direction, efforts can be futile. By choosing Ai Financial, you’re building your future on a foundation of professionalism and trust, ensuring a solid base for long-term financial success.”

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More