加拿大TD银行在4月30号, 被爆出因反...

Read MoreCategories

Recent Posts

- 华尔街上涨以弥补本周的损失, 苹果宣布史上最大规模回购 | Ai Financial 财经日报 May 2, 2024

- AiF观点 | TD银行反洗黑钱监管不当, 被重罚4.5 亿 + 920万 May 2, 2024

- AiF观点 | 万锦王府井购物中心被接管,债务超过 5200 万美元 May 2, 2024

- Stocks are rising Thursday after Fed decides to hold rates steady May 2, 2024

- Dow closes higher as Powell says Fed’s next move is unlikely to be a hike May 1, 2024

- 加拿大央行:是时候打破玻璃了 – 解决加拿大的生产力问题 | Ai Financial 基金投资 May 1, 2024

- S&P 500 inches lower as Wall Street readies for Fed rate decision May 1, 2024

- The Dow plunges as Wall Street concludes a dismal April April 30, 2024

- Stocks fall on disappointing earnings and inflation data before Fed decision April 30, 2024

- Stocks break losing streak, while tech stocks rallied; Slow progress on inflation means rates will stay high for longer April 29, 2024

The market is uncertain at the start of the second quarter

Concerns about rate cuts are intensifying

- April 08, 2024

- April 08, 2024

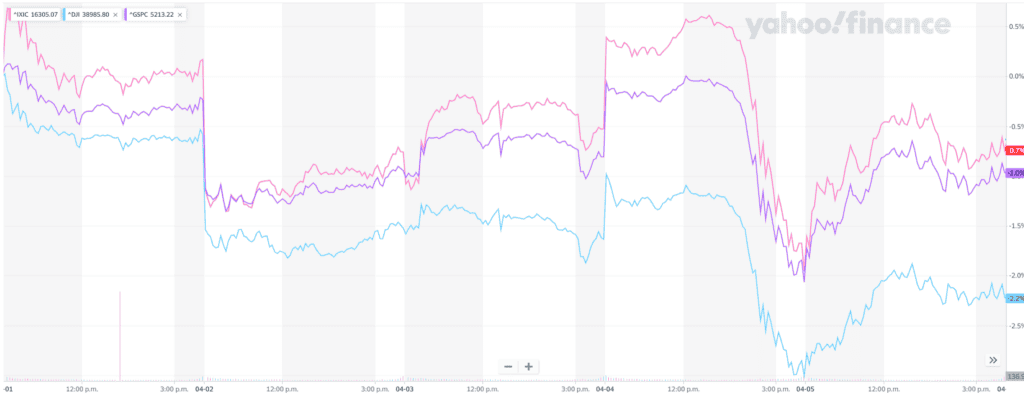

Last week, the three major U.S. stock indexes closed lower. On a weekly basis, the Dow Jones Industrial Average (DJIA) fell by 903.33 points, or 2.2%, to close at 38,904.04 points; the S&P 500 index dropped by 50.01 points, or 0.9%, to close at 5,204.34 points; and the NASDAQ index declined by 130.94 points, or 0.8%, to close at 16,248.52 points.

Key Takeaways:

The market is uncertain at the start of the second quarter

Concerns about rate cuts are intensifying

Markets got off to a shaky start to the week and the second quarter, as strong economic readings raised concerns around if and when the Fed will be able to start cutting rates.The week finished with the latest jobs report, which showed that the labor market remains in very good shape. Job growth was better than expected, unemployment remains low, and wage gains are healthy but moderating, helping the inflation outlook.

Despite growing nervousness around the timing and magnitude of Fed rate cuts this year, markets closed out a challenging week on an up note, treating the strong jobs report as an indication that economic growth, and thus corporate earnings growth, remains on a path higher, which should offer broader support to the bull market.

This Wednesday's consumer price index (CPI) report will be the catalyst for markets to adjust and react to expectations for the timing and magnitude of rate cuts this year. Expectations are for core CPI to have ticked down to 3.7% last month (from 3.8% in February).

Friday's mostly sunny U.S. jobs report is in the books but may get eclipsed by this week's critical inflation data. The March Consumer Price Index (CPI) Wednesday and Producer Price Index (PPI) Thursday could help determine whether the Federal Reserve cuts rates by mid-year or keeps its foot firmly on the brakes.

AiF believes that the market is not afraid of no rate cuts, or even rate hikes. The market fears uncertainty. As for whether there will be rate cuts this year, the Federal Reserve has made its stance clear, read more:

AiF insight | Market Panic Selling, Fed Makes Clear Statement

AiF insight | No Rate Cut This Year? Stock Market Crash Ahead?

AiF insight | Concerns About Rates Cutting

The US stock market is in a bull market. Ai Financial, with its professional investment philosophy, seizing the opportunities of our time together and reap wealth.

21.6%

Average Annual Compound Return For Past 10 Years

Ai Financial delivers consistent and stable investment returns to clients, achieving 10%+ annual compounded returns over the past decade.

Thursday Seminar

Free Financial Online Seminar

Weekly free online seminars every Thursday evening, offering investors the latest insights on hot topics and market trends.

Mission and Vision

You fulfil your dream, we pay for your bill

Improve Canadian Retirement System.

Ai Financial Funds Investing - You fulfill your dreams, we cover your bills

Ai Financial is a leading Canadian Fin-Techfund investmentservice provider. We leverage cutting-edge technology to adhere toValue Investing principles,aiming to drive reform in Canada's pension system and enable more people to live better lives through financial investment.

Ai Financial has a background in financial compliance and anti-money laundering (AML). Through collaborations with banks, funds, and insurance companies, we select fund products suitable for clients and managevarious investment accountssuch as TFSA and RRSP. Additionally, we assist clients in applying for unique CanadianInvestment Loan, facilitating early attainment of financial freedom.

RELATED READING

Stocks break losing streak, while tech stocks rallied; Slow progress on inflation means rates will stay high for longer

Between a barrage of earnings, the first-quarter GDP report, and the release of……

Read More