加拿大TD银行在4月30号, 被爆出因反...

Read MoreCategories

Recent Posts

- AiF观点 | TD银行反洗黑钱监管不当, 被重罚4.5 亿 + 920万 May 2, 2024

- AiF观点 | 万锦王府井购物中心被接管,债务超过 5200 万美元 May 2, 2024

- Stocks are rising Thursday after Fed decides to hold rates steady May 2, 2024

- Dow closes higher as Powell says Fed’s next move is unlikely to be a hike May 1, 2024

- 加拿大央行:是时候打破玻璃了 – 解决加拿大的生产力问题 | Ai Financial 基金投资 May 1, 2024

- S&P 500 inches lower as Wall Street readies for Fed rate decision May 1, 2024

- The Dow plunges as Wall Street concludes a dismal April April 30, 2024

- Stocks fall on disappointing earnings and inflation data before Fed decision April 30, 2024

- Stocks break losing streak, while tech stocks rallied; Slow progress on inflation means rates will stay high for longer April 29, 2024

- Wall Street edges higher at the start of a busy week April 29, 2024

AiF insight | No Rate Cut This Year? Stock Market Crash Ahead?

- April 05, 2024

- April 05, 2024

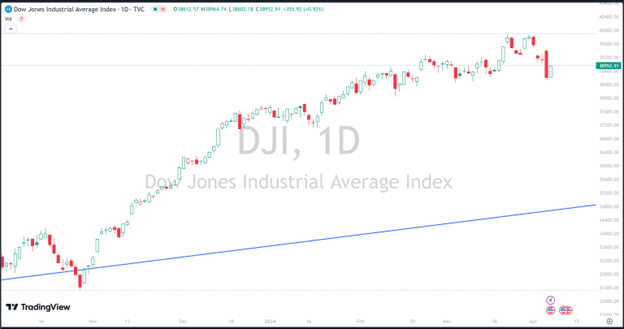

On April 4th, the US stock market plunged, with the Dow Jones Industrial Average falling by 530 points, marking the largest decline so far this year. Panic spread in the market, leaving many investors bewildered.

The reason is that prior to April 4, many investors, including numerous large institutions and numerous small companies, were predicting that the Federal Reserve would cut interest rates three times this year. However, when there was suddenly another voice in the market saying that not only would there not be three rate cuts, but there might not be any rate cuts this year. So everyone started to panic again, leading to panic selling.

In the article dated March 20, AiF expressed the following viewpoint:《AiF insight | Will Fed cut interest rates this year?》https://www.aifinancial.ca/zh/aifinsight-240320/

On April 2nd, AiF reiterated its stance:《AiF insight | Concerns about Fed rate cuts》 https://www.aifinancial.ca/zh/aifinsight-fed-cut-rates-20240402/ After that,

Next, several key figures from the Federal Reserve also came forward with statements.

Firstly, on April 3rd, the President of the Atlanta Fed stated: "There may be only one interest rate cut this year."

https://www.cnbc.com/2024/04/03/atlanta-fed-president-bostic-sees-only-one-rate-cut-this-year-occurring-in-the-fourth-quarter.html?__source=androidappshare

Following that, on April 3rd, Federal Reserve Chair Powell stated: "We need more evidence before cutting interest rates."

https://www.cnbc.com/2024/04/03/feds-powell-emphasizes-need-for-more-evidence-that-inflation-is-easing-before-cutting-rates.html

Later, on April 4th, Minneapolis Federal Reserve President mentioned: "There may not be rate cuts this year."

https://www.marketwatch.com/story/feds-kashkari-says-he-expects-two-rate-cuts-this-year-but-its-possible-there-will-be-none-b8365841?mod=the-fed

Subsequently, on April 5th, Dallas Federal Reserve President remarked: "It's too early to consider rate cuts now."

https://www.reuters.com/markets/us/feds-logan-too-soon-start-thinking-about-rate-cuts-2024-04-05/

Dear investors, may I ask: Do you believe in the predictions of real estate brokers and institutions, or do you stand with AiF, aligning with the Federal Reserve?

RELATED READING

Stocks break losing streak, while tech stocks rallied; Slow progress on inflation means rates will stay high for longer

Between a barrage of earnings, the first-quarter GDP report, and the release of……

Read MoreAi Financial Funds Investing - You fulfill your dreams, we cover your bills

Ai Financial is a leading Canadian Fin-Techfund investmentservice provider. We leverage cutting-edge technology to adhere toValue Investing principles,aiming to drive reform in Canada's pension system and enable more people to live better lives through financial investment.

Ai Financial has a background in financial compliance and anti-money laundering (AML). Through collaborations with banks, funds, and insurance companies, we select fund products suitable for clients and managevarious investment accountssuch as TFSA and RRSP. Additionally, we assist clients in applying for unique CanadianInvestment Loan, facilitating early attainment of financial freedom.

21.6%

Average Annual Compound Return For Past 10 Years

Ai Financial delivers consistent and stable investment returns to clients, achieving 10%+ annual compounded returns over the past decade.

Thursday Seminar

Free Financial Online Seminar

Weekly free online seminars every Thursday evening, offering investors the latest insights on hot topics and market trends.

Mission and Vision

You fulfil your dream, we pay for your bill

Improve Canadian Retirement System.