道琼斯工业平均指数上涨176.59点,涨...

Read MoreCategories

Recent Posts

- 美国股市周一收高,继续上周的涨势 | Ai Financial 财经日报 May 6, 2024

- 【Weekly Recap】The labor market played both the villain and the hero;Fed policy: From “when” to “if” May 6, 2024

- 华尔街开盘高开,继续上周的涨势 | Ai Financial 财经日报 May 6, 2024

- 股市大幅上涨,市场乐观情绪重燃 | Ai Financial 财经日报 May 3, 2024

- 道琼斯指数上涨500点,因劳动力市场报告疲软,提升了市场对美联储降息的期望 | Ai Financial 财经日报 May 3, 2024

- 华尔街上涨以弥补本周的损失, 苹果宣布史上最大规模回购 | Ai Financial 财经日报 May 2, 2024

- AiF观点 | TD银行反洗黑钱监管不当, 被重罚4.5 亿 + 920万 May 2, 2024

- AiF观点 | 万锦王府井购物中心被接管,债务超过 5200 万美元 May 2, 2024

- Stocks are rising Thursday after Fed decides to hold rates steady May 2, 2024

- Dow closes higher as Powell says Fed’s next move is unlikely to be a hike May 1, 2024

- 加拿大央行:是时候打破玻璃了 – 解决加拿大的生产力问题 | Ai Financial 基金投资 May 1, 2024

- S&P 500 inches lower as Wall Street readies for Fed rate decision May 1, 2024

- The Dow plunges as Wall Street concludes a dismal April April 30, 2024

- Stocks fall on disappointing earnings and inflation data before Fed decision April 30, 2024

- Stocks break losing streak, while tech stocks rallied; Slow progress on inflation means rates will stay high for longer April 29, 2024

- Wall Street edges higher at the start of a busy week April 29, 2024

- AiF insight | Tesla's Rise, AiF Proven Wrong! April 29, 2024

- S&P 500 rises to kick off new week as Tesla, Apple jump April 29, 2024

- AiF Insight | The Impact of 7 Major Weighted Stocks on the Market April 26, 2024

- AiF Insight | Canadian Census: Middle-Class Income at $70,000 - Are You There Yet? April 26, 2024

U.S. STOCK PICKS

Closing: 4:00 PM EST

- Stocks jumped Friday, and the S&P 500 and Nasdaq Composite notched their best week since November as Big Tech names rallied on strong earnings and traders pored through fresh U.S. inflation data.

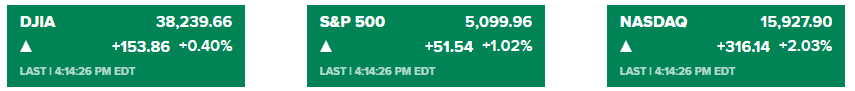

- The broad market index advanced 1% to settle at 5,099.96. The tech-heavy Nasdaq climbed 2% to close at 15,927.90 and secure its best daily move since February. The Dow Jones Industrial Average rose 153.86 points, or 0.4%, to finish at 38,239.66.

- The S&P and Nasdaq clinched their best week since November. The S&P popped 2.7% to snap a three-week losing streak, while the Nasdaq gained 4.2% for its first positive week in five. The Dow edged up 0.7%.

- Stocks got a boost from robust results from artificial intelligence competitors Alphabet and Microsoft after the bell Thursday. Alphabet jumped more than 10% on better-than-expected first-quarter earnings and recorded its best day since July 2015. The company also authorized its first-ever dividend and a $70 billion buyback.

- Microsoft added about 2% as the software maker posted strong fiscal third-quarter results and showed an acceleration in cloud growth.

- Investors also parsed March’s core personal consumption expenditures reading following a spate of reports that suggested slowing growth and sticky inflation. The gauge, excluding food and energy, rose 2.8% from a year ago and came in ahead of the 2.7% expected by Dow Jones. Personal spending rose 0.8%, ahead of a 0.7% estimate.

- Intel, once the biggest and most valuable U.S. chip company, has been surpassed by numerous rivals in recent years due to a series of missteps. The shares plummeted further on Friday following disappointing earnings.

- Federal regulator finds Tesla Autopilot has ‘critical safety gap’ linked to hundreds of collisions.

- The busy earnings season continues next week, headlined by results from technology giants Apple and Amazon. The Federal Reserve’s next rate decision is due out Wednesday.

U.S. STOCK PICKS

- Stocks jumped Friday as Big Tech names Alphabet and Microsoft rallied on strong earnings and traders pored through fresh U.S. inflation data.

- Shares of Alphabet jumped more than 10% following better-than-expected first-quarter earnings and headed for their best day since July 2015. The company also authorized its first-ever dividend and a $70 billion buyback.

- Microsoft, meanwhile, climbed 1.7% after also reporting stronger profit and revenue than expected. It cited strong growth in its cloud-computing business as it pushes artificial-intelligence technology to its customers.

- They helped offset a 12.5% drop for Intel. It reported stronger profit for the latest quarter than expected, but its revenue fell short of analysts’ estimates. So did its forecast for profit in the current quarter.

- Stocks also appeared to get a boost from March’s core personal consumption expenditures reading. The gauge, excluding food and energy, rose 2.8% from a year ago and came in ahead of the 2.7% expected by Dow Jones. Personal spending rose 0.8% and ahead of a 0.7% estimate.

- Those moves are helping Wall Street regain some of its footing after a down day. The blue-chip Dow slid 375 points Thursday after new U.S. economic data showed a sharp slowdown in growth and pointed to persistent inflation. Gross domestic product expanded by 1.6% in the first quarter, compared to a Dow Jones forecast of 2.4%.

- The Fed has been keeping its main interest rate at the highest level since 2001 in hopes of undercutting inflation by putting downward pressure on the economy and financial markets. Inflation has come down from its peak, and progress last year had the Federal Reserve recently indicating it could cut rates three times this year. But the recent stalling in progress pushed top Fed officials to since say they could hold its main interest rate high for a while.

*All information sourced from news portals such as CNBC, Yahoo Finance, Reuters, etc.

RELATED READING

【Weekly Recap】The labor market played both the villain and the hero;Fed policy: From “when” to “if”

With a series of economic and earnings data released, the stock market rebounded……

Read More【Weekly Recap】The labor market played both the villain and the hero;Fed policy: From “when” to “if”

With a series of economic and earnings data released, the stock market rebounded……

Read MoreSubscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.