Discover how a Canadian family achieved 239% returns using strategic...

Read MoreInvesting for beginners: how to start with $100 in your TFSA

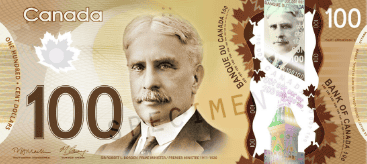

If you’ve ever scrolled through TikTok or YouTube and seen people your age talking about dividends, stock portfolios, or building passive income, you might be wondering: How do I even start? The good news is you don’t need thousands of dollars to begin. In fact, just $100 and a Tax-Free Savings Account (TFSA) is enough to get you on the path to growing your money. This article will walk you through the basics of investing for beginners, using your TFSA as a launchpad.

What Is a TFSA and Why Use It?

Before diving into investment strategies, it’s important to understand what a TFSA actually is. A TFSA (Tax-Free Savings Account) is a registered account available to Canadian residents aged 18 and older. Unlike a regular savings account, any income you earn inside a TFSA—whether it’s from stocks, bonds, ETFs, or interest—is tax-free, even when you withdraw it.

For young adults new to money management, this is a game-changer. It allows you to experiment with investing, make gains, and not worry about being taxed on your profits. Plus, if you lose money, you won’t owe taxes either. It’s low-risk from a tax standpoint, and perfect for those just getting started.

How to Start Investing with $100

Many people assume investing is only for the rich, but in reality, beginner-friendly platforms have made it easier than ever to invest small amounts. With just $100 in your TFSA, you can begin building a basic portfolio. Here’s how:

- Open a TFSA account with a brokerage (Questrade, Wealthsimple, or your bank are popular options).

- Choose a type of investment: Consider starting with ETFs (exchange-traded funds), which are low-cost and diversified. You could also look at fractional shares of major companies.

- Stick to low fees: Make sure you’re not paying high management fees (MERs). Look for ETFs with MERs below 0.5%.

- Set a goal: Are you investing for a trip, a car, or your long-term future? Knowing your timeline helps guide your investment choices.

By starting small and staying consistent, you’ll get comfortable with how the market works and how your money can grow over time—core lessons in investing for beginners.

Best Investments for Beginners in a TFSA

When you only have $100, you’ll want to choose options that are simple, safe, and give you some room to grow. The TFSA is flexible, so you can hold many different types of investments, but here are three beginner-friendly picks:

- ETFs (Exchange-Traded Funds): These are collections of stocks or bonds bundled into a single investment. You can invest in an ETF that tracks the whole Canadian or U.S. stock market. Great for automatic diversification.

- Robo-advisors: If you’re not ready to pick investments yourself, platforms like Wealthsimple will create a portfolio for you based on your risk tolerance and goals.

- Dividend stocks: Some blue-chip companies pay regular dividends (a portion of their profits). These can be reinvested to buy more shares and build wealth slowly.

Investing for beginners doesn’t need to be overwhelming. These tools make it easy to put your money to work without needing to master the stock market overnight.

Mistakes to Avoid When Starting Small

Even with a small amount of money, it’s possible to fall into common traps. Here are a few to avoid as you begin investing in your TFSA:

- Trying to “time” the market: It’s nearly impossible to predict short-term price movements. Focus on long-term growth instead.

- Putting all your money into one stock: This is risky, especially if that stock drops in value. Diversify to reduce risk.

- Ignoring fees: High trading fees can eat into your small investment quickly. Use commission-free platforms when starting out.

- Not staying consistent: The best way to grow your investments is by contributing regularly—even if it’s just $25/month.

Staying disciplined and avoiding emotional investing is crucial. Part of investing for beginners is learning that consistency and patience matter more than flashy wins.

Build Wealth One Step at a Time

Getting started with investing doesn’t require a finance degree or a big bank account. With just $100 and a TFSA, you can take your first steps toward financial freedom. Over time, your contributions, however small, can grow into something meaningful. The earlier you begin, the more time your money has to compound.

Investing for beginners is about progress, not perfection. Start where you are, use the tools available, and keep learning. The habits you build now will set you up for success down the road—no matter how big or small your starting point

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More