Discover how a Canadian family achieved 239% returns using strategic...

Read MoreMarkets wrap: S&P 500 Slips as Fed Rally Stalls, Trade Fears Linger

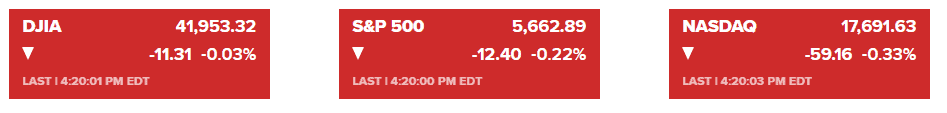

Market Overview

The S&P 500 slipped on Thursday as uncertainty surrounding the U.S. economy continued to weigh on equities, hindering the market’s efforts to recover from a monthlong decline. The index fell 0.22% to close at 5,662.89. The Nasdaq Composite declined 0.33% to 17,691.63, dragged down by losses in Apple and Alphabet. The Dow Jones Industrial Average edged down 11.31 points, or 0.03%, to 41,953.32.

Investor sentiment remained fragile following the Federal Reserve’s recent policy decision, which kept interest rates unchanged while projecting two rate cuts in 2025. Fed Chair Jerome Powell pointed to tariffs as a potential economic pressure, particularly for consumers. The central bank also revised its inflation outlook upward and lowered its economic growth projection.

The market is bracing for increased volatility ahead of Friday’s triple witching event, where an estimated $4.5 trillion in options contracts will expire. Meanwhile, the yield on 10-year Treasuries remained steady at 4.24%, and the U.S. dollar strengthened by 0.3%. Copper prices fluctuated near $10,000 per ton.

Corporate News

- Accenture shares fell over 7% after the company reported that its Federal Services business lost contracts with the U.S. government due to tighter spending measures under the Trump administration.

- Apple Inc. is reportedly undergoing a rare executive restructuring to realign its artificial intelligence efforts after facing months of delays and setbacks.

- Nvidia Corp. plans to invest billions of dollars over the next four years to source U.S.-made chips and electronics, according to the Financial Times.

Markets continue to react to policy uncertainty, trade concerns, and economic data, with volatility expected to persist in the near term.

The 2025 Winter Promotion is in full swing! Successfully apply to get approved for a $200,000 investment loan to receive an IPhone 16 Pro Max! More offers are available for a limited time—learn more now!

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More