Discover how a Canadian family achieved 239% returns using strategic...

Read MoreMarkets Wrap: Stocks Drop as Trump’s Auto Tariffs Fuel Trade War Concerns

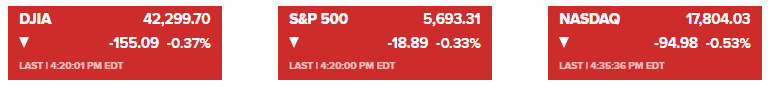

Market Overview

Stocks declined on Thursday as investors reacted to President Donald Trump’s latest trade measures, including new tariffs on foreign automakers. The Dow Jones Industrial Average dropped 155.09 points, or 0.37%, to 42,299.70. The S&P 500 fell 0.33% to 5,693.31, while the Nasdaq Composite slid 0.53% to 17,804.03.

The sell-off came despite stronger-than-expected U.S. economic data. The economy expanded at a quicker pace in the fourth quarter than previously estimated, and a key inflation measure was revised lower. However, market sentiment remained cautious ahead of Friday’s personal consumption expenditures (PCE) price index, which is expected to provide further insights into inflation trends.

Bond markets reflected concerns about inflation, with short-dated Treasuries outperforming longer-term ones. The yield on the 10-year Treasury note rose one basis point to 4.36%. The U.S. dollar fluctuated as investors assessed the impact of Trump’s trade policies on global markets.

The major indexes have held onto modest weekly gains. The S&P 500 is up 0.5%, the Nasdaq has gained 0.1%, and the Dow has added 0.8% so far this week.

Corporate News

- Automakers: Stocks of major automakers fell after Trump announced a 25% tariff on all imported vehicles, effective April 2. General Motors dropped more than 7%, while Ford declined nearly 4%. However, Tesla edged up 0.4%, as analysts see the company benefiting due to its domestic production.

- Toyota & Mercedes-Benz: Shares of Toyota Motor Corp. and Mercedes-Benz Group AG also fell as investors worried about the potential impact of the new tariffs on foreign automakers.

- AppLovin Corp.: The company’s stock dropped following a negative short report from Muddy Waters.

- Nvidia & Apple: Tech giants saw mixed results, with Apple gaining while Nvidia declined.

- Lululemon: The company issued a weaker-than-expected outlook, leading to a decline in its stock price during after-hours trading.

- ByteDance & TikTok: Trump signaled a willingness to ease tariffs on China in exchange for cooperation in securing a deal regarding TikTok’s U.S. operations.

- European & Canadian Trade: Trump threatened higher tariffs on the European Union and Canada if they coordinate actions against U.S. trade policies, increasing tensions in global markets.

Investors remain focused on upcoming inflation data and the potential economic impact of Trump’s trade policies. Market analysts suggest that while uncertainties persist, technical indicators point to a possible stabilization of equities following recent declines.

The 2025 Winter Promotion is in full swing! Successfully apply to get approved for a $200,000 investment loan to receive an IPhone 16 Pro Max! More offers are available for a limited time—learn more now!

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More