How much do Canadians need to retire? Surveys show the...

Read MoreRESP In 2025 - An Ai Financial Guide

The costs of post-secondary education can add up quickly, with expenses for tuition, school supplies, food, and housing. Opening a Registered Education Savings Plan (RESP) can help you save for your child’s education effectively. With an RESP, your savings can grow through contributions, as well as bonuses and grants from both federal and provincial governments. Here’s an overview of how RESPs work and their benefits.

What is a RESP

A Registered Education Savings Plan is a savings vehicle that allows you to put money aside for your children’s post-secondary education or to save for your grandchildren or other relatives.

Not only does the money you deposit in an RESP grow tax-free, but your savings will also be supplemented by Canadian and provincial government grants equivalent to 20% to 40% of your annual contributions, depending on your family income and province of residence.

By leveraging Ai Financial’s investment capabilities, your child will have the opportunity to enter adulthood with greater financial support than others, empowering them to confidently pursue diverse life choices.

You have until the end of the 35th year after the RESP was first opened to use the funds, unless your agreement stipulates otherwise. This allows the child beneficiary to take a break from school and work or travel before continuing their education if they so choose—the funds will be waiting for them for when they decide to go back to school.

Having an RESP investment account is a guarantee for a child’s future education. As parents, we might cut costs in other areas, but education expenses for our children are non-negotiable.

The Do's and Don'ts of RESP Investments

Requirements for application

When applying for an RESP investment account, the beneficiary must be:

- A Canadian resident and must be under 17 years of age.

- Have a Social Insurance Number (SIN).

- Preparing to attend an eligible post-secondary education program and requiring withdrawals from the RESP account to cover related expenses.

If the beneficiary decides not to pursue higher education, the subscriber can:

Transfer the RESP account to another sibling.

If the subscriber or their spouse has available contribution room in their RRSP (Registered Retirement Savings Plan), funds can be transferred into the RRSP.

Take your time before withdrawing funds from the account while it’s still valid. You can retain them temporarily to prevent any future needs. Typically, RESP accounts have a lifespan of 35 years.

If you wish to withdraw, you’ll need to return the government grant portion to the government, and earnings will be subject to taxation plus a 20% penalty. Some RESP investment plans/types might have additional restrictions; it’s advisable to inquire about these when opening the account.

RESP contributions are limited to a lifetime maximum of $50,000 per beneficiary.

An RESP will not affect your child’s eligibility for student loans and bursaries.

How can you open a RESP

The steps are as follows:

- Apply for SIN for the beneficiary

- Select a financial institution for your RESP investment

- Provide beneficiary information and open the account in the beneficiary’s name (remember to bring the SIN for the subscriber, the beneficiary’s SIN, and the birth certificate).

- Apply for government grants or subsidies

- Make deposits

- Regularly check your account and verify the subsidy amounts received to ensure accurate disbursements.

What types of products can be held in RESP

Despite its name, RESP is not a typical savings account – it’s a place where you can put investments like segregated funds.

Unlike an RRSP, an RESP does not reduce your taxable income. However, the capital you invest generates investment income that accumulates tax-free.

Returns will, of course, vary depending on the financial market and the investment vehicles you choose. But generally speaking, the sooner you start contributing, the higher your RESP returns will be.

Ai Financial offers this investment opportunity:

Segregated Funds

Segregated fund policies give you the freedom to invest while offering insurance protection to preserve your savings. With our choice of guarantees, you can expand your wealth and secure it at the same time.

You can purchase Segregated Funds using various accounts, including but not limited to TFSA, RRSP, RESP, Non-Reg, etc.

Why you should Invest in RESP ASAP

We know the best time to invest was 20 years ago, and the second best time is now. For your child, this means having ample time for the assets you set aside to grow, leveraging the benefits of time and compounding interest.

At Ai Financial, our historical investment returns have successfully doubled our clients’ assets within five years.

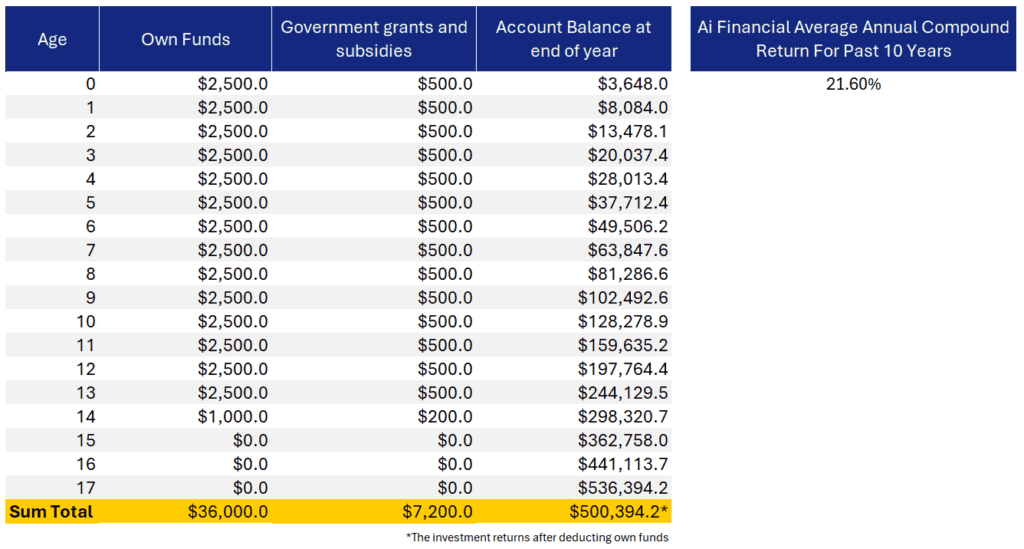

Let’s simulate how much financial support your child could potentially receive from birth to adulthood based on our historical investment returns:

By making annual deposits from the beneficiary’s birth until age 14, you can maximize the government grant with a final $1,000 deposit in the 14th year, reaching the $7,200 cap. By age 18, the account could grow to $500,000, providing substantial financial support for a young adult to achieve financial freedom. Even with a more conservative return of 15% (based on the SPY 500), the beneficiary would still receive around $210,000, which can help them overcome financial challenges such as affording a home, managing student loans, and finding a job—making it an invaluable and relatively low-cost gift to support their future.

The Best Time to Start Is Now

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More

What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

Why do you need segregated funds for retirement?

Segregated funds are a popular choice for group savings and retirement plans. They provide access to high-end and unique……

Invest with TFSA

A Tax-Free Savings Account (TFSA) provides you with a flexible way to save for a financial goal, while growing your money tax-free……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……