Between a barrage of earnings, the first-quarter GDP report, and the release of……

Read MoreCategories

Recent Posts

- Stocks fall on disappointing earnings and inflation data before Fed decision April 30, 2024

- Stocks break losing streak, while tech stocks rallied; Slow progress on inflation means rates will stay high for longer April 29, 2024

- Wall Street edges higher at the start of a busy week April 29, 2024

- AiF insight | Tesla's Rise, AiF Proven Wrong! April 29, 2024

- S&P 500 rises to kick off new week as Tesla, Apple jump April 29, 2024

- AiF Insight | The Impact of 7 Major Weighted Stocks on the Market April 26, 2024

- AiF Insight | Canadian Census: Middle-Class Income at $70,000 - Are You There Yet? April 26, 2024

- S&P 500 posts best week since November, Nasdaq surges 2% Friday as Alphabet soars April 26, 2024

- AiF Insight | Core Inflation Rises Again! Means More Spending for Everyone! April 26, 2024

- S&P 500 and Nasdaq jump, boosted by Alphabet and Microsoft April 26, 2024

- Dow drops 500 points on slowing U.S. economic growth. April 25, 2024

- AiF观点 | 加拿大打击房地产泡沫初见成效 April 24, 2024

- AiF观点 | 美联储:长期高利率不是坏事 April 24, 2024

- Tesla's stock soared by 12%, while the stock market struggled amidst the profit frenzy April 24, 2024

- 五年翻倍的基金选择策略 | Ai Financial基金投资 April 24, 2024

- The Nasdaq rose for the third consecutive day, driven by gains in the technology sector April 24, 2024

- AiF观点 | 第四次工业革命的时代浪潮滚滚向前 April 23, 2024

- The S&P 500 and Nasdaq surged significantly, with Tesla kicking off the "Magnificent 7" earnings season April 23, 2024

- AiF观点 | 财报季到了 April 23, 2024

- Stocks rise for a second day as earnings season ramps up, Dow up more than 100 points April 23, 2024

AiF insight | Oh Canada, tax! Tax!

- April 17, 2024

- April 17, 2024

On April 16, 2024, Canada announced its 2024 fiscal budget. While there are many details, the key takeaway is: Raise Tax!

Many our clients are feeling quite nervous, especially since the tax hikes mainly target the wealthy. In terms of taxation, let's discussing it with everyone to understand its impact on us.

1. All investment in RRSP, FHSA, TFSA is not taxed.

2. Reducing tax if you contribute to RRSP or FHSA.

3. Withdraws from an FHSA are tax-free.

AiF opinion: Everyone should fully utilize RRSP, FHSA, and TFSA.

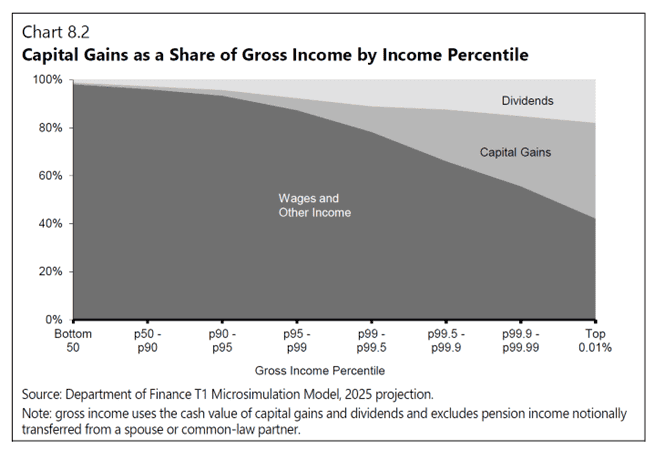

Chart 8.2 reflects the income composition of various socioeconomic strata.

1. For the bottom 50% of individuals, almost 99% of their income comes from active sources.

2. For 95-99% of individuals, active income comprises over 90% of their total income.

3. For less than 1% of wealthy individuals, active income accounts for less than 80%, while passive income exceeds 20%.

4. Among the wealthiest 0.01% of individuals, active income constitutes 45%, while passive income stands at 55%.

AiF's viewpoint: Wealthy individuals have a higher proportion of passive income.

Investment is the sole method for generating passive income.

Therefore: Without investing, one remains impoverished.

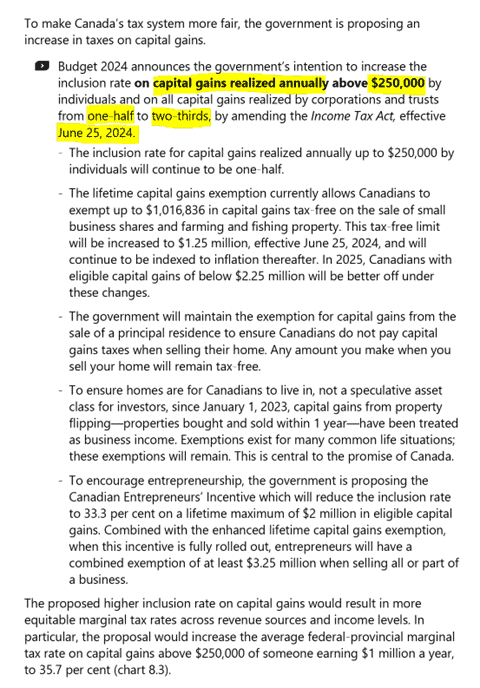

This passage describes the tax changes that everyone is concerned about:

1. For individual investment profits annually below $250,000, the capital gains tax remains unchanged. It's calculated at the original rate, with 50% considered as income and taxed according to the income tax brackets.

2. For individual investment profits exceeding $250,000 annually, the capital gains tax increases from the original 50% to 66.7%. This 66.7% is considered as income and taxed according to the income tax brackets.

3. Effective June 25, 2024.

AiF's opinion: This has an impact on our investments. The premise is that you must earn over $250,000 annually, and you withdraw all of it.

If you earn over $250,000 annually, don't worry. We have many other tools in our toolbox tailored for high-net-worth clients.

There are better tools and methods available to address these situations.

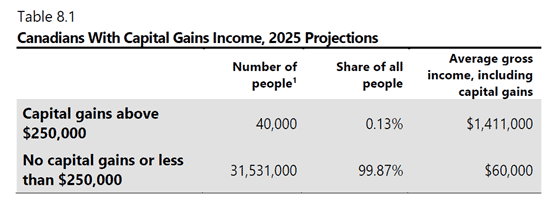

Table 8.1 shows:

By 2025, there will be a total of 40,000 wealthy individuals whose annual investment profits exceed $250,000, comprising 0.13% of the population. Their average annual income is $1.4 million. Currently, with a population of 40 million in Canada, only 40,000 individuals reach this level of wealth.

AiF's opinion: If you're within this group, congratulations! You are truly a wealthy individual.

RELATED READING

AiF Insight | Canadian Census: Middle-Class Income at $70,000 - Are You There Yet?

加拿大统计局公布了2022年的收入调查报...

Read MoreAiF Insight | Core Inflation Rises Again! Means More Spending for Everyone!

刚公布的3月份美国通胀显示, 比一年前涨...

Read MoreStocks break losing streak, while tech stocks rallied; Slow progress on inflation means rates will stay high for longer

Between a barrage of earnings, the first-quarter GDP report, and the release of……

Read MoreAiF Insight | Canadian Census: Middle-Class Income at $70,000 - Are You There Yet?

加拿大统计局公布了2022年的收入调查报...

Read MoreAiF Insight | Core Inflation Rises Again! Means More Spending for Everyone!

刚公布的3月份美国通胀显示, 比一年前涨...

Read MoreAi Financial Funds Investing - You fulfill your dreams, we cover your bills

Ai Financial is a leading Canadian Fin-Techfund investmentservice provider. We leverage cutting-edge technology to adhere toValue Investing principles,aiming to drive reform in Canada's pension system and enable more people to live better lives through financial investment.

Ai Financial has a background in financial compliance and anti-money laundering (AML). Through collaborations with banks, funds, and insurance companies, we select fund products suitable for clients and managevarious investment accountssuch as TFSA and RRSP. Additionally, we assist clients in applying for unique CanadianInvestment Loan, facilitating early attainment of financial freedom.

21.6%

Average Annual Compound Return For Past 10 Years

Ai Financial delivers consistent and stable investment returns to clients, achieving 10%+ annual compounded returns over the past decade.

Thursday Seminar

Free Financial Online Seminar

Weekly free online seminars every Thursday evening, offering investors the latest insights on hot topics and market trends.

Mission and Vision

You fulfil your dream, we pay for your bill

Improve Canadian Retirement System.

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.