AiF 在19号发表了观点, Tesla...

Read MoreCategories

Recent Posts

- AiF观点 | Tesla 涨了, AiF 被打脸了! April 29, 2024

- S&P 500 开启新一周上涨,特斯拉、苹果股价飙涨 | Ai Financial 财经日报 April 29, 2024

- AiF Insight | The Impact of 7 Major Weighted Stocks on the Market April 26, 2024

- AiF Insight | Canadian Census: Middle-Class Income at $70,000 - Are You There Yet? April 26, 2024

- S&P 500 posts best week since November, Nasdaq surges 2% Friday as Alphabet soars April 26, 2024

- AiF Insight | Core Inflation Rises Again! Means More Spending for Everyone! April 26, 2024

- S&P 500 and Nasdaq jump, boosted by Alphabet and Microsoft April 26, 2024

- Dow drops 500 points on slowing U.S. economic growth. April 25, 2024

- AiF观点 | 加拿大打击房地产泡沫初见成效 April 24, 2024

- AiF观点 | 美联储:长期高利率不是坏事 April 24, 2024

- 特斯拉股价飙升12%,股市在盈利热潮中步履维艰 | Ai Financial 财经日报 April 24, 2024

- 五年翻倍的基金选择策略 | Ai Financial基金投资 April 24, 2024

- 纳斯达克连续第三天上涨,科技股涨势推动上涨 | Ai Financial 财经日报 April 24, 2024

- AiF观点 | 第四次工业革命的时代浪潮滚滚向前 April 23, 2024

- 标普500和纳斯达克大幅上涨,特斯拉开启“Magnificent 7”季报 | Ai Financial 财经日报 April 23, 2024

- AiF观点 | 财报季到了 April 23, 2024

- Stocks rise for a second day as earnings season ramps up, Dow up more than 100 points April 23, 2024

- Dow closes more than 200 points higher, S&P 500 snaps 6-day losing run as tech resurges April 22, 2024

- 【Weekly Recap】 Global dynamics, rate expectations, and earnings impact market volatility; Bull market persists, pullback brings investment opportunities April 22, 2024

- AiF观点 | 我们交的税去哪儿啦? April 22, 2024

U.S. STOCK PICKS

Closing: 4:00 PM EST

- The S&P 500 slipped on Tuesday after Federal Reserve Chair Jerome Powell said interest rates may need to stay elevated.

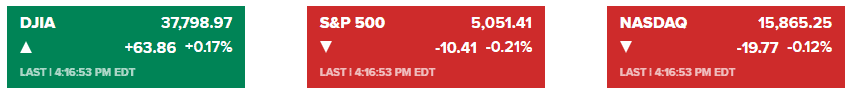

- The broad index lost 0.21% to finish at 5,051.41, while the Nasdaq Composite shed 0.12% to 15,865.25. The Dow Jones Industrial Average rose 63.86 points, or 0.17%, to 37,798.97, lifted by UnitedHealth shares. The 30-stock blue-chip index snapped a six-day run of losses.

- Stocks were choppy in afternoon trading after Powell said that the current state of economic policy should remain in place amid sticky prices.

- “More recent data shows solid growth and continued strength in the labor market, but also a lack of further progress so far this year on returning to our 2% inflation goal,” the central bank chief said during a panel discussion.

- At the same time, CNN’s Fear and Greed Index has tipped into “fear” territory this week. The market mood tracker sat in the “neutral” zone one week prior, but was comfortably in the “greed” range both a month and a year prior.

- Meanwhile, earnings reports flooded in before the bell. UnitedHealth (UNH) shares added about 5% after the healthcare group beat quarterly profit estimates, even as it said it expects to take a $1.6 billion hit from a February cyberattack.

- Apple stock down as Needham cuts estimates on lower iPhone sales.

U.S. STOCK PICKS

- The Dow Jones Industrial Average edged higher on Tuesday, as the blue-chip average attempted to snap a six-day losing streak.

- Traders will monitor remarks from Federal Reserve Chair Jerome Powell, who is set to speak at the Washington Forum on the Canadian Economy in the afternoon. Investors will watch for any insights into the path of monetary policy.

- UnitedHealth shares rallied more than 6% on the back of better-than-expected revenue for the first quarter. But Johnson & Johnson, another Dow member, posted mixed quarterly results, sending shares down almost 2%.

- Morgan Stanley advanced more than 2% after beating analyst consensus forecasts on both lines.

- Bank of America also topped expectations for the quarter, but shares slipped around 3%.

- America’s largest companies have given Wall Street reason for optimism in the early innings of the new corporate earnings season. Of the less than 10% of S&P 500-listed firms that have reported financials, nearly four of of every five have exceeded Wall Street consensus estimates, according to FactSet.

- But higher rates continued to weigh on investors. The 10-year U.S. Treasury yield continued trading above the key 4.6% level on Tuesday, marking its highest point going back to November.

- AMD rolls out its latest chips for AI PCs as competition with Nvidia and Intel heats up.

- Tesla job cuts heighten Wall Street concerns that EV maker faces a demand problem.

CANADA MARKET

- Housing starts down seven per cent in March from February: CMHC

- Canada's inflation rate ticks up to 2.9% in March amid higher gas prices, boosting June rate-cut bets

*All information sourced from news portals such as CNBC, Yahoo Finance, Reuters, etc.

RELATED READING

AiF Insight | Canadian Census: Middle-Class Income at $70,000 - Are You There Yet?

加拿大统计局公布了2022年的收入调查报...

Read MoreS&P 500 posts best week since November, Nasdaq surges 2% Friday as Alphabet soars

周五,股市上涨,标普500指数和纳斯达克...

Read MoreAiF Insight | Canadian Census: Middle-Class Income at $70,000 - Are You There Yet?

加拿大统计局公布了2022年的收入调查报...

Read MoreS&P 500 posts best week since November, Nasdaq surges 2% Friday as Alphabet soars

周五,股市上涨,标普500指数和纳斯达克...

Read MoreSubscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.