股市迎来自2月以来的最大涨幅,美国就业增...

Read MoreCategories

Recent Posts

- 股市大幅上涨,市场乐观情绪重燃 | Ai Financial 财经日报 May 3, 2024

- 道琼斯指数上涨500点,因劳动力市场报告疲软,提升了市场对美联储降息的期望 | Ai Financial 财经日报 May 3, 2024

- 华尔街上涨以弥补本周的损失, 苹果宣布史上最大规模回购 | Ai Financial 财经日报 May 2, 2024

- AiF观点 | TD银行反洗黑钱监管不当, 被重罚4.5 亿 + 920万 May 2, 2024

- AiF观点 | 万锦王府井购物中心被接管,债务超过 5200 万美元 May 2, 2024

- Stocks are rising Thursday after Fed decides to hold rates steady May 2, 2024

- Dow closes higher as Powell says Fed’s next move is unlikely to be a hike May 1, 2024

- 加拿大央行:是时候打破玻璃了 – 解决加拿大的生产力问题 | Ai Financial 基金投资 May 1, 2024

- S&P 500 inches lower as Wall Street readies for Fed rate decision May 1, 2024

- The Dow plunges as Wall Street concludes a dismal April April 30, 2024

- Stocks fall on disappointing earnings and inflation data before Fed decision April 30, 2024

- Stocks break losing streak, while tech stocks rallied; Slow progress on inflation means rates will stay high for longer April 29, 2024

- Wall Street edges higher at the start of a busy week April 29, 2024

- AiF insight | Tesla's Rise, AiF Proven Wrong! April 29, 2024

- S&P 500 rises to kick off new week as Tesla, Apple jump April 29, 2024

- AiF Insight | The Impact of 7 Major Weighted Stocks on the Market April 26, 2024

- AiF Insight | Canadian Census: Middle-Class Income at $70,000 - Are You There Yet? April 26, 2024

- S&P 500 posts best week since November, Nasdaq surges 2% Friday as Alphabet soars April 26, 2024

- AiF Insight | Core Inflation Rises Again! Means More Spending for Everyone! April 26, 2024

- S&P 500 and Nasdaq jump, boosted by Alphabet and Microsoft April 26, 2024

U.S. STOCK PICKS

Closing: 4:00 PM EST

- Stocks ripped higher Monday, recovering their footing after a tough week, as tech shares rebounded and tensions in the Middle East dimmed. Traders also looked ahead to the release of major earnings.

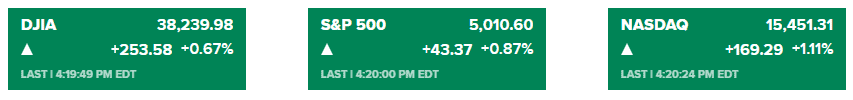

- The Dow Jones Industrial Average climbed 253.58 points, or 0.67%, to close at 38,239.98. The S&P 500 traded 0.87% higher to finish the session at 5,010.60 while the Nasdaq Composite advanced 1.11% to 15,451.31. Both the S&P 500 and Nasdaq ended a six-day losing streak.

- Chipmaker and artificial intelligence favorite Nvidia climbed 4.4%, bouncing from a nearly 14% sell-off last week — its worst since September 2022. Arm Holdings also rebounded nearly 7% on Monday.

- U.S. crude prices slipped after Iran said it will not escalate the conflict with Israel. Investors had been concerned higher oil prices could contribute to inflation, leading the Federal Reserve to hold off on cutting rates.

- There is some potentially bigger news in the back part of this week, with GDP due out on Thursday and a key inflation reading on Friday, when the Commerce Department reports personal consumption expenditures price index data for March. The PCE deflator is the Fed’s preferred inflation gauge.

- The focus Monday was on Tesla (TSLA) as the EV maker cut prices in the US, China, and several other countries. Tesla will report quarterly results on Tuesday after the market close. The Elon Musk-led company has already unsettled some investors with its robotaxi push and decision to have shareholders vote again on Musk's rejected pay package. Tesla shares lost 3.4%.

- Mark Zuckerberg says Meta will offer its virtual reality OS to hardware companies, creating iPhone versus Android dynamic.

U.S. STOCK PICKS

- The S&P 500 rose Monday as Wall Street tried to rebound from a pullback last week, with Middle East tensions easing. Traders also looked ahead to the release of major tech earnings.

- Companies including Tesla, Meta Platforms, American Airlines, Microsoft, and Alphabet all set to report in the week ahead. Tesla reports after the bell Tuesday, Facebook-parent Meta is on deck Wednesday, while Apple, Intel and Microsoft all report Thursday.

- Tesla slides 3% in premarket, Li Auto sinks 8% as EV makers slash prices amid fierce competition.

- Express files for bankruptcy, plans to close nearly 100 stores as investor group looks to save the brand.

- Zions Bancorp. climbed after reporting stronger earnings for the latest quarter than expected. Analysts called it a solid showing, and its stock rose 2.7% to recover some of the sharp slide they took last year on worries surrounding the strength of the larger regional banking industry.

- There is some potentially bigger news in the back part of this this week, with GDP due out on Thursday and a key inflation reading on Friday, when the Commerce Department reports personal consumption expenditures price index data for March. The PCE deflator is the Fed’s preferred inflation gauge.

CANADA MARKET

Five things to watch for in the Canadian business world in the coming week:

- Railway earnings: The country's two biggest railway companies will report their first-quarter results this week. Canadian National Railway Co. will report its results after the close of financial markets on Tuesday, while Canadian Pacific Kansas City Ltd. will release its results before markets open Wednesday.

- Bank of Canada deliberations: The Bank of Canada will release Wednesday its summary of monetary policy deliberations for its interest rate decision earlier this month. The central bank kept its key interest rate target on hold at five per cent, but governor Tiff Macklem said it was "within the realm of possibilities" that he could cut rates in June.

- Metro results: Grocer Metro Inc. will report its second-quarter results and hold a conference call with financial analysts on Wednesday morning. The results come as discussions toward a grocery code of conduct continue. The industry has been under scrutiny as food inflation has outpaced the overall increases in the cost of living.

- Retail sales: Statistics Canada is set to report retail sales figures for February on Wednesday. The agency said last month that retail sales in January fell 0.3 per cent to $67.0 billion for the first month of the year, but its early estimate for February pointed to an increase of 0.1 per cent.

- Resource sector results: Quarterly results from several of the big names in the Canadian resource sector are expected this week. First Quantum Minerals Ltd. will report after the close of trading on Tuesday and hold a conference call Wednesday. Teck Resources Ltd. is expected to report its results before markets open on Thursday, while Agnico Eagle Mines Ltd. is expected to report after markets close on Thursday. Imperial Oil Ltd. will report its results and hold a conference call with financial analysts and investors Friday morning.

*All information sourced from news portals such as CNBC, Yahoo Finance, Reuters, etc.

RELATED READING

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.