AiF 在19号发表了观点, Tesla...

Read MoreCategories

Recent Posts

- AiF观点 | Tesla 涨了, AiF 被打脸了! April 29, 2024

- S&P 500 开启新一周上涨,特斯拉、苹果股价飙涨 | Ai Financial 财经日报 April 29, 2024

- AiF Insight | The Impact of 7 Major Weighted Stocks on the Market April 26, 2024

- AiF Insight | Canadian Census: Middle-Class Income at $70,000 - Are You There Yet? April 26, 2024

- S&P 500 posts best week since November, Nasdaq surges 2% Friday as Alphabet soars April 26, 2024

- AiF Insight | Core Inflation Rises Again! Means More Spending for Everyone! April 26, 2024

- S&P 500 and Nasdaq jump, boosted by Alphabet and Microsoft April 26, 2024

- Dow drops 500 points on slowing U.S. economic growth. April 25, 2024

- AiF观点 | 加拿大打击房地产泡沫初见成效 April 24, 2024

- AiF观点 | 美联储:长期高利率不是坏事 April 24, 2024

- 特斯拉股价飙升12%,股市在盈利热潮中步履维艰 | Ai Financial 财经日报 April 24, 2024

- 五年翻倍的基金选择策略 | Ai Financial基金投资 April 24, 2024

- 纳斯达克连续第三天上涨,科技股涨势推动上涨 | Ai Financial 财经日报 April 24, 2024

- AiF观点 | 第四次工业革命的时代浪潮滚滚向前 April 23, 2024

- 标普500和纳斯达克大幅上涨,特斯拉开启“Magnificent 7”季报 | Ai Financial 财经日报 April 23, 2024

- AiF观点 | 财报季到了 April 23, 2024

- Stocks rise for a second day as earnings season ramps up, Dow up more than 100 points April 23, 2024

- Dow closes more than 200 points higher, S&P 500 snaps 6-day losing run as tech resurges April 22, 2024

- 【Weekly Recap】 Global dynamics, rate expectations, and earnings impact market volatility; Bull market persists, pullback brings investment opportunities April 22, 2024

- AiF观点 | 我们交的税去哪儿啦? April 22, 2024

CPI snapping the rate cut excitement

Stocks stumble after a steady march higher

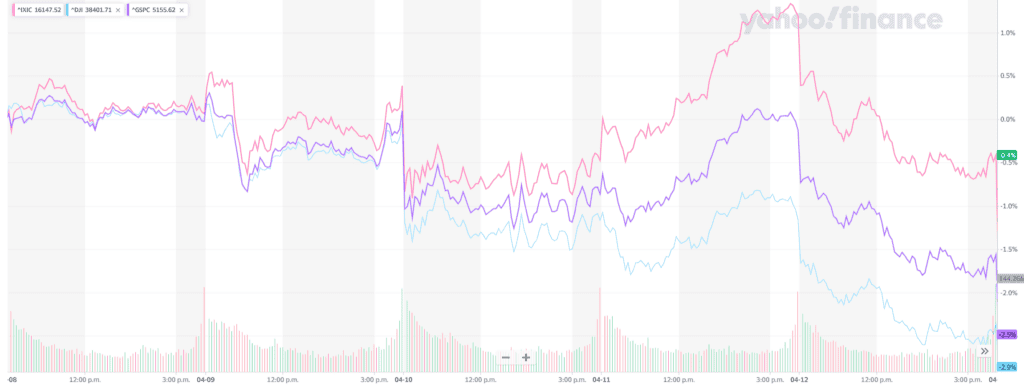

Last week, the three major U.S. stock indexes closed lower. From a weekly perspective, the Dow Jones Industrial Average (DJIA) fell by 920.80 points, or 2.4%, to close at 37,983.24 points; the S&P 500 index dropped by 80.93 points, or 1.6%, to close at 5,123.41 points; and the NASDAQ index declined by 73.43 points, or 0.5%, to close at 16,175.09 points.

Key Takeaways:

CPI snapping the rate cut excitement

Stocks stumble after a steady march higher

The headliner last week was the latest Consumer Price Index (CPI) report, providing a fresh look at the all-important trend in inflation. The results were not what markets were looking for, with CPI coming in hotter than expected.

Consumer prices rose by 3.5% year over year in March, up from 3.2% the prior month. Core CPI, which strips out volatile food and energy prices, held steady at 3.8%, coming in slightly above consensus expectations. Services prices remain the fly in the ointment, with particularly large increases in medical costs and insurance premiums playing a role last month. While not captured in core inflation, the recent rise in oil prices is also driving worries of renewed upward pressure on headline CPI. The pace of improvement in core CPI has slowed. This means the next leg — in which core CPI trends toward the Fed’s 2% target — may prove more gradual (and challenging) than hoped.

Encouragingly, auto prices moved lower, and the pace of shelter inflation moderated again, hitting its lowest level since June 2022. The sharp drop in goods inflation over the past 18 months has been a key driver of the moderation in overall inflation. Durable goods prices remain in outright deflationary territory, falling again in March. We believe this trend reflects the healing of supply chains and an increase in manufacturing output.

Stocks have pulled back in recent days but remain only slightly below all-time highs. We think some temporary weakness is reasonable given the strength of the recent rally and the adjustments to policy expectations. That said, markets have handled this news fairly well, which we think reflects the still-favorable outlook for economic and corporate earnings growth.

It should not be lost just how strong and steady the stock market rally has been. Consider the following:

- The S&P 500 has declined the last two weeks but saw a stretch from November to February in which it was higher in 14 out of 15 consecutive weeks.

- In the last five months coming into last week, the stock market had experienced only five days in which it declined by 1% or more. And in four of those instances, the market rose by 1% the next day.

- Despite the weakness in recent days, the S&P 500 is just 2% below its all-time high, which is the largest pullback since October of last year. The stock market has returned 27% during that stretch.

AiF believes that the market is not afraid of no rate cuts, or even rate hikes. The market fears uncertainty. As for whether there will be rate cuts this year, the Federal Reserve has made its stance clear, read more:

AiF insight | Market Panic Selling, Fed Makes Clear Statement

AiF insight | No Rate Cut This Year? Stock Market Crash Ahead?

AiF insight | Concerns About Rates Cutting

The US stock market is in a bull market. Ai Financial, with its professional investment philosophy, seizing the opportunities of our time together and reap wealth.

21.6%

Average Annual Compound Return For Past 10 Years

Ai Financial delivers consistent and stable investment returns to clients, achieving 10%+ annual compounded returns over the past decade.

Thursday Seminar

Free Financial Online Seminar

Weekly free online seminars every Thursday evening, offering investors the latest insights on hot topics and market trends.

Mission and Vision

You fulfil your dream, we pay for your bill

Improve Canadian Retirement System.

Ai Financial Funds Investing - You fulfill your dreams, we cover your bills

Ai Financial is a leading Canadian Fin-Techfund investmentservice provider. We leverage cutting-edge technology to adhere toValue Investing principles,aiming to drive reform in Canada's pension system and enable more people to live better lives through financial investment.

Ai Financial has a background in financial compliance and anti-money laundering (AML). Through collaborations with banks, funds, and insurance companies, we select fund products suitable for clients and managevarious investment accountssuch as TFSA and RRSP. Additionally, we assist clients in applying for unique CanadianInvestment Loan, facilitating early attainment of financial freedom.

RELATED READING

AiF Insight | Canadian Census: Middle-Class Income at $70,000 - Are You There Yet?

加拿大统计局公布了2022年的收入调查报...

Read MoreAiF Insight | Core Inflation Rises Again! Means More Spending for Everyone!

刚公布的3月份美国通胀显示, 比一年前涨...

Read More